Citibank 2011 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.144

and trade names, are not amortized and are subject to annual impairment

tests. An impairment exists if the carrying value of the indefinite-lived

intangible asset exceeds its fair value. For other Intangible assets subject to

amortization, an impairment is recognized if the carrying amount is not

recoverable and exceeds the fair value of the Intangible asset.

Other Assets and Other Liabilities

Other assets include, among other items, loans held-for-sale, deferred tax

assets, equity-method investments, interest and fees receivable, premises

and equipment, repossessed assets, and other receivables. Other liabilities

include, among other items, accrued expenses and other payables, deferred

tax liabilities, and reserves for legal claims, taxes, unfunded lending

commitments, repositioning reserves, and other matters.

Other Real Estate Owned and Repossessed Assets

Real estate or other assets received through foreclosure or repossession are

generally reported in Other assets, net of a valuation allowance for selling

costs and net of subsequent declines in fair value.

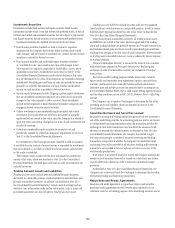

Securitizations

The Company primarily securitizes credit card receivables and mortgages.

Other types of securitized assets include corporate debt instruments (in cash

and synthetic form) and student loans.

There are two key accounting determinations that must be made

relating to securitizations. Citi first makes a determination as to whether the

securitization entity would be consolidated. Second, it determines whether

the transfer of financial assets to the entity is considered a sale under GAAP. If

the securitization entity is a VIE, the Company consolidates the VIE if it is the

primary beneficiary.

The Company consolidates VIEs when it has both: (1) power to direct

activities of the VIE that most significantly impact the entity’s economic

performance and (2) an obligation to absorb losses or right to receive

benefits from the entity that could potentially be significant to the VIE.

For all other securitization entities determined not to be VIEs in which

Citigroup participates, a consolidation decision is based on who has voting

control of the entity, giving consideration to removal and liquidation rights

in certain partnership structures. Only securitization entities controlled by

Citigroup are consolidated.

Interests in the securitized and sold assets may be retained in the form

of subordinated or senior interest-only strips, subordinated tranches, spread

accounts, and servicing rights. In credit card securitizations, the Company

retains a seller’s interest in the credit card receivables transferred to the trusts,

which is not in securitized form. In the case of consolidated securitization

entities, including the credit card trusts, these retained interests are not

reported on Citi’s Consolidated Balance Sheet; rather, the securitized loans

remain on the balance sheet. Substantially all of the Consumer loans sold

or securitized through non-consolidated trusts by Citigroup are U.S. prime

residential mortgage loans. Retained interests in non-consolidated mortgage

securitization trusts are classified as Trading Account Assets, except for

MSRs which are included in Mortgage Servicing Rights on Citigroup’s

Consolidated Balance Sheet.

Debt

Short-term borrowings and long-term debt are accounted for at amortized

cost, except where the Company has elected to report the debt instruments,

including certain structured notes, at fair value or the debt is in a fair value

hedging relationship.

Transfers of Financial Assets

For a transfer of financial assets to be considered a sale: the assets must have

been isolated from the Company, even in bankruptcy or other receivership;

the purchaser must have the right to pledge or sell the assets transferred or,

if the purchaser is an entity whose sole purpose is to engage in securitization

and asset-backed financing activities and that entity is constrained from

pledging the assets it receives, each beneficial interest holder must have

the right to sell the beneficial interests; and the Company may not have

an option or obligation to reacquire the assets. If these sale requirements

are met, the assets are removed from the Company’s Consolidated Balance

Sheet. If the conditions for sale are not met, the transfer is considered to be

a secured borrowing, the assets remain on the Consolidated Balance Sheet,

and the sale proceeds are recognized as the Company’s liability. A legal

opinion on a sale is generally obtained for complex transactions or where

the Company has continuing involvement with assets transferred or with the

securitization entity. For a transfer to be eligible for sale accounting, those

opinions must state that the asset transfer is considered a sale and that the

assets transferred would not be consolidated with the Company’s other assets

in the event of the Company’s insolvency.

For a transfer of a portion of a financial asset to be considered a sale,

the portion transferred must meet the definition of a participating interest.

A participating interest must represent a pro rata ownership in an entire

financial asset; all cash flows must be divided proportionally, with the same

priority of payment; no participating interest in the transferred asset may

be subordinated to the interest of another participating interest holder; and

no party may have the right to pledge or exchange the entire financial asset

unless all participating interest holders agree. Otherwise, the transfer is

accounted for as a secured borrowing.

See Note 22 to the Consolidated Financial Statements for further

discussion.

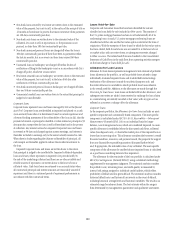

Risk Management Activities—Derivatives Used for

Hedging Purposes

The Company manages its exposures to market rate movements outside its

trading activities by modifying the asset and liability mix, either directly

or through the use of derivative financial products, including interest-rate

swaps, futures, forwards, and purchased options, as well as foreign-exchange

contracts. These end-user derivatives are carried at fair value in Other assets,

Other liabilities, Trading account assets and Trading account liabilities.

To qualify as an accounting hedge under the hedge accounting rules

(versus a management hedge where hedge accounting is not sought), a

derivative must be highly effective in offsetting the risk designated as being

hedged. The hedge relationship must be formally documented at inception,

detailing the particular risk management objective and strategy for the

hedge, which includes the item and risk that is being hedged and the