Citibank 2014 Annual Report Download - page 280

Download and view the complete annual report

Please find page 280 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

263

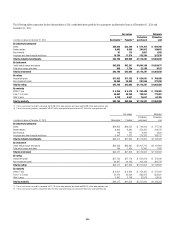

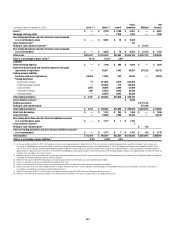

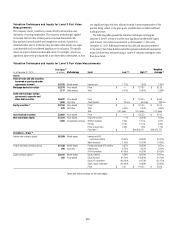

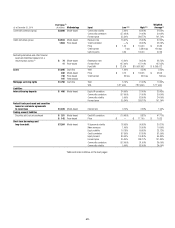

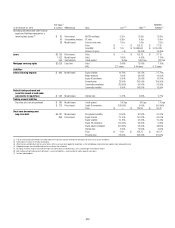

In millions of dollars at December 31, 2014 Level 1 (1) Level 2 (1) Level 3

Gross

inventory Netting (2)

Net

balance

Loans (4) $ — $ 2,793 $ 3,108 $ 5,901 $ — $ 5,901

Mortgage servicing rights — — 1,845 1,845 — 1,845

Non-trading derivatives and other financial assets measured

on a recurring basis, gross $ — $ 9,352 $ 78 $ 9,430

Cash collateral paid (5) 123

Netting of cash collateral received (8) $ (1,791)

Non-trading derivatives and other financial assets measured

on a recurring basis $ — $ 9,352 $ 78 $ 9,553 $ (1,791) $ 7,762

Total assets $261,637 $1,322,433 $42,393 $1,633,109 $(873,723) $759,386

Total as a percentage of gross assets (6) 16.1% 81.3% 2.6%

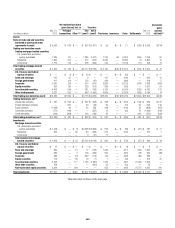

Liabilities

Interest-bearing deposits $ — $ 1,198 $ 486 $ 1,684 $ — $ 1,684

Federal funds purchased and securities loaned or sold under

agreements to repurchase — 82,811 1,043 83,854 (47,129) 36,725

Trading account liabilities

Securities sold, not yet purchased 59,463 11,057 424 70,944 — 70,944

Trading derivatives

Interest rate contracts 77 617,933 4,272 622,282

Foreign exchange contracts — 158,354 472 158,826

Equity contracts 2,955 26,616 2,898 32,469

Commodity contracts 669 22,872 2,645 26,186

Credit derivatives — 39,787 3,643 43,430

Total trading derivatives $ 3,701 $ 865,562 $13,930 $ 883,193

Cash collateral received (7) $ 9,846

Netting agreements $(777,178)

Netting of cash collateral paid (47,769)

Total trading derivatives $ 3,701 $ 865,562 $13,930 $ 893,039 $ (824,947) $ 68,092

Short-term borrowings $ — $ 1,152 $ 344 $ 1,496 $ — $ 1,496

Long-term debt — 18,890 7,290 26,180 — 26,180

Non-trading derivatives and other financial liabilities measured

on a recurring basis, gross $ — $ 1,777 $ 7 $ 1,784

Cash collateral received (8) 7

Netting of cash collateral paid (5) $ (15)

Total non-trading derivatives and other financial liabilities measured

on a recurring basis $ — $ 1,777 $ 7 $ 1,791 $ (15) $ 1,776

Total liabilities $ 63,164 $ 982,447 $23,524 $1,078,988 $(872,091) $206,897

Total as a percentage of gross liabilities (6) 5.9% 91.9% 2.2%

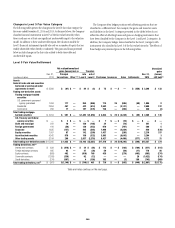

(1) For the year ended December 31, 2014, the Company transferred assets of approximately $4.1 billion from Level 1 to Level 2, primarily related to foreign government securities not traded in active markets and

Citi refining its methodology for certain equity contracts to reflect the prevalence of off-exchange trading. During the year ended December 31, 2014, the Company transferred assets of approximately $4.2 billion

from Level 2 to Level 1, primarily related to foreign government bonds traded with sufficient frequency to constitute a liquid market. During the year ended December 31, 2014, the Company transferred liabilities of

approximately $1.4 billion from Level 1 to Level 2, as Citi refined its methodology for certain equity contracts to reflect the prevalence of off-exchange trading. During the year ended December 31, 2014, there were no

material transfers of liabilities from Level 2 to Level 1.

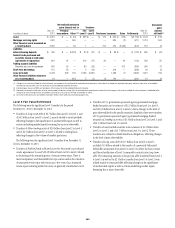

(2) Represents netting of: (i) the amounts due under securities purchased under agreements to resell and the amounts owed under securities sold under agreements to repurchase; and (ii) derivative exposures covered by

a qualifying master netting agreement and cash collateral offsetting.

(3) Reflects the net amount of $54,292 million of gross cash collateral paid, of which $47,769 million was used to offset derivative liabilities.

(4) There is no allowance for loan losses recorded for loans reported at fair value.

(5) Reflects the net amount of $138 million of gross cash collateral paid, of which $15 million was used to offset non-trading derivative liabilities.

(6) Because the amount of the cash collateral paid/received has not been allocated to the Level 1, 2 and 3 subtotals, these percentages are calculated based on total assets and liabilities measured at fair value on a

recurring basis, excluding the cash collateral paid/received on derivatives.

(7) Reflects the net amount of $57,471 million of gross cash collateral received, of which $47,625 million was used to offset derivative assets.

(8) Reflects the net amount of $1,798 million of gross cash collateral received, of which $1,791 million was used to offset non-trading derivative assets.