Citibank 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.126

Income Taxes

Overview

Citi is subject to the income tax laws of the U.S., its states and local

municipalities and the foreign jurisdictions in which Citi operates. These

tax laws are complex and are subject to differing interpretations by the

taxpayer and the relevant governmental taxing authorities. Disputes over

interpretations of the tax laws may be subject to review and adjudication by

the court systems of the various tax jurisdictions or may be settled with the

taxing authority upon audit.

In establishing a provision for income tax expense, Citi must make

judgments and interpretations about the application of these inherently

complex tax laws. Citi must also make estimates about when in the future

certain items will affect taxable income in the various tax jurisdictions, both

domestic and foreign. Deferred taxes are recorded for the future consequences

of events that have been recognized in the financial statements or tax

returns, based upon enacted tax laws and rates. Deferred tax assets (DTAs)

are recognized subject to management’s judgment that realization is more-

likely-than-not.

DTAs

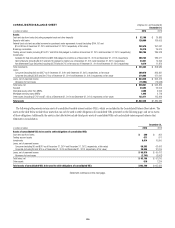

At December 31, 2014, Citi had recorded net DTAs of $49.5 billion, a

decrease of $3.3 billion (including approximately $400 million in the fourth

quarter of 2014) from $52.8 billion at December 31, 2013. The decrease

in total DTAs year-over-year was primarily due to the earnings in Citicorp.

Foreign tax credits (FTCs) composed approximately $17.6 billion of Citi’s

DTAs as of December 31, 2014, compared to approximately $19.6 billion

as of December 31, 2013. The decrease in FTCs year-over-year was due

to the generation of U.S. taxable income and represented $2.0 billion

of the $3.3 billion decrease in Citi’s overall DTAs noted above. The FTCs

carry-forward periods represent the most time-sensitive component of Citi’s

DTAs. Accordingly, in 2015, Citi will continue to prioritize reducing the FTC

carry-forward component of the DTAs. Secondarily, Citi’s actions will focus

on reducing other DTA components and, thereby, reduce the total DTAs.

While Citi’s net total DTAs decreased year-over-year, the time remaining for

utilization has shortened, given the passage of time, particularly with respect

to the FTCs component of the DTAs. Although realization is not assured,

Citi believes that the realization of the recognized net DTAs of $49.5 billion

at December 31, 2014 is more-likely-than-not based upon expectations as

to future taxable income in the jurisdictions in which the DTAs arise and

available tax planning strategies (as defined in ASC 740, Income Taxes) that

would be implemented, if necessary, to prevent a carry-forward from expiring.

In general, Citi would need to generate approximately $81 billion of U.S.

taxable income during the FTCs carry-forward periods to prevent Citi’s DTAs

from expiring. Citi’s net DTAs will decline primarily as additional domestic

GAAP taxable income is generated.

Citi has concluded that two components of positive evidence support the

full realization of its DTAs. First, Citi forecasts sufficient U.S. taxable income

in the carry-forward periods, exclusive of ASC 740 tax planning strategies.

Citi’s forecasted taxable income, which will continue to be subject to overall

market and global economic conditions, incorporates geographic business

forecasts and taxable income adjustments to those forecasts (e.g., U.S.

tax exempt income, loan loss reserves deductible for U.S. tax reporting in

subsequent years), and actions intended to optimize its U.S. taxable earnings.

Second, Citi has sufficient tax planning strategies available to it under

ASC 740 that would be implemented, if necessary, to prevent a carry-forward

from expiring. These strategies include repatriating low-taxed foreign source

earnings for which an assertion that the earnings have been indefinitely

reinvested has not been made; accelerating U.S. taxable income into, or

deferring U.S. tax deductions out of, the latter years of the carry-forward

period (e.g., selling appreciated assets, electing straight-line depreciation);

accelerating deductible temporary differences outside the U.S.; and selling

certain assets that produce tax-exempt income, while purchasing assets that

produce fully taxable income. In addition, the sale or restructuring of certain

businesses can produce significant U.S. taxable income within the relevant

carry-forward periods.

Based upon the foregoing discussion, Citi believes the U.S. federal and

New York state and city net operating loss carry-forward period of 20 years

provides enough time to fully utilize the DTAs pertaining to the existing

net operating loss carry-forwards and any net operating loss that would be

created by the reversal of the future net deductions that have not yet been

taken on a tax return.

With respect to the FTCs component of the DTAs, the carry-forward period

is 10 years. Citi believes that it will generate sufficient U.S. taxable income

within the 10-year carry-forward period to be able to fully utilize the FTCs, in

addition to any FTCs produced in such period, which must be used prior to

any carry-forward utilization.

For additional information on Citi’s income taxes, including its income

tax provision, tax assets and liabilities, and a tabular summary of Citi’s

net DTAs balance as of December 31, 2014 (including the FTCs and

applicable expiration dates of the FTCs), see Note 9 to the Consolidated

Financial Statements.

Litigation Accruals

See the discussion in Note 28 to the Consolidated Financial Statements for

information regarding Citi’s policies on establishing accruals for litigation

and regulatory contingencies.

Accounting Changes and Future Application of

Accounting Standards

See Note 1 to the Consolidated Financial Statements for a

discussion of “Accounting Changes” and the “Future Application of

Accounting Standards.”