Citibank 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

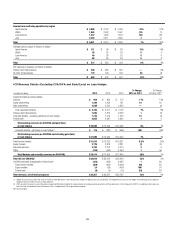

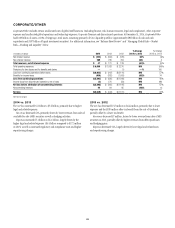

The discussion of the results of operations for Citi Holdings below excludes the impact of CVA/DVA for all periods presented. Presentations of the results

of operations, excluding the impact of CVA/DVA, are non-GAAP financial measures. Citi believes the presentation of Citi Holdings’ results excluding the

impact of CVA/DVA is a more meaningful depiction of the underlying fundamentals of the business. For a reconciliation of these metrics to the reported

results, see the table above.

2014 vs. 2013

The net loss increased by $1.4 billion to $3.3 billion, largely due to the

impact of the mortgage settlement in July 2014 (see “Executive Summary”

above), partially offset by higher revenues and lower cost of credit.

Excluding the mortgage settlement, net income increased by $2.3 billion to

$385 million, primarily due to lower expenses, higher revenues and lower net

credit losses, partially offset by a lower net loan loss reserve release.

Revenues increased 28%, primarily driven by gains on asset sales,

including the sales of the consumer operations in Greece and Spain in the

third quarter of 2014, lower funding costs and the absence of residential

mortgage repurchase reserve builds for representation and warranty claims

in 2014, partially offset by losses on the redemption of debt associated with

funding Citi Holdings assets.

Expenses increased 29%, principally reflecting higher legal and related

costs ($4.7 billion compared to $2.6 billion in 2013) due to the mortgage

settlement, partially offset by lower expenses driven by the ongoing decline

in assets. Excluding the impact of the mortgage settlement, expenses

declined 34%, primarily driven by lower legal and related costs ($986 million

compared to $2.6 billion in 2013) as well as the ongoing decline in assets.

Provisions decreased 18%, driven by lower net credit losses, partially

offset by a lower net loss reserve release. Excluding the impact of the

mortgage settlement, provisions declined 22%, driven by a 46% decline in

net credit losses primarily due to continued improvements in North America

mortgages and overall lower asset levels. The net reserve release decreased

56% to $903 million, primarily due to lower releases related to the North

America mortgage portfolio, partially offset by lower losses on asset sales.

Excluding the impact of the mortgage settlement, the net reserve release

decreased 53%. Loan loss reserves related to the North America mortgage

portfolio were utilized to nearly fully offset net credit losses in the portfolio

in 2014.

2013 vs. 2012

The net loss decreased by 71% to $1.9 billion. 2012 included the pretax

loss of $4.7 billion ($2.9 billion after-tax) related to the sale of the Morgan

Stanley Smith Barney joint venture (MSSB) to Morgan Stanley. Excluding

the MSSB loss, the net loss decreased to $1.9 billion from a net loss of

$3.8 billion in 2012, due to significantly lower provisions for credit losses and

higher revenues, partially offset by higher expenses.

Revenues increased to $4.6 billion, primarily due to the absence of the

MSSB loss. Excluding the MSSB loss, revenues increased 23%, primarily

driven by lower funding costs and lower residential mortgage repurchase

reserve builds for representation and warranty claims ($470 million,

compared to $700 million in 2012).

Expenses increased 13%, primarily due to higher legal and related costs

($2.6 billion in 2013 compared to $1.2 billion in 2012), driven largely

by legacy private-label securitization and other mortgage-related issues,

partially offset by lower overall assets. Excluding legal and related costs,

expenses declined 18% versus 2012.

Provisions decreased 66%, driven by the absence of incremental net

credit losses relating to the national mortgage settlement and those required

by Office of the Comptroller of the Currency (OCC) guidance during 2012

(for additional information, see Note 16 to the Consolidated Financial

Statements), as well as improved credit in North America mortgages

and overall lower asset levels. Loan loss reserve releases increased 27% to

$2 billion, which included a loan loss reserve release of approximately

$2.2 billion related to the North America mortgage portfolio, partially offset

by losses on asset sales.

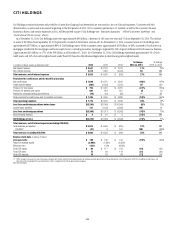

Japan Consumer Finance

In 2008, Citi decided to exit its Japan Consumer Finance business and

has liquidated approximately 95% of the portfolio since that time. As

of December 31, 2014, Citi’s Japan Consumer Finance business had

approximately $151 million in outstanding loans that currently charge

or have previously charged interest rates in the “gray zone” (interest at

rates that are legal but may not be enforceable and thus may subject Citi

to customer refund claims), compared to approximately $278 million as

of December 31, 2013. Although the portfolio has largely been liquidated,

Citi could be subject to refund claims on previously outstanding loans that

charged gray zone interest and thus could be subject to losses on loans in

excess of these amounts.

At December 31, 2014, Citi’s reserves related to customer refunds in

the Japan Consumer Finance business were $442 million, compared to

$434 million at December 31, 2013. The increase in the total reserve year-

over-year primarily resulted from net reserve builds in 2014 ($248 million

compared to $28 million in 2013) due to less than expected declines in

customer refund claims, partially offset by payments made to customers and

a continuing reduction in the population of current and former customers

who are eligible to make refund claims.

Citi continues to monitor and evaluate trends and developments relating

to the charging of gray zone interest, including customer defaults, refund

claims and litigation, and financial, legislative, regulatory, judicial and

other political developments, as well as the potential impact to both currently

and previously outstanding loans in this legacy business and its reserves

related thereto. Citi could be subject to additional losses as a result of these

developments and the impact on Citi is subject to uncertainty and continues

to be difficult to predict.