Citibank 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.143

In the event of a breach of these representations and warranties,

Citi may be required to either repurchase the mortgage loans with the

identified defects (generally at unpaid principal balance plus accrued

interest) or indemnify (“make-whole”) the investors for their losses. Citi’s

representations and warranties are generally not subject to stated limits in

amount or time of coverage.

In the case of a repurchase, Citi will bear any subsequent credit loss on

the mortgage loan and the loan is typically considered a credit-impaired

loan and accounted for under SOP 03-3, “Accounting for Certain Loans and

Debt Securities Acquired in a Transfer” (now incorporated into ASC 310-30,

Receivables—Loans and Debt Securities Acquired with Deteriorated

Credit Quality) (SOP 03-3). These repurchases have not had a material

impact on Citi’s non-performing loan statistics because credit-impaired

purchased SOP 03-3 loans are not included in non-accrual loans, since they

generally continue to accrue interest until write-off. Citi’s repurchases have

primarily been from the U.S. government sponsored entities (GSEs).

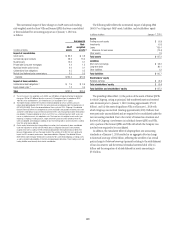

Citi has recorded a reserve for its exposure to losses from the obligation

to repurchase previously sold loans (referred to as the repurchase reserve)

that is included in Other liabilities in the Consolidated Balance Sheet. In

estimating the repurchase reserve, Citi considers reimbursements estimated

to be received from third-party correspondent lenders and indemnification

agreements relating to previous acquisitions of mortgage servicing rights.

The estimated reimbursements are based on Citi’s analysis of its most recent

collection trends and the financial solvency of the correspondents.

In the case of a repurchase of a credit-impaired SOP 03-3 loan, the

difference between the loan’s fair value and unpaid principal balance at the

time of the repurchase is recorded as a utilization of the repurchase reserve.

Make-whole payments to the investor are also treated as utilizations and

charged directly against the reserve. The repurchase reserve is estimated

when Citi sells loans (recorded as an adjustment to the gain on sale, which is

included in Other revenue in the Consolidated Statement of Income) and is

updated quarterly. Any change in estimate is recorded in Other revenue.

The repurchase reserve is calculated by individual sales vintage (i.e.,

the year the loans were sold) and is based on various assumptions. These

assumptions contain a level of uncertainty and risk that, if different from

actual results, could have a material impact on the reserve amount. The

most significant assumptions used to calculate the reserve levels are as

follows:

loan documentation requests;

repurchase claims as a percentage of loan documentation requests;

claims appeal success rate; and

estimated loss per repurchase or make-whole.

Securities and Banking-

Sponsored Legacy Private Label

Residential Mortgage Securitizations—Representations

and Warranties

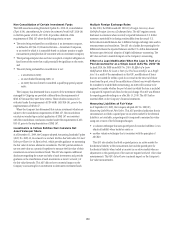

Legacy mortgage securitizations sponsored by Citi’s S&B business have

represented a much smaller portion of Citi’s mortgage business.

The mortgages included in S&B-sponsored legacy securitizations were

purchased from parties outside of S&B. Representations and warranties

relating to the mortgage loans included in each trust issuing the securities

were made either by Citi, by third-party sellers (which were also often the

originators of the loans), or both. These representations and warranties were

generally made or assigned to the issuing trust and related to, among other

things, the following:

the absence of fraud on the part of the borrower, the seller or any

appraiser, broker or other party involved in the origination of the

mortgage (which was sometimes wholly or partially limited to the

knowledge of the representation and warranty provider);

whether the mortgage property was occupied by the borrower as his or her

principal residence;

the mortgage’s compliance with applicable federal, state and local laws;

whether the mortgage was originated in conformity with the originator’s

underwriting guidelines; and

detailed data concerning the mortgages that were included on the

mortgage loan schedule.

In the event of a breach of its representations and warranties, Citi may

be required either to repurchase the mortgage with the identified defects

(generally at unpaid principal balance plus accrued interest) or indemnify

the investors for their losses through make-whole payments.

To date, Citi has received actual claims for breaches of representations

and warranties relating to only a small percentage of the mortgages included

in these securitization transactions, although the pace of claims remains

volatile and has recently increased.

Goodwill

Goodwill represents the excess of acquisition cost over the fair value of

net tangible and intangible assets acquired. Goodwill is subject to annual

impairment tests, whereby Goodwill is allocated to the Company’s reporting

units and an impairment is deemed to exist if the carrying value of a

reporting unit exceeds its estimated fair value. Furthermore, on any business

dispositions, Goodwill is allocated to the business disposed of based on the

ratio of the fair value of the business disposed of to the fair value of the

reporting unit.

Intangible Assets

Intangible assets—including core deposit intangibles, present value

of future profits, purchased credit card relationships, other customer

relationships, and other intangible assets, but excluding MSRs—are

amortized over their estimated useful lives. Intangible assets deemed to

have indefinite useful lives, primarily certain asset management contracts