Citibank 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327

|

|

112

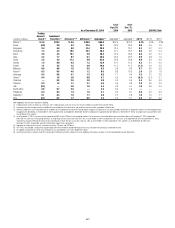

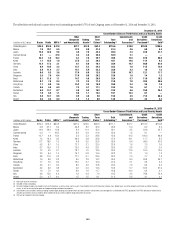

The following table provides the VAR for ICG during 2014, excluding the

CVA relating to derivative counterparties, hedges of CVA, fair value option

loans and hedges to the loan portfolio.

In millions of dollars Dec. 31, 2014

Total—all market risk

factors, including general and specific risk $122

Average—during year $109

High—during year 159

Low—during year 82

VAR Model Review and Validation

Generally, Citi’s VAR review and model validation process entails reviewing

the model framework, major assumptions, and implementation of the

mathematical algorithm. In addition, as part of the model validation

process, product specific back-testing on portfolios is periodically completed

and reviewed with Citi’s U.S. banking regulators. Furthermore, Regulatory

VAR (as described below) back-testing is performed against buy-and-hold

profit and loss on a monthly basis for approximately 167 portfolios across the

organization (trading desk level, ICG business segment and Citigroup) and

the results are shared with the U.S. banking regulators.

Significant VAR model and assumption changes must be independently

validated within Citi’s risk management organization. This validation

process includes a review by Citi’s model validation group and further

approval from its model validation review committee, which is composed

of senior quantitative risk management officers. In the event of significant

model changes, parallel model runs are undertaken prior to implementation.

In addition, significant model and assumption changes are subject to the

periodic reviews and approval by Citi’s U.S. banking regulators.

In the second quarter of 2014, Citi implemented two VAR model

enhancements that were reviewed by Citi’s U.S. banking regulators as well

as Citi’s model validation group. Specifically, Citi enhanced the correlation

among mortgage products as well as introduced industry sectors (financial

and non-financial) into the credit spread component of the VAR model.

Citi uses the same independently validated VAR model for both Regulatory

VAR and Risk Management VAR (i.e., Total Trading and Total Trading and

Credit Portfolios VARs) and, as such, the model review and oversight process

for both purposes is as described above.

Regulatory VAR, which is calculated in accordance with Basel III, differs

from Risk Management VAR due to the fact that certain positions included

in Risk Management VAR are not eligible for market risk treatment in

Regulatory VAR. The composition of Risk Management VAR is discussed

under “Value at Risk” above. The applicability of the VAR model for positions

eligible for market risk treatment under U.S. regulatory capital rules is

periodically reviewed and approved by Citi’s U.S. banking regulators.

In accordance with Basel III, Regulatory VAR includes all trading book

covered positions and all foreign exchange and commodity exposures.

Pursuant to Basel III, Regulatory VAR excludes positions that fail to meet

the intent and ability to trade requirements and are therefore classified as

non-trading book and categories of exposures that are specifically excluded

as covered positions. Regulatory VAR excludes CVA on derivative instruments

and DVA on Citi’s own fair value option liabilities. With the April 2014

implementation of the U.S. final Basel III rules, CVA hedges are excluded

from Regulatory VAR and included in credit risk-weighted assets as computed

under the Advanced Approaches for determining risk-weighted assets.