Citibank 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

Market and Economic Environment

During 2011, Citigroup remained focused on executing its strategy of growth

through increasing the returns on and investments in its core businesses of

Citicorp—Global Consumer Banking and Institutional Clients Group—

while continuing to reduce the assets and businesses within Citi Holdings in

an economically rational manner. While Citi continued to make progress

in these areas during the year, its 2011 operating results were impacted by

the ongoing challenging operating environment, particularly in the second

half of the year, as macroeconomic concerns, including in the U.S. and the

Eurozone, weighed heavily on investor and corporate confidence. Market

activity was down globally, with a particular impact on capital markets-

related activities in the fourth quarter of 2011. This affected Citigroup’s

results of operations in many businesses, including not only Securities and

Banking, but also the Securities and Fund Services business in Transaction

Services and investment sales in Global Consumer Banking. Citi believes

that the European sovereign debt crisis and its potential impact on the global

markets and growth will likely continue to create macro uncertainty and

remain an issue until the market, investors and Citi’s clients and customers

believe that a comprehensive resolution to the crisis is structured, and

achievable. Such uncertainty could have a continued negative impact on

investor activity, and thus on Citi’s activity levels and results of operations,

in 2012.

Compounding this continuing macroeconomic uncertainty is the

ongoing uncertainty facing Citigroup and its businesses as a result of

the numerous regulatory initiatives underway, both in the U.S. and

internationally. As of December 31, 2011, regulatory changes in significant

areas, such as Citi’s future capital requirements and prudential standards, the

proposed implementation of the “Volcker Rule” and the proposed regulation

of the derivatives markets, were incomplete and significant rulemaking and

interpretation remained. See “Risk Factors—Regulatory Risks” below. The

continued uncertainty, including the potential costs, associated with the

actual implementation of these changes will continue to require significant

attention by Citi’s management. In addition, it is also not clear what the

cumulative impact of regulatory reform will be.

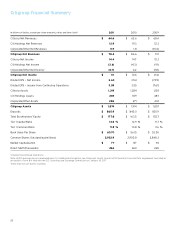

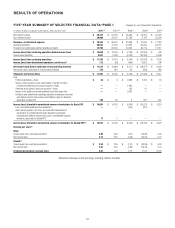

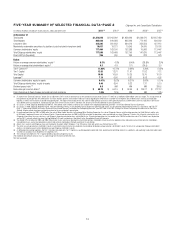

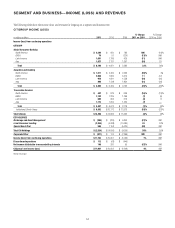

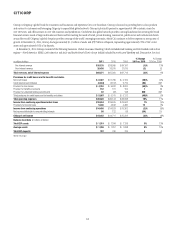

2011 Summary Results

Citigroup

Citigroup reported net income of $11.1 billion and diluted EPS of $3.63 per

share in 2011, compared to $10.6 billion and $3.54 per share, respectively,

in 2010. In 2011, results included a net positive impact of $1.8 billion from

credit valuation adjustments (CVA) on derivatives (excluding monolines),

net of hedges, and debt valuation adjustments (DVA) on Citigroup’s fair

value option debt, compared to a net negative impact of $(469) million in

2010. In addition, Citi has adjusted its 2011 results of operations that were

previously announced on January 17, 2012 for an additional $209 million

(after tax) charge. This charge relates to the agreement in principle with

the United States and state attorneys general announced on February 9,

2012 regarding the settlement of a number of investigations into residential

loan servicing and origination litigation, as well as the resolution of related

mortgage litigation (see Notes 29, 30 and 32 to the Consolidated Financial

Statements). Excluding CVA/DVA, Citi’s net income declined $952 million, or

9%, to $9.9 billion in 2011, reflecting lower revenues and higher operating

expenses as compared to 2010, partially offset by a significant decline in

credit costs.

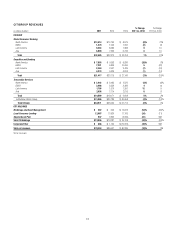

Citi’s revenues of $78.4 billion were down $8.2 billion, or 10%,

compared to 2010. Excluding CVA/DVA, revenues of $76.5 billion were down

$10.5 billion, or 12%, as lower revenues in Citi Holdings and Securities

and Banking more than offset growth in Global Consumer Banking and

Transaction Services. Net interest revenues decreased by $5.7 billion, or 11%,

to $48.4 billion in 2011 as compared to 2010, primarily due to continued

declining loan balances and lower interest-earning assets in Citi Holdings.

Non-interest revenues, excluding CVA/DVA, declined by $4.8 billion, or 15%,

to $28.1 billion in 2011 as compared to 2010, driven by lower revenues in Citi

Holdings and Securities and Banking.

Because of Citi’s extensive global operations, foreign exchange translation

also impacts Citi’s results of operations as Citi translates revenues, expenses,

loan balances and other metrics from foreign currencies to U.S. dollars in

preparing its financial statements. During 2011, the U.S. dollar generally

depreciated versus local currencies in which Citi operates. As a result, the

impact of foreign exchange translation (as used throughout this Form 10-K,

FX translation) accounted for an approximately 1% growth in Citi’s revenues

and 2% growth in expenses, while contributing less than 1% to Citi’s pretax

net income for the year.