Citibank 2014 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

222

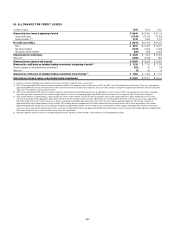

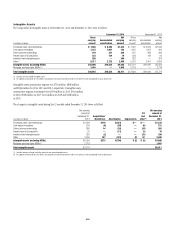

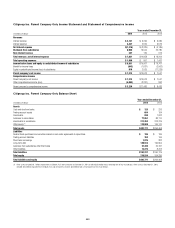

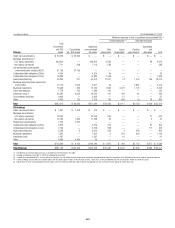

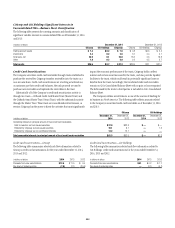

20. CHANGES IN ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Changes in each component of Citigroup’s Accumulated other comprehensive income (loss) for the three years ended December 31, 2014 are as follows:

In millions of dollars

Net

unrealized

gains (losses)

on investment

securities

Cash flow

hedges (1)

Benefit

plans (2)

Foreign

currency

translation

adjustment,

net of

hedges

(CTA) (3)(4)

Accumulated

other

comprehensive

income (loss)

Balance, December 31, 2011 $ (35) $(2,820) $(4,282) $ (10,651) $ (17,788)

Change, net of taxes (5)(6) 632 527 (988) 721 892

Balance, December 31, 2012 $ 597 $(2,293) $(5,270) $ (9,930) $ (16,896)

Other comprehensive income before reclassifications $(1,962) $ 512 $ 1,098 $ (2,534) $ (2,886)

Increase (decrease) due to amounts reclassified from AOCI (7) (275) 536 183 205 649

Change, net of taxes (7) $(2,237) $ 1,048 $ 1,281 $ (2,329) $ (2,237)

Balance, December 31, 2013 $(1,640) $(1,245) $(3,989) $ (12,259) $ (19,133)

Other comprehensive income before reclassifications $ 1,790 $ 85 $(1,346) $ (4,946) $ (4,417)

Increase (decrease) due to amounts reclassified from AOCI (93) 251 176 — 334

Change, net of taxes $ 1,697 $ 336 $(1,170) $ (4,946) $ (4,083)

Balance at December 31, 2014 $ 57 $ (909) $(5,159) $(17,205) $(23,216)

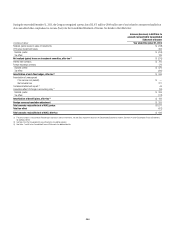

(1) Primarily driven by Citigroup’s pay fixed/receive floating interest rate swap programs that hedge the floating rates on liabilities.

(2) Primarily reflects adjustments based on the quarterly actuarial valuations of the Company’s significant pension and postretirement plans, annual actuarial valuations of all other plans, and amortization of amounts

previously recognized in other comprehensive income. Reflects the adoption of new mortality tables effective December 31, 2014 (see Note 8 to the Consolidated Financial Statements).

(3) Primarily reflects the movements in (by order of impact) the Mexican peso, euro, Japanese yen, and Russian ruble against the U.S. dollar, and changes in related tax effects and hedges for the year ended

December 31, 2014. Primarily reflects the movements in (by order of impact) the Japanese yen, Mexican peso, Australian dollar, and Indian rupee against the U.S. dollar, and changes in related tax effects and hedges

for the year ended December 31, 2013. Primarily reflects the movements in (by order of impact) the Mexican peso, Japanese yen, euro, and Brazilian real against the U.S. dollar, and changes in related tax effects and

hedges for the year ended December 31, 2012.

(4) During 2014, $137 million ($84 million net of tax) was reclassified to reflect the allocation of foreign currency translation between net unrealized gains (losses) on investment securities to CTA.

(5) Includes the after-tax impact of realized gains from the sales of minority investments: $672 million from the Company’s entire interest in Housing Development Finance Corporation Ltd. (HDFC); and $421 million from

the Company’s entire interest in Shanghai Pudong Development Bank (SPDB).

(6) The after-tax impact due to impairment charges and the loss related to Akbank included within the foreign currency translation adjustment, during 2012 was $667 million (see Note 14 to the Consolidated

Financial Statements).

(7) On December 20, 2013, the sale of Credicard was completed (see Note 2 to the Consolidated Financial Statements). The total impact to the gross CTA (net CTA including hedges) was a pretax loss of $314 million

($205 million net of tax).

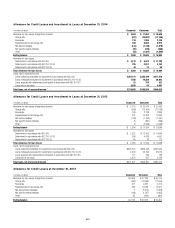

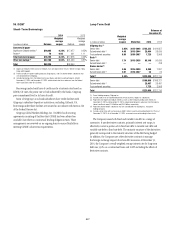

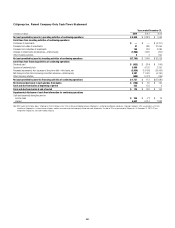

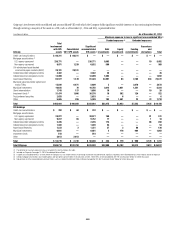

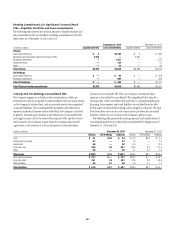

The pretax and after-tax changes in each component of Accumulated other comprehensive income (loss) for the three years ended December 31, 2014

are as follows:

In millions of dollars Pretax Tax effect After-tax

Balance, December 31, 2011 $ (25,807) $ 8,019 $ (17,788)

Change in net unrealized gains (losses) on investment securities 1,001 (369) 632

Cash flow hedges 838 (311) 527

Benefit plans (1,378) 390 (988)

Foreign currency translation adjustment 12 709 721

Change $ 473 $ 419 $ 892

Balance, December 31, 2012 $ (25,334) $ 8,438 $ (16,896)

Change in net unrealized gains (losses) on investment securities (3,537) 1,300 (2,237)

Cash flow hedges 1,673 (625) 1,048

Benefit plans 1,979 (698) 1,281

Foreign currency translation adjustment (2,377) 48 (2,329)

Change $ (2,262) $ 25 $ (2,237)

Balance, December 31, 2013 $ (27,596) $ 8,463 $ (19,133)

Change in net unrealized gains (losses) on investment securities 2,704 (1,007) 1,697

Cash flow hedges 543 (207) 336

Benefit plans (1,830) 660 (1,170)

Foreign currency translation adjustment (4,881) (65) (4,946)

Change $ (3,464) $ (619) $ (4,083)

Balance, December 31, 2014 $(31,060) $ 7,844 $(23,216)