Citibank 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.125

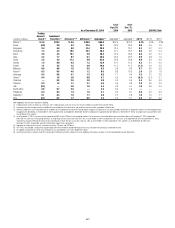

Goodwill

Citi tests goodwill for impairment annually on July 1 and between annual

tests if an event occurs or circumstances change that would more-likely-

than-not reduce the fair value of a reporting unit below its carrying amount,

such as a significant adverse change in the business climate, a decision

to sell or dispose of all or a significant portion of a reporting unit, or a

significant decline in Citi’s stock price. No goodwill impairment was recorded

during 2014, 2013 and 2012.

As of December 31, 2014, Citigroup consists of the following business

segments: Global Consumer Banking, Institutional Clients Group,

Corporate/Other and Citi Holdings. Goodwill impairment testing is

performed at the level below the business segment (referred to as a reporting

unit). Goodwill is allocated to Citi’s eight reporting units at the date the

goodwill is initially recorded. Once goodwill has been allocated to the

reporting units, it generally no longer retains its identification with a

particular acquisition, but instead becomes identified with the reporting unit

as a whole. As a result, all of the fair value of each reporting unit is available

to support the allocated goodwill.

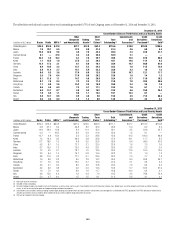

The carrying value used in the impairment test for each reporting unit is

derived by allocating Citigroup’s total stockholders’ equity to each component

(defined below) of the Company based on regulatory capital and tangible

common equity assessed for each component. The assigned carrying value of

the eight reporting units and Corporate/Other (together the “components”)

is equal to Citigroup’s total stockholders’ equity. Regulatory capital is derived

using each component’s Basel III risk-weighted assets. Specifically identified

Basel III capital deductions are then added to the components’ regulatory

capital to assign Citigroup’s total Tangible Common Equity. In allocating

Citigroup’s total stockholders’ equity to each component, the reported

goodwill and intangibles associated with each reporting unit are specifically

included in the carrying amount of the respective reporting units and the

remaining stockholders’ equity is then allocated to each component based on

the relative tangible common equity associated with each component.

Goodwill impairment testing involves management judgment, requiring

an assessment of whether the carrying value of the reporting unit can be

supported by the fair value of the individual reporting unit using widely

accepted valuation techniques, such as the market approach (earnings

multiples and/or transaction multiples) and/or the income approach

(discounted cash flow (DCF) method). In applying these methodologies,

Citi utilizes a number of factors, including actual operating results, future

business plans, economic projections, and market data. Citi prepares

a formal three-year plan for its businesses on an annual basis. These

projections incorporate certain external economic projections developed at

the point in time the plan is developed. For the purpose of performing any

impairment test, the most recent three-year forecast available is updated by

Citi to reflect current economic conditions as of the testing date. Citi used

the updated long-range financial forecasts as a basis for its annual goodwill

impairment test. Management may engage an independent valuation

specialist to assist in Citi’s valuation process.

Citigroup engaged an independent valuation specialist in 2013 and 2014

to assist in Citi’s valuation for most of the reporting units employing both the

market approach and DCF method. Citi believes that the DCF method, using

management projections for the selected reporting units and an appropriate

risk-adjusted discount rate, is most reflective of a market participant’s view

of fair values given current market conditions. For the reporting units where

both methods were utilized in 2013 and 2014, the resulting fair values were

relatively consistent and appropriate weighting was given to outputs from

both methods.

The DCF method used at the time of each impairment test used discount

rates that Citi believes adequately reflected the risk and uncertainty in the

financial markets generally and specifically in the internally generated cash

flow projections. The DCF method employs a capital asset pricing model in

estimating the discount rate. Citi continues to value the remaining reporting

units where it believes the risk of impairment to be low, using primarily the

market approach.

Since none of the Company’s reporting units are publicly traded,

individual reporting unit fair value determinations cannot be directly

correlated to Citigroup’s common stock price. The sum of the fair values of

the reporting units at July 1, 2014 exceeded the overall market capitalization

of Citi as of July 1, 2014. However, Citi believes that it is not meaningful to

reconcile the sum of the fair values of the Company’s reporting units to its

market capitalization due to several factors. The market capitalization of

Citigroup reflects the execution risk in a transaction involving Citigroup due

to its size. However, the individual reporting units’ fair values are not subject

to the same level of execution risk or a business model that is perceived to be

as complex.

See Note 17 to the Consolidated Financial Statements for additional

information on goodwill, including the changes in the goodwill

balance year-over-year and the reporting unit goodwill balances as of

December 31, 2014.

During the fourth quarter of 2014, Citi announced its intention to exit

its consumer businesses in 11 markets in Latin America, Asia and EMEA,

as well as its consumer finance business in Korea. Citi also announced its

intention to exit several non-core transactions businesses within ICG. These

businesses were transferred to Citi Holdings effective January 1, 2015.

Goodwill balances associated with the transfers were allocated to each of

the component businesses based on their relative fair values to the legacy

reporting units.

As required by ASC 350, a goodwill impairment test is being performed as

of January 1, 2015 under the legacy and new reporting structures, which may

result in an impairment for one or more of the new reporting units. Such

impairment, if any, is not expected to be significant.