Citibank 2014 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170

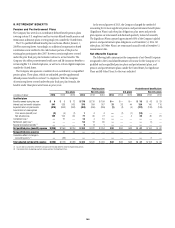

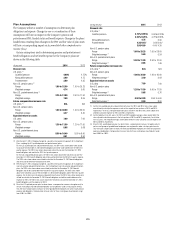

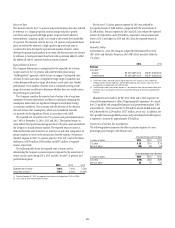

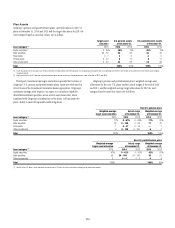

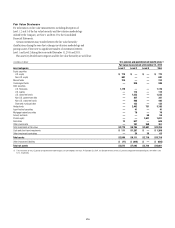

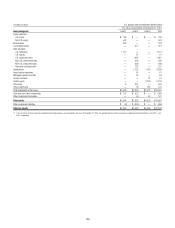

Plan Assumptions

The Company utilizes a number of assumptions to determine plan

obligations and expense. Changes in one or a combination of these

assumptions will have an impact on the Company’s pension and

postretirement PBO, funded status and benefit expense. Changes in the plans’

funded status resulting from changes in the PBO and fair value of plan assets

will have a corresponding impact on Accumulated other comprehensive

income (loss).

Certain assumptions used in determining pension and postretirement

benefit obligations and net benefit expense for the Company’s plans are

shown in the following table:

At year end 2014 2013

Discount rate

U.S. plans (1)

Qualified pension 4.00% 4.75%

Nonqualified pension 3.90 4.75

Postretirement 3.80 4.35

Non-U.S. pension plans (2)

Range 1.00 to 32.50 1.60 to 29.25

Weighted average 4.74 5.60

Non-U.S. postretirement plans (2)

Range 2.25 to 12.00 3.50 to 11.90

Weighted average 7.50 8.65

Future compensation increase rate

U.S. plans (3) N/A N/A

Non-U.S. pension plans

Range 1.00 to 30.00 1.00 to 26.00

Weighted average 3.27 3.40

Expected return on assets

U.S. plans 7.00 7.00

Non-U.S. pension plans

Range 1.30 to 11.50 1.20 to 11.50

Weighted average 5.08 5.68

Non-U.S. postretirement plans

Range 8.50 to 10.40 8.50 to 8.90

Weighted average 8.51 8.50

(1) Effective April 1, 2013, Citigroup changed to a quarterly remeasurement approach for its Significant

Plans, including the U.S. qualified pension and postretirement plans.

For the U.S. qualified pension and postretirement plans, the 2014 rates shown above were utilized

to calculate the December 31, 2014 benefit obligation and will be used to determine the 2015 first

quarter expense. The 2013 rates shown above were utilized to calculate the December 31, 2013

benefit obligation and used for the 2014 first quarter expense.

For the U.S. nonqualified pension plans, the 2014 rates shown above were utilized to calculate the

December 31, 2014 benefit obligation and will be used to determine the 2015 first quarter expense.

The 2013 rates shown above were utilized to calculate the December 31, 2013 benefit obligations

and were used to determine the expense for 2014.

(2) Effective April 1, 2013, Citigroup changed to a quarterly remeasurement approach for its Significant

non-U.S. pension and postretirement plans. For the Significant non-U.S. pension and postretirement

plans, the 2014 rates shown above were utilized to calculate the December 31, 2014 benefit

obligation and will be used to determine the 2015 first quarter expense. The 2013 rates shown

above were utilized to calculate the December 31, 2013 benefit obligation and the 2014 first quarter

expense. For all other non-U.S. pension and postretirement plans, the 2014 rates shown above were

utilized to calculate the December 31, 2014 benefit obligations and will be used to determine the

expense for 2015. The 2013 rates shown above were utilized to calculate the December 31, 2013

benefit obligations and the expense for 2014.

(3) Since the U.S. qualified pension plan has been frozen, a compensation increase rate applies only to

certain small groups of grandfathered employees accruing benefits under a final pay plan formula.

Only the future compensation increases for these grandfathered employees will affect future pension

expense and obligations. Compensation increase rates for these small groups of participants range

from 3.00% to 4.00%.

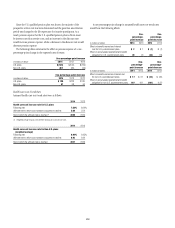

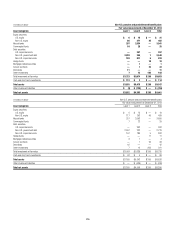

During the year 2014 2013

Discount rate

U.S. plans (1)

Qualified pension 4.75%/4.55

4.25%/4.25

%/

%

3.90%/4.20

4.75%/4.80

%/

%

Nonqualified pension 4.75 3.90

Postretirement 4.35/4.15

3.95/4.00

/3.60/3.60

4.40/ 4.30

/

Non-U.S. pension plans

Range 1.60 to 29.25 1.50 to 28.00

Weighted average (2) 5.60 5.24

Non-U.S. postretirement plans

Range 3.50 to 11.90 3.50 to 10.00

Weighted average (2) 8.65 7.46

Future compensation increase rate

U.S. plans (3) N/A N/A

Non-U.S. pension plans

Range 1.00 to 26.00 1.20 to 26.00

Weighted average (2) 3.40 3.93

Expected return on assets

U.S. plans 7.00 7.00

Non-U.S. pension plans

Range 1.20 to 11.50 0.90 to 11.50

Weighted average (2) 5.68 5.76

Non-U.S. postretirement plans

Range 8.50 to 8.90 8.50 to 9.60

Weighted average (2) 8.50 8.50

(1) For the U.S. qualified pension and postretirement plans, the 2014 and 2013 rates shown above

were utilized to calculate the expense in each of the respective four quarters in 2014 and 2013,

respectively. For the U.S. nonqualified pension plans, the 2014 and 2013 rates shown above were

utilized to calculate expense for 2014 and 2013, respectively.

(2) For the Significant non-U.S. plans, the 2014 and 2013 weighted averages shown above reflect the

rates utilized to calculate expense in the first quarters of 2014 and 2013, respectively. For all other

non-U.S. plans, the weighted averages shown above reflect the rates utilized to calculate expense for

2014 and 2013, respectively.

(3) Since the U.S. qualified pension plan has been frozen, a compensation increase rate applies only to

certain small groups of grandfathered employees accruing benefits under a final pay plan formula.

Only the future compensation increases for these grandfathered employees will affect future pension

expense and obligations. Compensation increase rates for these small groups of participants range

from 3.00% to 4.00%.