Citibank 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320

|

|

7

Yet while 2011 was a good year for us, our results fell short of

expectations in the fourth quarter. Fears of a banking crisis

in Europe — or worse, a change in the status of the euro —

affected the entire sector and weighed on client confidence

and activity throughout the world. Market activity was down

significantly, and our clients reduced their risk exposures.

All of our businesses geared to the capital markets — such

as Sales and Trading, Securities and Fund Services in GTS,

and even investment sales in consumer banking — were

adversely impacted.

In addition, we are not completely through with our

remediation efforts. We reduced Citi Holdings assets by an

additional $90 billion in 2011 after many successful sales.

We have split what used to be CitiFinancial into two

components: a servicing portfolio for existing loans and

OneMain Financial, which continues to originate personal

loans in the U.S. This restructuring will help us prepare for

an eventual sale of OneMain, a solid business but one outside

the scope of our core mission and current strategy. As with

every asset in Citi Holdings, we will sell only on economically

rational terms. Now that Retail Partner Cards (renamed Citi

Retail Services) is back in Citicorp, Citi Holdings assets stand

at only 12% of our balance sheet — well below 19% at the end

of last year.

Our expenses rose by $3.6 billion in 2011. Approximately

two-thirds of that was owing to the impact of foreign

exchange and nonoperating expenses such as increased

legal and repositioning charges. Factoring those out, expenses

rose by $1.0 billion, or 2.0%, driven by investments.

Investments in the Future

Despite the soft economy and market turmoil over the

past year, we judged it important to continue making key

investments in the long-term health of our businesses

even as we worked to bolster our quarterly earnings. Thus,

in keeping with our strategy, we invested an additional

$3.9 billion to bring our franchise up to the standards our

clients and regulators expect from a global bank of our

caliber. Nearly half of that, $1.9 billion, was self-funded

through reengineering savings. We also made much-needed

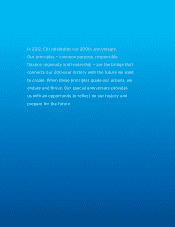

2010 2011

2009

11.7% 12.9% 13.6%

Citigroup Tier 1 Capital Ratio

2010 2011

2009

$(1.6) $10.6 $11.1

Citigroup Net Income

(in billions of dollars)

2010 2011

2009

9.6% 10.8% 11.8%

Citigroup Tier 1 Common Ratio

2010 2011

2009

$91.1 $86.6 $78.4

Citigroup Net Revenues

(in billions of dollars)

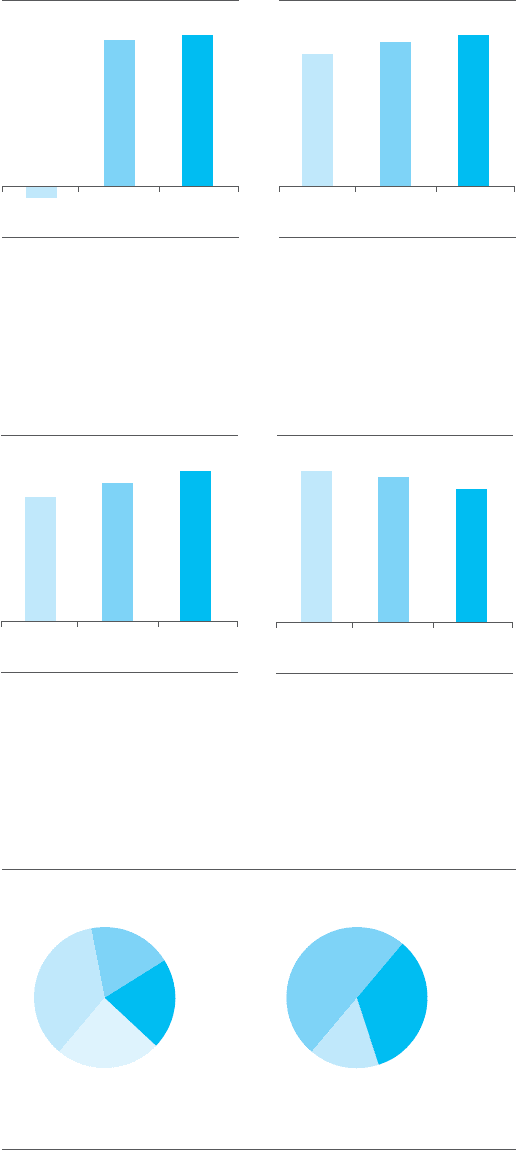

Citicorp Revenues

2011 Revenues: $64.6 billion

By Region By Business

GCB

50%

GTS

16%

S&B

34%

NA

36%

ASIA

24%

LATAM

21%

EMEA

19%

GCB — Global Consumer Banking

S&B — Securities and Banking

GTS — Global Transaction Services

NA — North America

EMEA — Europe, Middle East and Africa

LATAM — Latin America