Citibank 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327

|

|

to close by the end of this year. And, after careful review, we

announced our intent to exit several non-core Consumer and

Institutional businesses, which will be reported as part of Citi

Holdings going forward. This move allows us to reallocate

those resources to businesses with far greater potential to

deliver value to clients and generate returns for the firm.

Turning now to the third goal, our record of delivering quality

and consistent earnings so far is mixed. We’ve produced

many strong quarters that show the power of our franchise

and what this firm can do at its best. But the environment

remains challenging and our results have also been undercut

by a series of legal accruals and settlements as well as

sizable repositioning charges.

Yet even in the face of these challenges, we made substantial

progress in every one of our business lines. In our Consumer

franchise, we further simplified our product offerings

while increasing the number of customers whose primary

interactions with the bank are through digital channels.

As a result, we were pleased to see an increase in customer

satisfaction, as measured by Net Promoter Scores.

We also made considerable progress toward the rationalization

and rightsizing of our country and branch networks. In the

11 markets we marked for divestiture in 2014, we didn’t see the

potential for achieving appropriate returns. Going forward,

our core Consumer network will comprise those 24 countries

where we enjoy some mixture of scale, competitive advantage,

history and expertise. We closed sales on our retail franchises

in Greece and Spain and signed agreements to sell those in

Peru and Japan. And, in an environment that continues to

be challenging, our U.S. business performed well, while we

showed modest growth internationally.

Our Institutional franchise performed well throughout

the year as we focused on serving core clients and our

institutional banking businesses continued to show solid

revenue growth. In Investment Banking, we gained share

with our target clients across most regions and generated

strong revenue growth. And despite the low interest rate

environment, Treasury and Trade Solutions grew revenues as

well, as did the Private Bank. While our Markets businesses

were impacted by lower client activity toward the end of

the year, we will continue to take steps to make sure these

businesses are sized correctly for the environment we see

going forward.

I know that, to fulfill the potential of this company, we

must both execute our strategy to our utmost and stop

undermining our progress with self-inflicted wounds.

That’s why I’ve made ethics and execution the core of

my agenda as CEO. Acting ethically in all that we do is a

cultural and business imperative. It also impacts directly

on the bottom line. Fines and settlements consume capital

that could otherwise be used to invest in our business, or

returned to you, our shareholders. Acting ethically is, first

and foremost, our license to do business. But even more

important, integrity is the currency through which we earn

and deserve the trust of our clients and customers — which

is the necessary foundation of everything we do.

And I want to make absolutely clear that we are still

committed to meeting, in 2015, the targets we set for our

firm’s return on assets and for our efficiency ratio. While

challenging to achieve this year, they are within reach if

market conditions remain stable. All that we accomplished

over the last two years has been in preparation for this year.

And I’m confident we will rise to the occasion.

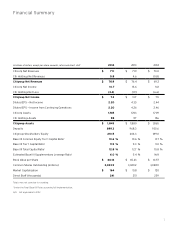

2014 Citicorp Net Revenues: $71.0 billion

By Region

North America

45%

Asia

21%

Latin America

19%

Europe,

Middle East

and Africa

15%

1 Results exclude Corporate/Other.

By Business

Global Consumer Banking

53%

ICG Markets and

Securities Services

23%

ICG Banking

24%

ICG — Institutional Clients Group

2014 Citicorp Net Revenues1

3