Citibank 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327

|

|

18

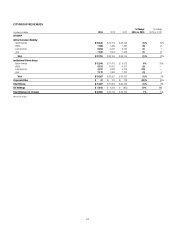

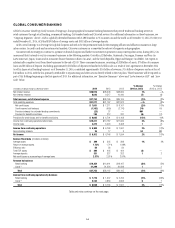

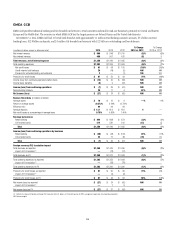

EMEA GCB

EMEA GCB provides traditional banking and Citi-branded card services to retail customers and small to mid-size businesses, primarily in Central and Eastern

Europe and the Middle East. The countries in which EMEA GCB has the largest presence are Poland, Russia and the United Arab Emirates.

At December 31, 2014, EMEA GCB had 137 retail bank branches with approximately 3.1 million retail banking customer accounts, $5.4 billion in retail

banking loans, $12.8 billion in deposits, and 2.0 million Citi-branded card accounts with $2.2 billion in outstanding card loan balances.

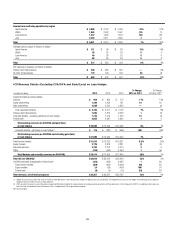

In millions of dollars, except as otherwise noted 2014 2013 2012

% Change

2014 vs. 2013

% Change

2013 vs. 2012

Net interest revenue $ 899 $ 948 $ 1,010 (5)% (6)%

Non-interest revenue 459 501 475 (8) 5

Total revenues, net of interest expense $1,358 $ 1,449 $ 1,485 (6)% (2)%

Total operating expenses $1,283 $ 1,359 $ 1,469 (6)% (7)%

Net credit losses $ 61 $ 68 $ 105 (10)% (35)%

Credit reserve build (release) 24 (18) (5) NM NM

Provision for unfunded lending commitments 2— (1) 100 100

Provisions for credit losses $ 87 $ 50 $ 99 74% (49)%

Income (loss) from continuing operations before taxes $ (12) $ 40 $ (83) NM NM

Income taxes (benefits) (5) 5 (22) NM NM

Income (loss) from continuing operations $ (7) $ 35 $ (61) NM NM

Noncontrolling interests 20 11 4 82% NM

Net income (loss) $ (27) $ 24 $ (65) NM NM

Balance Sheet data (in billions of dollars)

Average assets $ 10 $ 10 $ 9 —% 11%

Return on average assets (0.27)% 0.24% (0.72)%

Efficiency ratio 94 94 99

Average deposits $ 13.1 $ 12.6 $ 12.6 4—

Net credit losses as a percentage of average loans 0.75% 0.85% 1.40%

Revenue by business

Retail banking $ 844 $ 868 $ 873 (3)% (1)%

Citi-branded cards 514 581 612 (12) (5)

Total $1,358 $ 1,449 $ 1,485 (6)% (2)%

Income (loss) from continuing operations by business

Retail banking $ (30) $ (42) $ (109) 29% 61%

Citi-branded cards 23 77 48 (70) 60

Total $ (7) $ 35 $ (61) NM NM

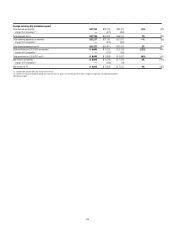

Foreign currency (FX) translation impact

Total revenues-as reported $1,358 $ 1,449 $ 1,485 (6)% (2)%

Impact of FX translation (1) —(72) (77)

Total revenues-ex-FX $1,358 $ 1,377 $ 1,408 (1)% (2)%

Total operating expenses-as reported $1,283 $ 1,359 $ 1,469 (6)% (7)%

Impact of FX translation (1) —(59) (79)

Total operating expenses-ex-FX $1,283 $ 1,300 $ 1,390 (1)% (6)%

Provisions for credit losses-as reported $ 87 $ 50 $ 99 74% (49)

Impact of FX translation (1) —(6) (6)

Provisions for credit losses-ex-FX $ 87 $ 44 $ 93 98% (53)%

Net income (loss)-as reported $ (27) $ 24 $ (65) NM NM

Impact of FX translation (1) —7 9

Net income (loss)-ex-FX $ (27) $ 31 $ (56) NM NM

(1) Reflects the impact of foreign exchange (FX) translation into U.S. dollars at the fourth quarter of 2014 average exchange rates for all periods presented.

NM Not meaningful