Citibank 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Stress Testing

Liquidity stress testing is performed for each of Citi’s major entities, operating

subsidiaries and/or countries. Stress testing and scenario analyses are

intended to quantify the potential impact of a liquidity event on the balance

sheet and liquidity position, and to identify viable funding alternatives that

can be utilized. These scenarios include assumptions about significant

changes in key funding sources, market triggers (such as credit ratings),

potential uses of funding and political and economic conditions in certain

countries. These conditions include standard and stressed market conditions

as well as firm-specific events.

A wide range of liquidity stress tests are important for monitoring

purposes. Some span liquidity events over a full year, some may cover an

intense stress period of one month, and still other time frames may be

appropriate. These potential liquidity events are useful to ascertain potential

mismatches between liquidity sources and uses over a variety of horizons

(overnight, one week, two weeks, one month, three months, one year),

and liquidity limits are set accordingly. To monitor the liquidity of a unit,

those stress tests and potential mismatches may be calculated with varying

frequencies, with several important tests performed daily.

Given the range of potential stresses, Citi maintains a series of contingency

funding plans on a consolidated basis as well as for individual entities. These

plans specify a wide range of readily available actions that are available in a

variety of adverse market conditions, or idiosyncratic disruptions.

Credit Ratings

Citigroup’s ability to access the capital markets and other sources of funds, as

well as the cost of these funds and its ability to maintain certain deposits, is

partially dependent on its credit ratings. See also “Risk Factors—Market and

Economic Risks” below. The table below indicates the ratings for Citigroup,

Citibank, N.A. and Citigroup Global Markets Inc. (a broker-dealer subsidiary

of Citi) as of December 31, 2011.

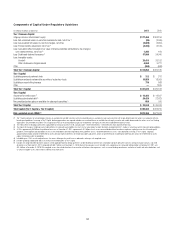

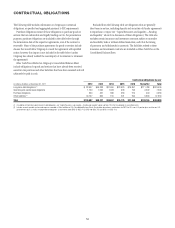

Citigroup’s Debt Ratings as of December 31, 2011

æ

Citigroup Inc./Citigroup

Funding Inc. (1) Citibank, N.A.

Citigroup Global

Markets Inc.

Senior

debt

Commercial

paper

Long-

term

Short-

term

Senior

debt

&ITCHæ2ATINGSæ&ITCH A F1 A F1 NR

-OODYSæ)NVESTORSæ3ERVICEæ-OODYS A3 P-2 A1 P-1 NR

3TANDARDææ0OORSæ30 A- A-2 A A-1 A

æ !SæAæRESULTæOFæTHEæ#ITIGROUPæGUARANTEEæTHEæRATINGSæOFæANDæCHANGESæINæRATINGSæFORæ#&)æAREæTHEæSAMEæASæTHOSEæOFæ#ITIGROUP

.2æ .OTæRATED

Recent Rating Changes

On September 21, 2011, Moody’s concluded its review of government support

assumptions for Citi and certain peers and upgraded Citi’s unsupported

“Baseline Credit Assessment” rating and affirmed Citi’s long-term debt

ratings at both the Citibank and Citigroup levels. At the same time, however,

Moody’s changed the short-term rating of Citigroup (the parent holding

company) to ‘P-2’ from ‘P-1’. On November 29, 2011, following its global

review of the banking industry under S&P’s revised bank criteria, S&P

downgraded the issuer credit rating for Citigroup Inc. to ‘A-/A-2’ from ‘A/A-

1’, and Citibank, N.A. to ‘A/A-1’ from ‘A+/A-1’. These ratings continue to

receive two notches of uplift, reflecting S&P’s view that the U.S. government

is supportive to Citi. On December 15, 2011, Fitch announced revised ratings

resulting from its review of government support assumptions for 17 U.S.

banks. The resolution of this review resulted in a revision to the issuer credit

ratings of Citigroup and Citibank, N.A. from ‘A+’ to ‘A’ and the short-term

issuer rating from ‘F1+’ to ‘F1’.

The above mentioned rating changes did not have a material impact on

Citi’s funding profile. Furthermore, forecasts of potential funding loss under

various stress scenarios, including the above mentioned rating downgrades,

did not occur.

Potential Impact of Ratings Downgrades

Ratings downgrades by Fitch, Moody’s or S&P could have material impacts

on funding and liquidity in the form of cash obligations, reduced funding

capacity and collateral triggers.

Most recently, on February 15, 2012, Moody’s announced a review of 17

banks and securities firms with global capital markets operations, including

Citi, for possible downgrade during the first half of 2012. Moody’s stated this

review was to assess adverse market trends, which it believes are weakening

the credit profiles of many rated banks globally. It is not certain what the

results of this review will be, or if Citigroup or Citibank, N.A. will be impacted.