Citibank 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.154

be effective from the second quarter of 2015. The effect of adopting the ASU

is required to be reflected as a cumulative effect adjustment to retained

earnings as of the beginning of the period of adoption. Adoption of the ASU

did not have a material effect on the Company’s financial statements.

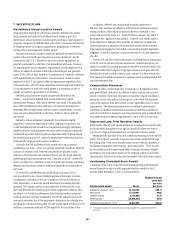

Measuring the Financial Assets and Liabilities of a

Consolidated Collateralized Financial Entity

In August 2014, the FASB issued ASU No. 2014-13, Consolidation (Topic

810): Measuring the Financial Assets and the Financial Liabilities

of a Consolidated Collateralized Financing Entity, which provides

two alternative methods for measuring the fair value of a consolidated

Collateralized Financing Entity’s (CFE) financial assets and financial

liabilities. This election is made separately for each CFE subject to the scope

of the ASU. The first method requires the fair value of the financial assets

and liabilities to be measured using the requirements of ASC Topic 820, Fair

Value Measurements and Disclosures, with any differences between the

fair value of the financial assets and financial liabilities being attributed to

the CFE and reflected in earnings in the consolidated statement of income.

The alternative method requires measuring both the financial assets and

financial liabilities using the more observable of the fair value of the assets

or liabilities. The alternative method would also take into consideration

the carrying value of any beneficial interests of the CFE held by the parent,

including those representing compensation for services, and the carrying

value of any nonfinancial assets held temporarily. The ASU will be effective

for Citi from the first quarter of 2016 and is not expected to have a material

effect on the Company.

Accounting for Derivatives: Hybrid Financial Instruments

In November 2014, the FASB issued ASU No. 2014-16, Derivatives and

Hedging (Topic 815): Determining Whether the Host Contract in a Hybrid

Financial Instrument Issued in the Form of a Share Is More Akin to

Debt or to Equity. The ASU will require an entity to evaluate the economic

characteristics and risks of an entire hybrid financial instrument issued in

the form of a share (including the embedded derivative feature) in order to

determine whether the nature of the host contract is more akin to debt or

equity. Additionally, the ASU clarifies that no single term or feature would

necessarily determine the economic characteristics and risks of the host

contract; therefore, an entity should use judgment based on an evaluation of

all the relevant terms and features.

This ASU is effective for Citi from the first quarter of 2016 with early

adoption permitted. Citi may choose to report the effects of initial adoption as

a cumulative-effect adjustment to retained earnings as of January 1, 2016 or

apply the guidance retrospectively to all prior periods. The impact of adopting

this ASU is not expected to be material to Citi.

Accounting for Financial Instruments-Credit Losses

In December 2012, the FASB issued a proposed ASU, Financial Instruments-

Credit Losses. This proposed ASU, or exposure draft, was issued for public

comment in order to allow stakeholders the opportunity to review the

proposal and provide comments to the FASB and does not constitute

accounting guidance until a final ASU is issued.

The exposure draft contains proposed guidance developed by the FASB

with the goal of improving financial reporting about expected credit losses on

loans, securities and other financial assets held by financial institutions and

other organizations. The exposure draft proposes a new accounting model

intended to require earlier recognition of credit losses, while also providing

additional transparency about credit risk.

The FASB’s proposed model would utilize an “expected credit loss”

measurement objective for the recognition of credit losses for loans,

held-to-maturity securities and other receivables at the time the financial

asset is originated or acquired and adjusted each period for changes in

expected credit losses. For available-for-sale securities where fair value is

less than cost, impairment would be recognized in the allowance for credit

losses and adjusted each period for changes in credit. This would replace the

multiple existing impairment models in GAAP, which generally require that a

loss be “incurred” before it is recognized.

The FASB’s proposed model represents a significant departure from

existing GAAP, and may result in material changes to the Company’s

accounting for financial instruments. The impact of the FASB’s final ASU

on the Company’s financial statements will be assessed when it is issued.

The exposure draft does not contain a proposed effective date; this would be

included in the final ASU, when issued.

Consolidation

In February 2015, the FASB issued ASU No. 2015-02, Consolidation

(Topic 810): Amendments to the Consolidation Analysis, which is intended

to improve certain areas of consolidation guidance for legal entities such

as limited partnerships, limited liability companies, and securitization

structures. The ASU will reduce the number of consolidation models. The ASU

will be effective on January 1, 2016. Early adoption is permitted, including

adoption in an interim period. The Company is evaluating the effect that ASU

2015-02 will have on its Consolidated Financial Statements.