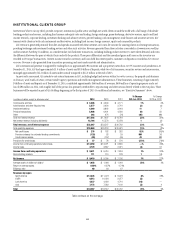

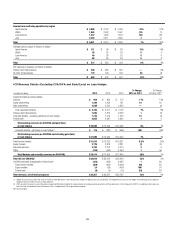

Citibank 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

Russia

Citi continues to monitor and manage its exposures in ICG resulting from

the instability in Russia and Ukraine. As discussed above, the ongoing

uncertainties created by the instability in the region have impacted markets

in the region, including certain of Citi’s markets businesses, and could

continue to do so in the future. Any actions Citi may take to mitigate its

exposures or risks, or the imposition of additional sanctions (such as asset

freezes) involving Russia or against Russian entities, business sectors,

individuals or otherwise, could negatively impact the results of operations of

EMEA ICG. For additional information on Citi’s exposures in these countries,

see “Managing Global Risk—Country and Cross-Border Risk” below.

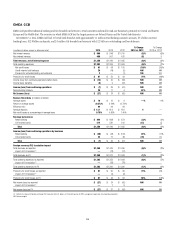

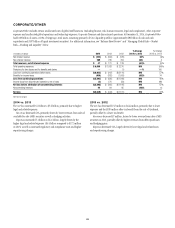

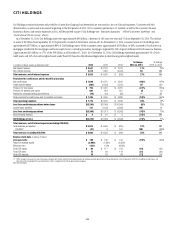

2013 vs. 2012

Net income increased 3%, primarily driven by higher revenues and lower

expenses and credit costs, partially offset by a higher effective tax rate.

• Revenues increased 2%, primarily reflecting higher revenues in Banking

(increase of 4%, 1% excluding the gains/(losses) on hedges on accrual

loans) and in Markets and securities services (increase of 1%).

Within Banking:

• Investment banking revenues increased 8%, reflecting gains in overall

investment banking wallet share. Advisory revenues increased 19%,

reflecting an improvement in wallet share, despite a contraction in the

overall M&A market wallet. Equity underwriting revenues increased

45%, driven by improved wallet share and increased market activity,

particularly initial public offerings. Debt underwriting revenues decreased

6%, primarily due to lower bond underwriting fees and a decline in wallet

share during the year.

• Treasury and trade solutions revenues decreased 3%, as the ongoing

impact of spread compression globally was partially offset by higher

balances and fee growth. Average deposits increased 7% and average

trade loans increased 22%, including the impact of the consolidation of

approximately $7 billion of trade loans during the second quarter of 2013.

• Corporate lending revenues increased 40%. Excluding the impact of

gains/(losses) on hedges on accrual loans, revenues decreased 4%,

primarily due to increased hedge premium costs and moderately lower

loan balances, partially offset by higher spreads.

• Private bank revenues increased 4%, with growth across all regions and

products, particularly in managed investments, where growth reflected

both higher client assets under management and increased placement

fees, as well as in capital markets. Revenue growth in lending and

deposits, primarily driven by growth in client volumes, was partially offset

by continued spread compression.

Within Markets and securities services:

• Fixed income markets revenues decreased 7%, primarily reflecting

industry-wide weakness in rates and currencies, partially offset by strong

performance in credit-related and securitized products and commodities.

Rates and currencies performance was lower compared to a strong 2012

that benefited from increased client revenues and a more liquid market

environment, particularly in EMEA. 2013 results also reflected a general

slowdown in client activity exacerbated by uncertainty around the

tapering of quantitative easing as well as geopolitical issues. Credit-related

and securitized products results reflected increased client activity driven by

improved market conditions and demand for spread products.

• Equity markets revenues increased 24%, primarily due to market

share gains, continued improvement in cash and derivative trading

performance and a more favorable market environment.

• Securities services revenues increased 3%, as settlement volumes

increased 15% and assets under custody increased 8%, partially offset by

spread compression related to deposits.

Expenses decreased 2%, primarily reflecting repositioning savings, the

impact of lower performance-based compensation, lower repositioning

charges and the impact of FX translation, partially offset by the net fraud

loss in 2013 as well as higher legal and related costs and volume-related

expenses. Excluding the impact of the net fraud loss, expenses decreased 4%,

primarily reflecting repositioning savings, the impact of lower performance-

based compensation, lower repositioning charges and the impact of FX

translation, partially offset by higher legal and related costs and volume-

related expenses.

Provisions decreased 72%, primarily reflecting higher loan loss reserve

releases and lower net credit losses.