Citibank 2014 Annual Report Download - page 276

Download and view the complete annual report

Please find page 276 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

259

Creditvaluationadjustments(CVA)and,effectiveinthethirdquarter

of2014,fundingvaluationadjustments(FVA),areappliedtoover-the-

counter (OTC) derivative instruments in which the base valuation generally

discounts expected cash flows using the relevant base interest rate curve

forthecurrencyofthederivative(e.g.,LIBORforuncollateralizedU.S.

dollar derivatives). As not all counterparties have the same credit risk as

thatimpliedbytherelevantbasecurve,aCVAisnecessarytoincorporate

the market view of both counterparty credit risk and Citi’s own credit risk

inthevaluation.FVAreflectsamarketfundingriskpremiuminherentin

the uncollateralized portion of derivative portfolios, and in collateralized

derivatives where the terms of the agreement do not permit the reuse of the

collateral received.

Citi’sCVAmethodologyiscomposedoftwosteps.First,thecreditexposure

profile for each counterparty is determined using the terms of all individual

derivative positions and a Monte Carlo simulation or other quantitative

analysis to generate a series of expected cash flows at future points in time.

The calculation of this exposure profile considers the effect of credit risk

mitigants, including pledged cash or other collateral and any legal right

of offset that exists with a counterparty through arrangements such as

netting agreements. Individual derivative contracts that are subject to an

enforceable master netting agreement with a counterparty are aggregated

for this purpose, since it is those aggregate net cash flows that are subject to

nonperformance risk. This process identifies specific, point-in-time future

cash flows that are subject to nonperformance risk, rather than using the

currentrecognizednetassetorliabilityasabasistomeasuretheCVA.Second,

market-based views of default probabilities derived from observed credit

spreads in the credit default swap (CDS) market are applied to the expected

futurecashflowsdeterminedinstepone.Citi’sown-creditCVAisdetermined

using Citi-specific CDS spreads for the relevant tenor. Generally, counterparty

CVAisdeterminedusingCDSspreadindicesforeachcreditratingandtenor.

For certain identified netting sets where individual analysis is practicable

(e.g., exposures to counterparties with liquid CDSs), counterparty-specific

CDS spreads are used.

TheCVAandFVAaredesignedtoincorporateamarketviewofthecredit

and funding risk, respectively, inherent in the derivative portfolio. However,

most unsecured derivative instruments are negotiated bilateral contracts

and are not commonly transferred to third parties. Derivative instruments

are normally settled contractually or, if terminated early, are terminated at

avaluenegotiatedbilaterallybetweenthecounterparties.Thus,theCVAand

FVAmaynotberealizeduponasettlementorterminationinthenormal

course of business. In addition, all or a portion of these adjustments may be

reversed or otherwise adjusted in future periods in the event of changes in the

credit or funding risk associated with the derivative instruments.

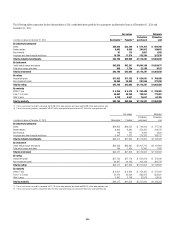

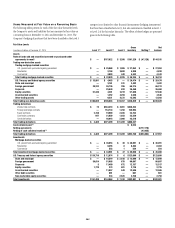

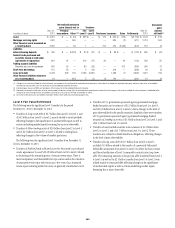

ThetablebelowsummarizestheCVAandFVAappliedtothefairvalueof

derivative instruments for the periods indicated:

Credit and funding valuation

adjustments

contra-liability (contra-asset)

In millions of dollars

December 31,

2014

December 31,

2013

Counterparty CVA $(1,853) $(1,733)

Asset FVA (518) —

Citigroup (own-credit) CVA 580 651

Liability FVA 19 —

Total CVA—derivative instruments (1) $(1,772) $(1,082)

(1) FVA is included with CVA for presentation purposes.

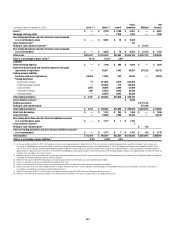

The table below summarizes pretax gains (losses) related to changes in

CVAonderivativeinstruments,netofhedges,FVAonderivativesanddebt

valuationadjustments(DVA)onCiti’sownfairvalueoption(FVO)liabilities

for the periods indicated:

Credit/funding/debt valuation

adjustments gain (loss)

In millions of dollars 2014 2013 2012

Counterparty CVA $ (43) $ 291 $ 805

Asset FVA (518) — —

Own-credit CVA (65) (223) (1,126)

Liability FVA 19 — —

Total CVA—derivative instruments $(607) $ 68 $ (321)

DVA related to own FVO liabilities $ 217 $(410) $(2,009)

Total CVA and DVA (1) $(390) $(342) $(2,330)

(1) FVA is included with CVA for presentation purposes.

Valuation Process for Fair Value Measurements

Price verification procedures and related internal control procedures are

governed by the Citigroup Pricing and Price Verification Policy and

Standards,whichisjointlyownedbyFinanceandRiskManagement.

Finance has implemented the ICG Pricing and Price Verification

Standards and Procedures to facilitate compliance with this policy.

For fair value measurements of substantially all assets and liabilities

held by the Company, individual business units are responsible for valuing

the trading account assets and liabilities, and Product Control within

Finance performs independent price verification procedures to evaluate

those fair value measurements. Product Control is independent of the

individual business units and reports to the Global Head of Product Control.

It has authority over the valuation of financial assets and liabilities. Fair

value measurements of assets and liabilities are determined using various

techniques, including, but not limited to, discounted cash flows and internal

models, such as option and correlation models.