Citibank 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

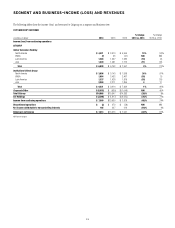

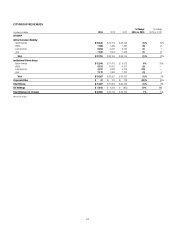

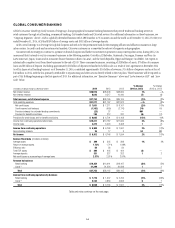

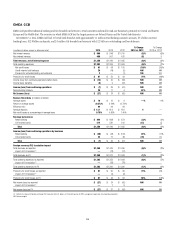

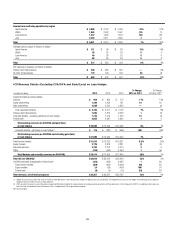

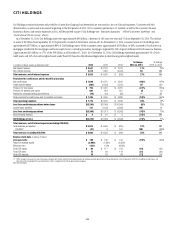

The discussion of the results of operations for EMEA GCB below excludes the impact of FX translation for all periods presented. Presentations of the

results of operations, excluding the impact of FX translation, are non-GAAP financial measures. Citi believes the presentation of EMEA GCB’s results

excluding the impact of FX translation is a more meaningful depiction of the underlying fundamentals of the business. For a reconciliation of certain

of these metrics to the reported results, see the table above.

2014 vs. 2013

Net income declined $58 million to a net loss of $27 million as higher credit

costs and lower revenues were partially offset by lower expenses.

Revenues decreased 1%, driven by lower revenues resulting from the

sales of Citi’s consumer operations in Turkey and Romania during 2013,

spread compression and the absence of the prior-year gain related to the

Turkey sale, largely offset by volume growth. Net interest revenue was roughly

unchanged as spread compression was offset by growth in average retail

loans. Non-interest revenue decreased 4%, mainly reflecting lower revenues

due to the sales of the consumer operations in Turkey and Romania, partially

offset by higher investment fees due to increased sales of higher spread

investment products.

Retail banking revenues increased 2%, primarily due to increases in

investment sales (3%), average deposits (5%) and average retail loans (11%),

partially offset by the impact of the sales of the consumer operations in

Turkey and Romania. Cards revenues declined 6%, primarily due to spread

compression, interest rate caps, particularly in Poland, and the impact of

the sales of the consumer operations in Turkey and Romania. Continued

regulatory changes, including caps on interchange rates in Poland, and

spread compression will likely continue to negatively impact revenues in

EMEA GCB in 2015.

Expenses decreased 1%, primarily due to the impact of the sales of the

consumer operations in Turkey and Romania and efficiency savings, which

were largely offset by higher repositioning charges, continued investment

spending on new internal operating platforms and volume-related expenses.

Provisions increased 98% to $87 million driven by a loan loss reserve

build mainly related to Citi’s consumer business in Russia due to the ongoing

economic situation in Russia (as discussed below), partially offset by a 1%

decline in net credit losses.

Russia

Citi’s ability to grow its consumer business in Russia has been negatively

impacted by actions Citi has taken to mitigate its risks and exposures in

response to the ongoing political instability, such as limiting its exposure

to additional credit risk. In addition, the ongoing economic situation in

Russia, coupled with consumer overleveraging in the market, has negatively

impacted consumer credit, particularly delinquencies in the Russian card

and personal installment loan portfolios (which totaled $1.2 billion as of

December 31, 2014, or 0.4% of total GCB loans), and Citi currently expects

these trends could continue into 2015. Citi has taken these trends into

consideration in determining its allowance for loan loss reserves. Any further

actions Citi may take to mitigate its exposures or risks, or the imposition

of additional sanctions (such as asset freezes) involving Russia or against

Russian entities, business sectors, individuals or otherwise, could further

negatively impact the results of operations of EMEA GCB. For additional

information on Citi’s exposures in Russia, see “Managing Global Risk—

Country and Cross-Border Risk” below.

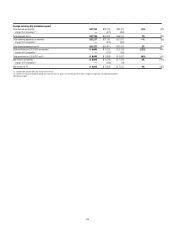

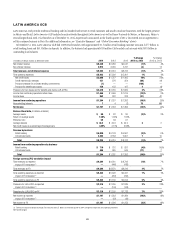

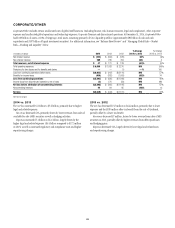

2013 vs. 2012

Net income of $31 million compared to a net loss of $56 million in 2012

as lower expenses and lower net credit losses were partially offset by lower

revenues, primarily due to the impact of the sales of Citi’s consumer

operations in Turkey and Romania.

Revenues decreased 2%, mainly driven by the lower revenues resulting

from the sales of the consumer operations in Turkey and Romania,

partially offset by higher volumes in core markets and a gain related to the

Turkey sale.

Retail banking revenues decreased 1%, driven by the sales of the consumer

operations in Turkey and Romania, partially offset by increases in average

deposits (1%) and average retail loans (13%) as well as the gain related

to the Turkey sale. Cards revenues declined 4%, primarily due to spread

compression and interest rate caps, particularly in Poland, and an 8%

decrease in average cards loans, primarily due to the sales of the consumer

operations in Turkey and Romania.

Expenses declined 6%, primarily due to repositioning savings as

well as lower repositioning charges, partially offset by higher volume-

related expenses and continued investment spending on new internal

operating platforms.

Provisions declined 53% due to a 37% decrease in net credit losses largely

resulting from the impact of the sales of the consumer operations in Turkey

and Romania and a net credit recovery in the second quarter 2013.