Citibank 2014 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.226

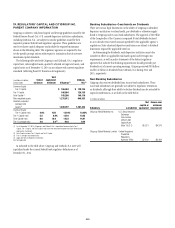

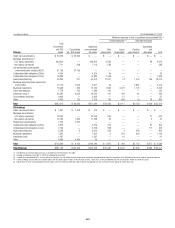

22. SECURITIZATIONS AND VARIABLE INTEREST

ENTITIES

Uses of Special Purpose Entities

A special purpose entity (SPE) is an entity designed to fulfill a specific

limited need of the company that organized it. The principal uses of SPEs

by Citi are to obtain liquidity and favorable capital treatment by securitizing

certain financial assets, to assist clients in securitizing their financial assets

and to create investment products for clients. SPEs may be organized in

various legal forms, including trusts, partnerships or corporations. In a

securitization, the company transferring assets to an SPE converts all (or a

portion) of those assets into cash before they would have been realized in

the normal course of business through the SPE’s issuance of debt and equity

instruments, certificates, commercial paper or other notes of indebtedness.

These issuances are recorded on the balance sheet of the SPE, which may

or may not be consolidated onto the balance sheet of the company that

organized the SPE.

Investors usually have recourse only to the assets in the SPE, but may

also benefit from other credit enhancements, such as a collateral account,

a line of credit or a liquidity facility, such as a liquidity put option or asset

purchase agreement. Because of these enhancements, the SPE issuances

typically obtain a more favorable credit rating than the transferor could

obtain for its own debt issuances. This results in less expensive financing

costs than unsecured debt. The SPE may also enter into derivative contracts

in order to convert the yield or currency of the underlying assets to match

the needs of the SPE investors or to limit or change the credit risk of the SPE.

Citigroup may be the provider of certain credit enhancements as well as the

counterparty to any related derivative contracts.

Most of Citigroup’s SPEs are variable interest entities (VIEs), as

described below.

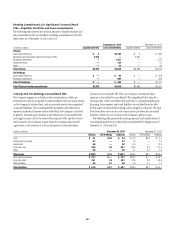

Variable Interest Entities

VIEs are entities that have either a total equity investment that is insufficient

to permit the entity to finance its activities without additional subordinated

financial support, or whose equity investors lack the characteristics of a

controlling financial interest (i.e., ability to make significant decisions

through voting rights and a right to receive the expected residual returns

of the entity or an obligation to absorb the expected losses of the entity).

Investors that finance the VIE through debt or equity interests or other

counterparties providing other forms of support, such as guarantees,

subordinated fee arrangements or certain types of derivative contracts are

variable interest holders in the entity.

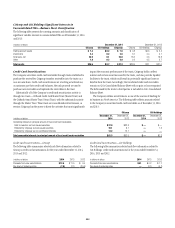

The variable interest holder, if any, that has a controlling financial interest

in a VIE is deemed to be the primary beneficiary and must consolidate the

VIE. Citigroup would be deemed to have a controlling financial interest and

be the primary beneficiary if it has both of the following characteristics:

• power to direct the activities of the VIE that most significantly impact the

entity’s economic performance; and

• an obligation to absorb losses of the entity that could potentially be

significant to the VIE, or a right to receive benefits from the entity that

could potentially be significant to the VIE.

The Company must evaluate each VIE to understand the purpose

and design of the entity, the role the Company had in the entity’s design

and its involvement in the VIE’s ongoing activities. The Company then

must evaluate which activities most significantly impact the economic

performance of the VIE and who has the power to direct such activities.

For those VIEs where the Company determines that it has the power

to direct the activities that most significantly impact the VIE’s economic

performance, the Company must then evaluate its economic interests, if any,

and determine whether it could absorb losses or receive benefits that could

potentially be significant to the VIE. When evaluating whether the Company

has an obligation to absorb losses that could potentially be significant, it

considers the maximum exposure to such loss without consideration of

probability. Such obligations could be in various forms, including, but not

limited to, debt and equity investments, guarantees, liquidity agreements and

certain derivative contracts.

In various other transactions, the Company may: (i) act as a derivative

counterparty (for example, interest rate swap, cross-currency swap, or

purchaser of credit protection under a credit default swap or total return

swap where the Company pays the total return on certain assets to the SPE);

(ii) act as underwriter or placement agent; (iii) provide administrative,

trustee or other services; or (iv) make a market in debt securities or other

instruments issued by VIEs. The Company generally considers such

involvement, by itself, not to be variable interests and thus not an indicator

of power or potentially significant benefits or losses.

See Note 1 to the Consolidated Financial Statements for a discussion of

impending changes to targeted areas of consolidation guidance.