Citibank 2011 Annual Report Download - page 263

Download and view the complete annual report

Please find page 263 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.241

24. CONCENTRATIONS OF CREDIT RISK

Concentrations of credit risk exist when changes in economic, industry or

geographic factors similarly affect groups of counterparties whose aggregate

credit exposure is material in relation to Citigroup’s total credit exposure.

Although Citigroup’s portfolio of financial instruments is broadly diversified

along industry, product, and geographic lines, material transactions are

completed with other financial institutions, particularly in the securities

trading, derivatives, and foreign exchange businesses.

In connection with the Company’s efforts to maintain a diversified

portfolio, the Company limits its exposure to any one geographic region,

country or individual creditor and monitors this exposure on a continuous

basis. At December 31, 2011, Citigroup’s most significant concentration of

credit risk was with the U.S. government and its agencies. The Company’s

exposure, which primarily results from trading assets and investments

issued by the U.S. government and its agencies, amounted to $177.9 billion

and $176.4 billion at December 31, 2011 and 2010, respectively. The

Japanese and Mexican governments and their agencies, which are

rated investment grade by both Moody’s and S&P, were the next largest

exposures. The Company’s exposure to Japan amounted to $33.2 billion

and $39.2 billion at December 31, 2011 and 2010, respectively, and was

composed of investment securities, loans and trading assets. The Company’s

exposure to Mexico amounted to $29.5 billion and $44.2 billion at

December 31, 2011 and 2010, respectively, and was composed of investment

securities, loans and trading assets.

The Company’s exposure to state and municipalities amounted

to $39.5 billion and $34.7 billion at December 31, 2011 and 2010,

respectively, and was composed of trading assets, investment securities,

derivatives and lending activities.

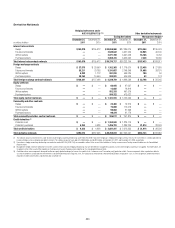

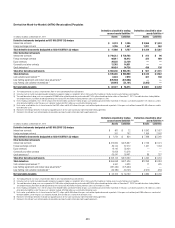

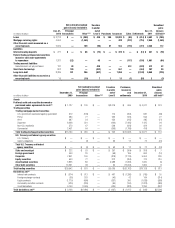

25. FAIR VALUE MEASUREMENT

ASC 820-10 (formerly SFAS 157) defines fair value, establishes a consistent

framework for measuring fair value and expands disclosure requirements

about fair value measurements. Fair value is defined as the price that

would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. Among

other things the standard requires the Company to maximize the use of

observable inputs and minimize the use of unobservable inputs when

measuring fair value. In addition, the use of block discounts is precluded

when measuring the fair value of instruments traded in an active market.

It also requires recognition of trade-date gains related to certain derivative

transactions whose fair values have been determined using unobservable

market inputs.

Under ASC 820-10, the probability of default of a counterparty is factored

into the valuation of derivative positions and includes the impact of

Citigroup’s own credit risk on derivatives and other liabilities measured at

fair value.

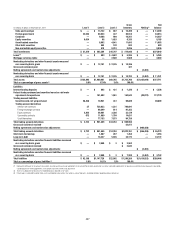

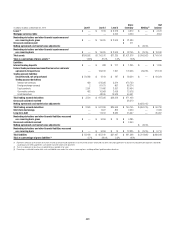

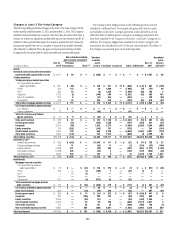

Fair Value Hierarchy

ASC 820-10, Fair Value Measurement, specifies a hierarchy of valuation

techniques based on whether the inputs to those valuation techniques are

observable or unobservable. Observable inputs reflect market data obtained

from independent sources, while unobservable inputs reflect the Company’s

market assumptions. These two types of inputs have created the following fair

value hierarchy:

identical instruments in active markets.

similar instruments in active markets; quoted

prices for identical or similar instruments in markets that are not

active; and model-derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

more significant inputs or significant value drivers are unobservable.

This hierarchy requires the use of observable market data when available.

The Company considers relevant and observable market prices in its

valuations where possible. The frequency of transactions, the size of the bid-

ask spread and the amount of adjustment necessary when comparing similar

transactions are all factors in determining the liquidity of markets and the

relevance of observed prices in those markets.

The Company’s policy with respect to transfers between levels of the fair

value hierarchy is to recognize transfers into and out of each level as of the

end of the reporting period.