Citibank 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

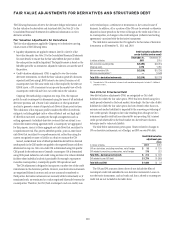

When Citi purchases credit default swaps as a hedge against a credit

exposure, Citi generally seeks to purchase products with a maturity date

similar to the exposure against which the protection is purchased. While

certain exposures may have longer maturities that extend beyond the credit

default swap tenors readily available in the market, Citi generally will

purchase credit protection with a maximum tenor that is readily available in

the market.

The above table contains all net credit default swaps (CDSs) purchased

or sold on GIIPS or French underlying entities, whether part of a trading

strategy or as purchased credit protection. With respect to the $16.9 billion

net purchased CDS contracts on underlying GIIPS reference entities,

approximately 89% has been purchased from non-GIIPS counterparties.

With respect to the $10.4 billion net purchased CDS contracts on underlying

French reference entities, approximately 72% has been purchased from non-

French counterparties. The net credit exposure to any counterparties arising

from these transactions, including any GIIPS or French counterparties, is

managed and mitigated through legally enforceable netting and margining

agreements. When Citi purchases credit default swaps as a hedge against a

credit exposure, it generally seeks to purchase products from counterparties

that would not be correlated with the underlying credit exposure it

is hedging.

Secured Financing Transactions

As part of its banking activities with its clients, Citi enters into secured

financing transactions, such as repurchase agreements and reverse

repurchase agreements. These transactions typically involve the lending of

cash, against which securities are taken as collateral. The amount of cash

loaned against the securities collateral is a function of the liquidity and

quality of the collateral as well as the credit quality of the counterparty. The

collateral is typically marked to market daily, and Citi has the ability to call

for additional collateral (usually in the form of cash), if the value of the

securities falls below a pre-defined threshold.

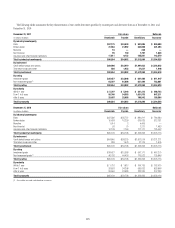

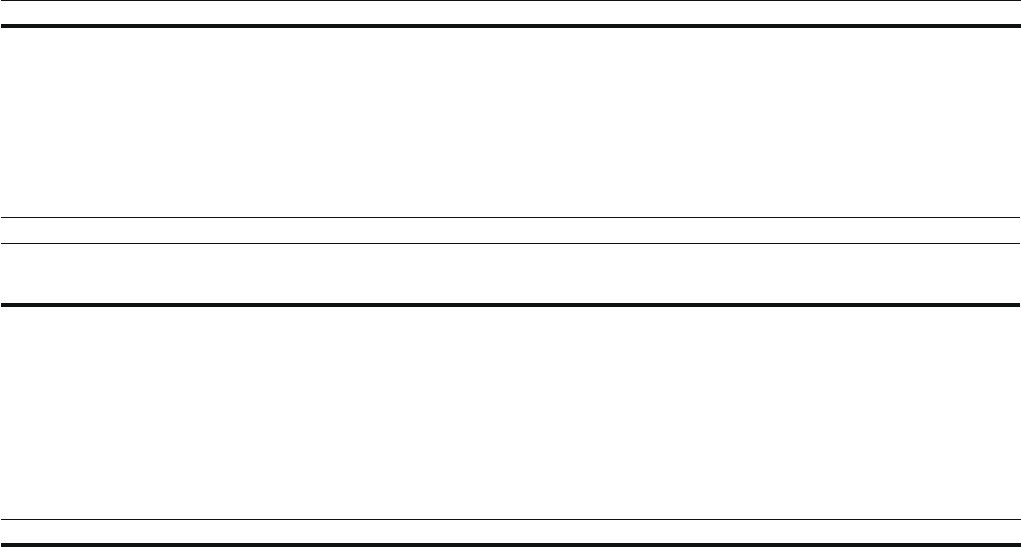

As of December 31, 2011, Citi had loaned $19.2 billion in cash through

secured financing transactions with GIIPS or French counterparties, usually

through reverse repurchase agreements, as shown in the table below. Against

those loans, it held approximately $21.2 billion fair value of securities

collateral as well as $1.1 billion in variation margin, most of which was

in cash.

Consistent with Citi’s risk management systems, secured financing

transactions are included in the counterparty derivative mark-to-market

exposure at their net credit exposure value, which is typically small or zero

given the over-collateralized structure of these transactions.

In billions of dollars Cash financing out Securities collateral in (1)

,ENDINGæTOæ'))03æANDæ&RENCHæCOUNTERPARTIESæTHROUGHæSECUREDæFINANCINGæTRANSACTIONSæ $19.2 $21.2

æ #ITIæHASæALSOæRECEIVEDæAPPROXIMATELYææBILLIONæINæVARIATIONæMARGINæPREDOMINATELYæCASHæASSOCIATEDæWITHæSECUREDæFINANCINGæTRANSACTIONSæWITHæTHESEæCOUNTERPARTIES

Collateral taken in against secured financing transactions is generally

high quality, marketable securities, consisting of government debt, corporate

debt, or asset-backed securities.

The table below sets forth the fair value of the securities collateral taken in

by Citi against secured financing transactions as of December 31, 2011.

In billions of dollars Total

Government

bonds

Municipal or corporate

bonds

Asset-backed

bonds

3ECURITIESæPLEDGEDæBYæ'))03æORæ&RENCHæCOUNTERPARTIESæINæSECUREDæFINANCINGæTRANSACTIONæLENDINGæ $21.2 $10.3 $0.7 $10.2

)NVESTMENTæGRADE $20.3 $10.2 $0.4 $ 9.8

.ONINVESTMENTæGRADE 0.2 0.2 0.1 —

.OTæRATED 0.7 — 0.2 0.4

æ 4OTALæINCLUDESæAPPROXIMATELYææBILLIONæINæCORRELATEDæRISKæCOLLATERALæPREDOMINATELYæ&RENCHæSOVEREIGNæDEBTæPLEDGEDæBYæ&RENCHæCOUNTERPARTIES

Secured financing transactions can be short term or can extend beyond

one year. In most cases, Citi has the right to call for additional margin

daily, and can terminate the transaction and liquidate the collateral if the

counterparty fails to post the additional margin.

The table below sets forth the remaining transaction tenor for these

transactions as of December 31, 2011.

Remaining transaction tenor

In billions of dollars Total <1 year 1-3 years 3-4 years (1)

#ASHæEXTENDEDæTOæ'))03æORæ&RENCHæCOUNTERPARTIESæINæSECUREDæFINANCINGæTRANSACTIONSæLENDINGæ $19.2 $11.6 $6.1 $1.5

æ 4HEæLONGESTæREMAININGæTENORæTRADESæMATUREæ*ANUARYæ