Citibank 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Proudly serving more than 100 million clients

in 40 countries, Citi’s Global Consumer

Banking (GCB) business is among the largest

retail banks in the world. Strategically centered

in the world’s top cities, it leverages its deep

footprint to gain local market advantages by

delivering a consistent and enhanced client-

centric banking experience. GCB accounted for

nearly 40% of total deposits and 50% of total

revenues within Citicorp in 2011.

GCB consists of four primary business units — Retail Banking,

Citi Branded Cards, CitiMortgage and Commercial Banking —

that operate in our four key global regions — North America,

Latin America, Europe, Middle East and Africa, and Asia

Pacific. Operations outside the U.S. account for approximately

half our total loans, deposits, revenues and net income.

Our GCB businesses are strong in some of the world’s most

important growth markets, from China, Malaysia, Korea and

India in Asia Pacific, to Poland and Russia in Europe, to Mexico,

Brazil, Colombia, Argentina and Panama in Latin America. In

Mexico, Citi’s Banamex franchise serves more than 20 million

customers and is the country’s largest financial institution

as measured by assets and customer-managed resources.

Citi Retail Services (formerly Retail Partner Cards), after

solidifying several existing partnerships and changing its

name to reflect the comprehensive suite of services it offers

to partners, is moving from Citi Holdings in 2012 to become an

integral part of GCB.

Retail Banking

Citi’s Retail Banking network consists of more than

4,600 branches across the globe and holds deposits

exceeding $300 billion. In 2011, we opened state-of-the-art

digitized Citi Smart Banking branches in Washington, D.C.,

New York, Tokyo and Busan (South Korea) and continued

renovating our entire branch network. We also opened

innovative sales and service centers in Moscow and

St. Petersburg and Citi Express modules — a 24-hour service

unit — in Colombia. Branch openings in three new cities in

China expanded our presence in the country to 13 cities.

Citi Branded Cards

As one of the world’s largest credit card issuers, Citi Branded

Cards introduced several new products in 2011, including:

Citi ThankYou®, Citi Executive®/AAdvantage® and Citi

Simplicity® cards in the U.S.; Latin America partnership cards

with Colombia-based airline Avianca and with Banamex and

AeroMexico; and a merchant loyalty program in Europe.

CitiMortgage

U.S. mortgage originations of $63 billion continued to show

strong improvement, particularly in branch volumes and

through the direct-to-consumer channel, which recently

surpassed $1 billion. Helping to keep people in their homes

remained a top priority throughout 2011. Since 2007, we have

helped more than one million homeowners in their efforts to

avoid potential foreclosure. We launched the Road to Recovery

consumer outreach and homeowner support network in the

U.S. to help distressed homeowners. Globally, CitiMortgage

partnered with target markets to build a foundation for

expansion in countries with high-growth opportunities.

Commercial Banking

Commercial Banking is dedicated to serving the needs of

100,000 small to medium-size companies in 32 countries.

The business’ global strategy is to leverage Citi’s worldwide

network to help our clients navigate a continually globalizing

marketplace. The business grew profitably in 2011 and has

improved overall client satisfaction within each region.

Digital Innovations

Global Consumer Banking continued making progress toward

Vikram Pandit’s vision of transforming Citi into the world’s

digital bank. Citibank unveiled Citibank for iPad®, a critically

acclaimed consumer banking app designed specifically for

iPad that provides clients with an engaging, visually rich

tool to track, analyze and plan their finances. We launched

a mobile banking platform and an updated Citibank® Online

website in the U.S. and are implementing a worldwide rollout

of both innovations, setting us on a course to bring the best

digital experiences to our customers worldwide.

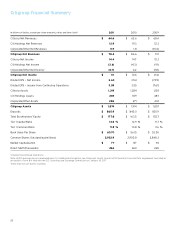

Global Consumer Banking