Citibank 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

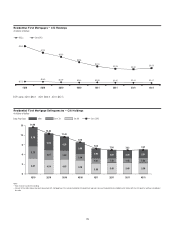

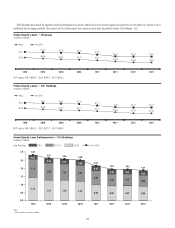

As previously disclosed, management actions, including asset sales and

modification programs, have been the primary drivers of the improved

asset performance within Citi’s residential first mortgage portfolio in Citi

Holdings during the periods presented above. With respect to asset sales, in

total, Citi has sold approximately $7.6 billion of delinquent first mortgages

since the beginning of 2010, including $2.7 billion in 2011. As evidenced

by the numbers above, the pace of Citi’s sales of residential first mortgages

has slowed, primarily due to the lack of remaining eligible inventory

and demand.

Regarding modifications of residential first mortgages, since the third

quarter of 2009, Citi has permanently modified approximately $6.1 billion

of residential first mortgage loans under its HAMP and CSM programs, two

of Citi’s more significant residential first mortgage modification programs.

(For additional information on Citi’s significant residential first mortgage

loan modification programs, see “Consumer Loan Modification Programs”

below.) However, the pace of modification activity has also slowed due to the

decrease in the inventory of residential first mortgage loans available for

modification, primarily as a result of the significant levels of modifications

in prior periods.

As a result of these two converging trends and as set forth in the tables

above, Citi’s residential first mortgage delinquency trends are beginning to

show the impact of re-defaults of previously modified mortgages, including

an increase in the 90+ days past due delinquencies during the fourth quarter

of 2011, although the re-default rates for the HAMP and CSM programs

continued to track favorably versus expectations as of December 31, 2011.

While net credit losses in this portfolio decreased during the periods set forth

above, if delinquencies continue to increase, Citi could begin experiencing

increasing net credit losses in this portfolio going forward. Citi has taken

these trends and uncertainties, including the potential for re-defaults, into

consideration in determining its loan loss reserves. See “North America

Consumer Mortgages – Loan Loss Reserve Coverage” below.

Residential First Mortgages – State Delinquency Trends

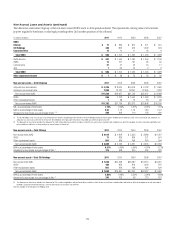

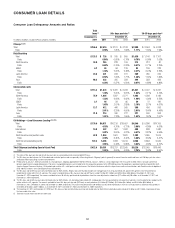

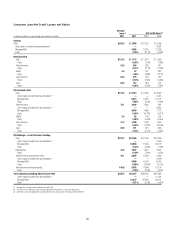

The following tables set forth, for total Citigroup, the six states and/or regions with the highest concentration of Citi’s residential first mortgages as of

December 31, 2011 and December 31, 2010.

In billions of dollars December 31, 2011 $ECEMBERææ

State (1) ENR (2)

ENR

Distribution

90+DPD

%

%

LTV >

100%

Refreshed

FICO %.2æ

%.2æ

$ISTRIBUTION

$0$æ

æ

,46ææ

2EFRESHEDæ

&)#/

#! $22.6 28% 2.7% 38% 727

.9.*#4 11.2 14 4.9 10 712

)./(-) 4.6 6 6.3 44 650

&, 4.3 5 10.2 57 668

), 3.5 4 7.2 45 686

!:.6 2.3 3 5.7 73 698

/THER 33.2 41 5.8 21 663

Total $81.7 100% 5.1% 30% 689

æ #ERTAINæOFæTHEæSTATESæAREæINCLUDEDæASæPARTæOFæAæREGIONæBASEDæONæ#ITISæVIEWæOFæSIMILARæHOMEæPRICESæ(0)æWITHINæTHEæREGION

æ %NDINGæNETæRECEIVABLESæ%XCLUDESæLOANSæINæ#ANADAæANDæ0UERTOæ2ICOæLOANSæGUARANTEEDæBYæ53æGOVERNMENTæAGENCIESæLOANSæRECORDEDæATæFAIRæVALUEæANDæLOANSæSUBJECTæTOæ,43#S

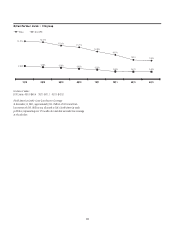

As evidenced by the tables above, Citi’s residential first mortgages portfolio

is primarily concentrated in California and the New York/New Jersey/

Connecticut region (with New York as the largest of the three states). Year

over year, the 90+ days past due delinquency rate improved across each

of the states and regions shown in the tables. As referenced under “Citi

Holdings—Residential First Mortgages” above, however, the vast majority of

the improvement in these delinquency rates was driven by Citi’s continued

asset sales of delinquent mortgages. As asset sales have slowed, Citi has

observed deterioration in 90+ days past due delinquencies for each of the

states and/or regions above, including during the fourth quarter of 2011.

Combined with the increase in the average number of days to foreclosure (see

discussion under “Foreclosures” below) in all of these states and regions,

Citi could experience continued deterioration in the 90+ days past due

delinquency rate in these areas.

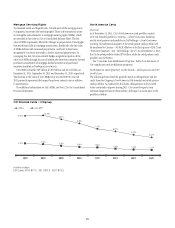

Foreclosures

As of December 31, 2011, approximately 2.5% of Citi’s residential first

mortgage portfolio was actively in the foreclosure process, which Citi refers

to as its “foreclosure inventory.” This was down from 3.1% at December 31,

2010. The decline in foreclosure inventory year over year was largely due

to two separate trends. First, during 2011, there were fewer residential first

mortgages moving into Citi’s foreclosure inventory primarily as a result

of Citi’s continued asset sales of delinquent first mortgages (as discussed

above), as well as increased state requirements for foreclosure filings. For

example, certain states have increased the number of pre-foreclosure filings

and notices required, including various requirements for affidavit filings and

demand letters (including the contents of such letters), as well as required

additional time to review a borrower’s loss mitigation activities prior to

permitting a foreclosure filing. In addition, while Citi may generally begin