Citibank 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

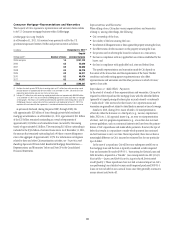

Consumer Mortgage—Representations and Warranties

The majority of Citi’s exposure to representation and warranty claims relates

to its U.S. Consumer mortgage business within CitiMortgage.

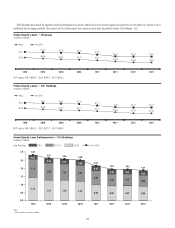

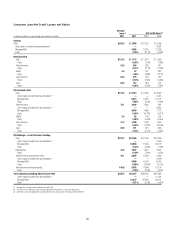

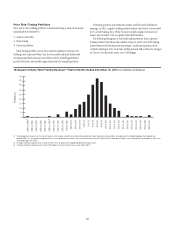

CitiMortgage Servicing Portfolio

As of December 31, 2011, Citi services loans previously sold to the U.S.

government sponsored entities (GSEs) and private investors as follows:

In millions December 31, 2011 (1)

6INTAGEæSOLDNumber of loans

Unpaid

principal balance

æANDæPRIOR 1.4 $141,122

0.3 43,040

0.2 40,080

0.3 39,279

0.2 45,811

0.2 40,474

0.2 46,501

Total 2.8 $396,307

æ %XCLUDESæTHEæFOURTHæQUARTERææSALEæOFæSERVICINGæRIGHTSæONææMILLIONæLOANSæWITHæREMAININGæUNPAIDæ

PRINCIPALæBALANCESæOFæAPPROXIMATELYææMILLIONæASæOFæ$ECEMBERæææ#ITIæCONTINUESæTOæBEæ

EXPOSEDæTOæREPRESENTATIONæANDæWARRANTYæCLAIMSæONæTHESEæLOANS

æ )NCLUDESææMILLIONæLOANSæWITHæREMAININGæUNPAIDæPRINCIPALæBALANCEæOFæAPPROXIMATELYææMILLIONæ

ASæOFæ$ECEMBERæææTHATæAREæSERVICEDæBYæ#ITI-ORTGAGEæPURSUANTæTOæPRIORæACQUISITIONSæOFæMORTGAGEæ

SERVICINGæRIGHTSæ4HESEæLOANSæAREæCOVEREDæBYæINDEMNIFICATIONæAGREEMENTSæFROMæTHIRDæPARTIESæINæFAVORæOFæ

#ITI-ORTGAGEæHOWEVERæSUBSTANTIALLYæALLæOFæTHESEæAGREEMENTSæWILLæEXPIREæPRIORæTOæ-ARCHæææ4HEæ

EXPIRATIONæOFæTHESEæINDEMNIFICATIONæAGREEMENTSæISæCONSIDEREDæINæDETERMININGæTHEæREPURCHASEæRESERVE

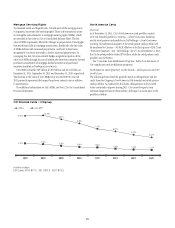

As previously disclosed, during the period 2005 through 2008, Citi

sold approximately $25 billion of loans through private-label residential

mortgage securitizations. As of December 31, 2011, approximately $11 billion

of the $25 billion remained outstanding as a result of repayments of

approximately $13 billion and cumulative losses (incurred by the issuing

trusts) of approximately $1 billion. The remaining $11 billion outstanding is

included in the $396 billion of serviced loans above. As of December 31, 2011,

the amount that remained outstanding had a 90 days or more delinquency

rate in the aggregate of approximately 12.9%. For information on litigation

related to these and other Citi securitization activities, see “Securities and

Banking-Sponsored Private-Label Residential Mortgage Securitizations—

Representations and Warranties” below and Note 29 to the Consolidated

Financial Statements.

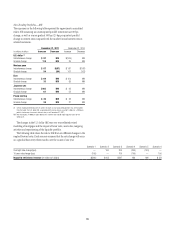

Representations and Warranties

When selling a loan, Citi makes various representations and warranties

relating to, among other things, the following:

Citi’s ownership of the loan;

the validity of the lien securing the loan;

the absence of delinquent taxes or liens against the property securing the loan;

the effectiveness of title insurance on the property securing the loan;

the process used in selecting the loans for inclusion in a transaction;

the loan’s compliance with any applicable loan criteria established by the

buyer; and

the loan’s compliance with applicable local, state and federal laws.

The specific representations and warranties made by Citi depend on

the nature of the transaction and the requirements of the buyer. Market

conditions and credit-rating agency requirements may also affect

representations and warranties and the other provisions to which Citi may

agree in loan sales.

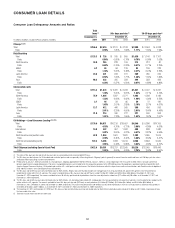

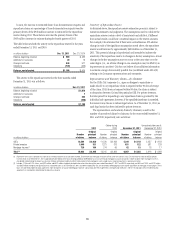

Repurchases or “Make-Whole” Payments

In the event of a breach of these representations and warranties, Citi may be

required to either repurchase the mortgage loans with the identified defects

(generally at unpaid principal balance plus accrued interest) or indemnify

(“make-whole”) the investors for their losses. Citi’s representations and

warranties are generally not subject to stated limits in amount or time of coverage.

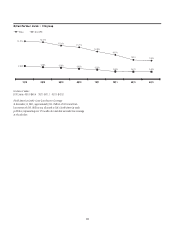

Similar to 2010, during 2011, issues related to (i) misrepresentation

of facts by either the borrower or a third party (e.g., income, employment,

debts, FICO, etc.), (ii) appraisal issues (e.g., an error or misrepresentation

of value), and (iii) program requirements (e.g., a loan that does not meet

investor guidelines, such as contractual interest rate) have been the primary

drivers of Citi’s repurchases and make-whole payments. However, the type of

defect that results in a repurchase or make-whole payment has continued

and will continue to vary over time. More importantly, there has not been a

meaningful difference in Citi’s incurred or estimated loss for any particular

type of defect.

In the case of a repurchase, Citi will bear any subsequent credit loss on

the mortgage loan and the loan is typically considered a credit-impaired

loan and accounted for under SOP 03-3, “Accounting for Certain Loans and

Debt Securities, Acquired in a Transfer” (now incorporated into ASC 310-30,

Receivables—Loans and Debt Securities Acquired with Deteriorated

Credit Quality). These repurchases have not had a material impact on Citi’s

non-performing loan statistics because credit-impaired purchased SOP 03-3

loans are not included in non-accrual loans, since they generally continue to

accrue interest until write-off.