Citibank 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

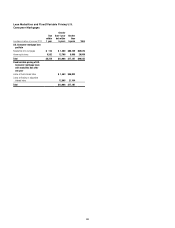

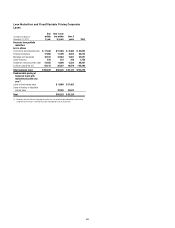

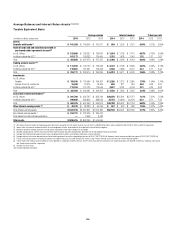

The table below shows Citi’s aggregate long-term debt maturities (including repurchases and redemptions) during 2014, as well as its aggregate expected

annual long-term debt maturities as of December 31, 2014:

In billions of dollars

Maturities

2014 2015 2016 2017 2018 2019 Thereafter Total

Parent $38.3 $16.6 $20.9 $26.1 $12.9 $20.0 $61.5 $ 158.0

Benchmark debt:

Senior debt 18.9 10.0 14.4 19.7 9.5 14.9 28.2 96.7

Subordinated debt 5.0 0.7 1.5 3.1 1.2 1.5 17.5 25.5

Trust preferred 2.1 — — — — — 1.7 1.7

Customer-related debt:

Structured debt 7.5 4.0 4.0 2.7 1.7 1.8 8.1 22.3

Non-structured debt 2.4 1.8 1.0 0.6 0.5 0.2 1.8 5.9

Local Country and Other 2.4 0.1 — — — 1.6 4.2 5.9

Bank $20.6 $14.5 $21.2 $14.2 $ 9.1 $ 2.1 $ 4.0 65.1

FHLB borrowings 8.0 3.8 9.2 6.3 0.5 — — 19.8

Securitizations 8.9 7.7 10.2 6.4 8.3 1.9 3.6 38.1

Local Country and Other 3.7 3.0 1.8 1.5 0.3 0.2 0.4 7.2

Total long-term debt $58.9 $31.1 $42.1 $40.3 $22.0 $22.1 $65.5 $ 223.1

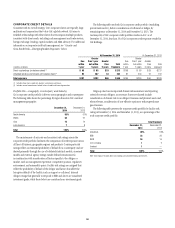

Total Loss-Absorbing Capacity (TLAC)

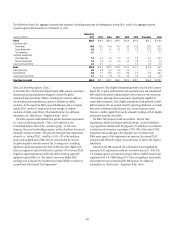

In November 2014, the Financial Stability Board (FSB) issued a consultative

document proposing requirements designed to ensure that global

systemically important banks (GSIBs), including Citi, maintain sufficient

loss-absorbing and recapitalization capacity to facilitate an orderly

resolution. In this regard, the FSB’s proposal builds upon and is consistent

with the FDIC’s preferred “single point of entry strategy” for orderly

resolution of GSIBs under Title II of the Dodd-Frank Act (for additional

information, see “Risk Factors—Regulatory Risks” above).

The FSB’s proposal would establish firm-specific minimum requirements

for “total loss-absorbing capacity” (TLAC), set by reference to the

Consolidated Balance Sheet of the “resolution group” (in Citi’s case,

Citigroup, the parent bank holding company, and its subsidiaries that are not

themselves resolution entities). The proposed minimum TLAC requirement,

referred to as “external TLAC,” would be (i) 16%–20% of the resolution

group’s risk-weighted assets (RWA) and (ii) at least double the amount

of capital required to meet the relevant Tier 1 Leverage ratio. Qualifying

regulatory capital instruments in the form of debt plus other eligible TLAC

that is not regulatory capital would need to constitute 33% of external TLAC.

Regulatory capital instruments used by the GSIB to satisfy its applicable

regulatory capital buffers (i.e., the Capital Conservation Buffer, GSIB

surcharge and, if imposed, the Countercyclical Capital Buffer) could not be

counted toward the external TLAC requirement.

As proposed, TLAC-eligible instruments generally would include Common

Equity Tier 1 Capital, preferred stock and unsecured senior and subordinated

debt issued by the parent holding company with at least one year remaining

until maturity. Although there is uncertainty regarding the eligibility of

certain debt instruments, TLAC-eligible instruments would generally exclude

debt instruments that are secured, issued by operating subsidiaries, or include

derivatives or derivative-linked features (e.g., certain structured notes).

Moreover, a GSIB’s eligible TLAC may be reduced by holdings of TLAC-eligible

instruments issued by other GSIBs.

The FSB’s TLAC proposal would also establish “internal TLAC”

requirements, which would require that each foreign “material subsidiary”

(as proposed to be defined under the proposal) of a GSIB that is not otherwise

a resolution entity maintain a minimum of 75%–90% of the external TLAC

requirement that would apply if the subsidiary was a resolution entity.

While many aspects of this requirement are uncertain, the internal TLAC

proposal would effectually require “pre-positioning” of TLAC to the required

subsidiaries.

Pursuant to the FSB’s proposal, the conformance period regarding the

minimum TLAC requirements would not occur before January 1, 2019. The

U.S. banking agencies are expected to propose rules to establish similar TLAC

requirements for U.S. GSIBs during 2015. There are significant uncertainties

and interpretive issues arising from the FSB proposal. For additional

information, see “Risk Factors—Regulatory Risks” above.