Citibank 2014 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

200

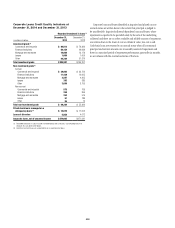

15. LOANS

Citigroup loans are reported in two categories—consumer and corporate.

These categories are classified primarily according to the segment and

subsegment that manage the loans.

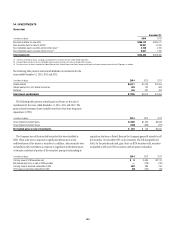

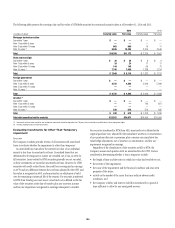

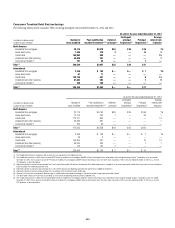

Consumer Loans

Consumer loans represent loans and leases managed primarily by the

Global Consumer Banking businesses in Citicorp and in Citi Holdings. The

following table provides information by loan type for the periods indicated:

In millions of dollars 2014 2013

Consumer loans

In U.S. offices

Mortgage and real estate (1) $ 96,533 $108,453

Installment, revolving credit, and other 14,450 13,398

Cards 112,982 115,651

Commercial and industrial 5,895 6,592

$229,860 $244,094

In offices outside the U.S.

Mortgage and real estate (1) $ 54,462 $ 55,511

Installment, revolving credit, and other 31,128 33,182

Cards 32,032 36,740

Commercial and industrial 22,561 24,107

Lease financing 609 769

$140,792 $150,309

Total Consumer loans $370,652 $394,403

Net unearned income (682) (572)

Consumer loans, net of unearned income $369,970 $393,831

(1) Loans secured primarily by real estate.

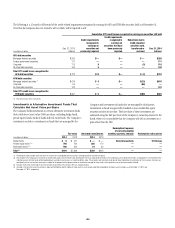

Citigroup has established a risk management process to monitor, evaluate

and manage the principal risks associated with its consumer loan portfolio.

Credit quality indicators that are actively monitored include delinquency

status, consumer credit scores (FICO), and loan to value (LTV) ratios, each as

discussed in more detail below.

Included in the loan table above are lending products whose terms may

give rise to greater credit issues. Credit cards with below-market introductory

interest rates and interest-only loans are examples of such products. These

products are closely managed using credit techniques that are intended to

mitigate their higher inherent risk.

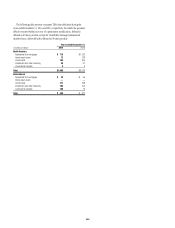

During the years ended December 31, 2014 and 2013, the Company sold

and/or reclassified to held-for-sale $7.9 billion and $11.5 billion, respectively,

of consumer loans. The Company did not have significant purchases of

consumer loans during the year ended December 31, 2014. During the year

ended December 31, 2013, Citi also acquired approximately $7 billion of

loans related to the acquisition of Best Buy’s U.S. credit card portfolio.

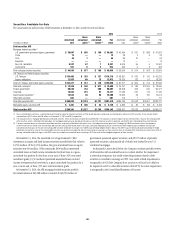

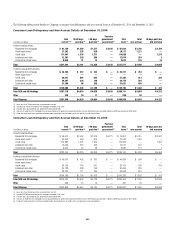

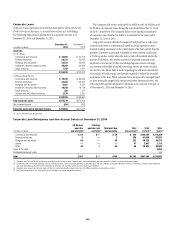

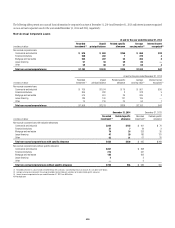

Delinquency Status

Delinquency status is monitored and considered a key indicator of credit

quality of consumer loans. Principally the U.S. residential first mortgage

loans use the Mortgage Banking Association (MBA) method of reporting

delinquencies, which considers a loan delinquent if a monthly payment has

not been received by the end of the day immediately preceding the loan’s

next due date. All other loans use a method of reporting delinquencies, which

considers a loan delinquent if a monthly payment has not been received by

the close of business on the loan’s next due date.

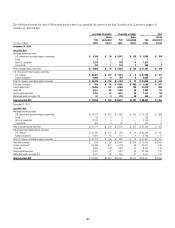

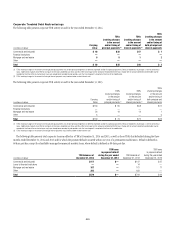

As a general policy, residential first mortgages, home equity loans and

installment loans are classified as non-accrual when loan payments are

90 days contractually past due. Credit cards and unsecured revolving loans

generally accrue interest until payments are 180 days past due. Home equity

loans in regulated bank entities are classified as non-accrual if the related

residential first mortgage is 90 days or more past due. Mortgage loans in

regulated bank entities discharged through Chapter 7 bankruptcy, other

than Federal Housing Administration (FHA)-insured loans, are classified as

non-accrual. Commercial market loans are placed on a cash (non-accrual)

basis when it is determined, based on actual experience and a forward-

looking assessment of the collectability of the loan in full, that the payment

of interest or principal is doubtful or when interest or principal is 90 days

past due.

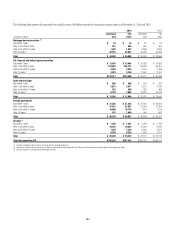

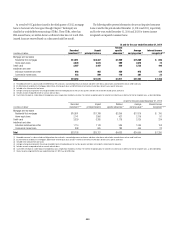

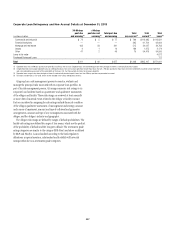

The policy for re-aging modified U.S. consumer loans to current status

varies by product. Generally, one of the conditions to qualify for these

modifications is that a minimum number of payments (typically ranging

from one to three) be made. Upon modification, the loan is re-aged to

current status. However, re-aging practices for certain open-ended consumer

loans, such as credit cards, are governed by Federal Financial Institutions

Examination Council (FFIEC) guidelines. For open-ended consumer loans

subject to FFIEC guidelines, one of the conditions for the loan to be re-aged

to current status is that at least three consecutive minimum monthly

payments, or the equivalent amount, must be received. In addition, under

FFIEC guidelines, the number of times that such a loan can be re-aged is

subject to limitations (generally once in 12 months and twice in five years).

Furthermore, FHA and Department of Veterans Affairs (VA) loans are modified

under those respective agencies’ guidelines and payments are not always

required in order to re-age a modified loan to current.