Citibank 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.148

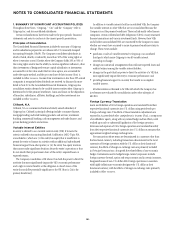

In the case of a repurchase of a credit-impaired SOP 03-3 loan, the

difference between the loan’s fair value and unpaid principal balance at the

time of the repurchase is recorded as a utilization of the repurchase reserve.

Make-whole payments to the investor are also treated as utilizations and

charged directly against the reserve. The repurchase reserve is estimated

when Citi sells loans (recorded as an adjustment to the gain on sale, which is

included in Other revenue in the Consolidated Statement of Income) and is

updated quarterly. Any change in estimate is recorded in Other revenue.

Goodwill

Goodwill represents the excess of acquisition cost over the fair value

of net tangible and intangible assets acquired. Goodwill is subject to

annual impairment testing and between annual tests if an event occurs or

circumstances change that would more-likely-than-not reduce the fair value

of a reporting unit below its carrying amount.

Under ASC 350, Intangibles—Goodwill and Other, the Company has an

option to assess qualitative factors to determine if it is necessary to perform

the goodwill impairment test. If, after assessing the totality of events or

circumstances, the Company determines that it is not more-likely-than-not

that the fair value of a reporting unit is less than its carrying amount, no

further testing is necessary. If, however, the Company determines that it

is more-likely-than not that the fair value of a reporting unit is less than

its carrying amount, then the Company must perform the first step of the

two-step goodwill impairment test.

The Company has an unconditional option to bypass the qualitative

assessment for any reporting unit in any reporting period and proceed

directly to the first step of the goodwill impairment test. Furthermore, on any

business dispositions, goodwill is allocated to the business disposed of based

on the ratio of the fair value of the business disposed of to the fair value of

the reporting unit.

The first step requires a comparison of the fair value of the individual

reporting unit to its carrying value, including goodwill. If the fair value of

the reporting unit is in excess of the carrying value, the related goodwill

is considered not to be impaired and no further analysis is necessary. If

the carrying value of the reporting unit exceeds the fair value, this is an

indication of potential impairment and a second step of testing is performed

to measure the amount of impairment, if any, for that reporting unit.

If required, the second step involves calculating the implied fair value

of goodwill for each of the affected reporting units. The implied fair value

of goodwill is determined in the same manner as the amount of goodwill

recognized in a business combination, which is the excess of the fair value of

the reporting unit determined in step one over the fair value of the net assets

and identifiable intangibles as if the reporting unit were being acquired.

If the amount of the goodwill allocated to the reporting unit exceeds the

implied fair value of the goodwill in the pro forma purchase price allocation,

an impairment charge is recorded for the excess. A recognized impairment

charge cannot exceed the amount of goodwill allocated to a reporting unit

and cannot subsequently be reversed even if the fair value of the reporting

unit recovers.

Additional information on Citi’s goodwill impairment testing can be

found in Note 17 to the Consolidated Financial Statements.

Intangible Assets

Intangible assets, including core deposit intangibles, present value of future

profits, purchased credit card relationships, other customer relationships,

and other intangible assets, but excluding MSRs, are amortized over their

estimated useful lives. Intangible assets deemed to have indefinite useful

lives, primarily certain asset management contracts and trade names, are

not amortized and are subject to annual impairment tests. An impairment

exists if the carrying value of the indefinite-lived intangible asset exceeds its

fair value. For other intangible assets subject to amortization, an impairment

is recognized if the carrying amount is not recoverable and exceeds the fair

value of the intangible asset.

Similar to the goodwill impairment analysis, in performing the annual

impairment analysis for indefinite-lived intangible assets, Citi may and has

elected to bypass the optional qualitative assessment, choosing instead to

perform a quantitative analysis.

Other Assets and Other Liabilities

Other assets include, among other items, loans held-for-sale, deferred tax

assets, equity method investments, interest and fees receivable, premises and

equipment (including purchased and developed software), repossessed assets,

and other receivables. Other liabilities include, among other items, accrued

expenses and other payables, deferred tax liabilities, and reserves for legal

claims, taxes, unfunded lending commitments, repositioning reserves, and

other matters.

Other Real Estate Owned and Repossessed Assets

Real estate or other assets received through foreclosure or repossession are

generally reported in Other assets, net of a valuation allowance for selling

costs and subsequent declines in fair value.

Securitizations

The Company primarily securitizes credit card receivables and mortgages.

Other types of securitized assets include corporate debt instruments (in cash

and synthetic form).

There are two key accounting determinations that must be made

relating to securitizations. Citi first makes a determination as to whether the

securitization entity must be consolidated. Second, it determines whether the

transfer of financial assets to the entity is considered a sale under GAAP. If

the securitization entity is a VIE, the Company consolidates the VIE if it is the

primary beneficiary (as discussed in “Variable Interest Entities” above). For

all other securitization entities determined not to be VIEs in which Citigroup

participates, consolidation is based on which party has voting control of

the entity, giving consideration to removal and liquidation rights in certain

partnership structures. Only securitization entities controlled by Citigroup

are consolidated.

Interests in the securitized and sold assets may be retained in the form

of subordinated or senior interest-only strips, subordinated tranches, spread

accounts and servicing rights. In credit card securitizations, the Company

retains a seller’s interest in the credit card receivables transferred to the trusts,

which is not in securitized form. In the case of consolidated securitization

entities, including the credit card trusts, these retained interests are not