Citibank 2011 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

228

A third-party asset manager is typically retained by the CDO/CLO to select

the pool of assets and manage those assets over the term of the SPE. The

Company is the manager for a limited number of CLO transactions.

The Company earns fees for warehousing assets prior to the creation of

a “cash flow” or “market value” CDO/CLO, structuring CDOs/CLOs and

placing debt securities with investors. In addition, the Company has retained

interests in many of the CDOs/CLOs it has structured and makes a market in

the issued notes.

The Company’s continuing involvement in synthetic CDOs/CLOs generally

includes purchasing credit protection through credit default swaps with the

CDO/CLO, owning a portion of the capital structure of the CDO/CLO in the

form of both unfunded derivative positions (primarily super-senior exposures

discussed below) and funded notes, entering into interest-rate swap and total-

return swap transactions with the CDO/CLO, lending to the CDO/CLO, and

making a market in the funded notes.

Where a CDO/CLO entity issues preferred shares (or subordinated notes

that are the equivalent form), the preferred shares generally represent an

insufficient amount of equity (less than 10%) and create the presumption

that preferred shares are insufficient to finance the entity’s activities

without subordinated financial support. In addition, although the preferred

shareholders generally have full exposure to expected losses on the collateral

and uncapped potential to receive expected residual returns, they generally

do not have the ability to make decisions about the entity that have a

significant effect on the entity’s financial results because of their limited

role in making day-to-day decisions and their limited ability to remove the

asset manager. Because one or both of the above conditions will generally be

met, the Company has concluded that, even where a CDO/CLO entity issued

preferred shares, the entity should be classified as a VIE.

In general, the asset manager, through its ability to purchase and sell

assets or—where the reinvestment period of a CDO/CLO has expired—the

ability to sell assets, will have the power to direct the activities of the entity

that most significantly impact the economic performance of the CDO/

CLO. However, where a CDO/CLO has experienced an event of default or an

optional redemption period has gone into effect, the activities of the asset

manager may be curtailed and/or certain additional rights will generally be

provided to the investors in a CDO/CLO entity, including the right to direct

the liquidation of the CDO/CLO entity.

The Company has retained significant portions of the “super-senior”

positions issued by certain CDOs. These positions are referred to as

“super-senior” because they represent the most senior positions in the

CDO and, at the time of structuring, were senior to tranches rated AAA by

independent rating agencies. The positions have included facilities structured

in the form of short-term commercial paper, where the Company wrote put

options (“liquidity puts”) to certain CDOs. Under the terms of the liquidity

puts, if the CDO was unable to issue commercial paper at a rate below a

specified maximum (generally LIBOR + 35 bps to LIBOR + 40 bps), the

Company was obligated to fund the senior tranche of the CDO at a specified

interest rate. As of December 31, 2011, the Company no longer had exposure

to this commercial paper as all of the underlying CDOs had been liquidated.

The Company does not generally have the power to direct the activities of

the entity that most significantly impacts the economic performance of the

CDOs/CLOs as this power is generally held by a third-party asset manager

of the CDO/CLO. As such, those CDOs/CLOs are not consolidated. The

Company may consolidate the CDO/CLO when: (i) the Company is the asset

manager and no other single investor has the unilateral ability to remove

the Company or unilaterally cause the liquidation of the CDO/CLO, or the

Company is not the asset manager but has a unilateral right to remove the

third-party asset manager or unilaterally liquidate the CDO/CLO and receive

the underlying assets, and (ii) the Company has economic exposure to the

entity that could be potentially significant to the entity.

The Company continues to monitor its involvement in unconsolidated

CDOs/CLOs to assess future consolidation risk. For example, if the Company

were to acquire additional interests in these entities and obtain the right, due

to an event of default trigger being met, to unilaterally liquidate or direct

the activities of a CDO/CLO, the Company may be required to consolidate

the asset entity. For cash CDOs/CLOs, the net result of such consolidation

would be to gross up the Company’s balance sheet by the current fair value

of the securities held by third parties and assets held by the CDO/CLO, which

amounts are not considered material. For synthetic CDOs/CLOs, the net result

of such consolidation may reduce the Company’s balance sheet, because

intercompany derivative receivables and payables would be eliminated in

consolidation, and other assets held by the CDO/CLO and the securities held

by third parties would be recognized at their current fair values.

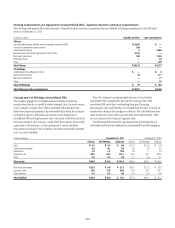

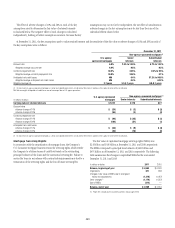

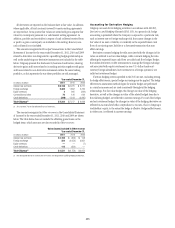

Key Assumptions and Retained Interests—Citi Holdings

The key assumptions, used for the securitization of CDOs and CLOs during

the year ended December 31, 2011, in measuring the fair value of retained

interests at the date of sale or securitization are as follows:

CDOs CLOs

$ISCOUNTæRATE 42.0% to 55.3% 4.1% to 5.0%

The effect of two negative changes in discount rates used to determine the

fair value of retained interests is disclosed below:

In millions of dollars CDOs CLOs

Carrying value of retained interests $14 $ 149

$ISCOUNTæRATES

!DVERSEæCHANGEæOFæ $ (3) $ (5)

!DVERSEæCHANGEæOFæ (5) (11)

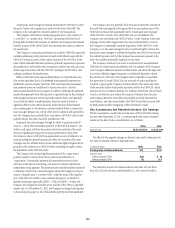

The cash flows received on retained interests and other net cash flows

from Citi’s CLOs for the year ended December 31, 2011 were $93 million.