Citibank 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

10

and the new global consumer organization. We worked hard

on leadership succession to ensure that the 200 or so most

critical roles within the company are backed by deep benches

of talent. And we held a huge number of leadership and

executive development programs that reached more than

10,000 of our best people.

Citi also made strong headway in 2011 in our efforts to

promote financial inclusion. Just two examples: In partnership

with the city and county of San Francisco, we rolled out

Kindergarten to College, the first universal college savings

program in the U.S. In Indonesia, working with the U.S.

Overseas Private Investment Corporation and Bank Danamon,

we executed a $20 million loan to fund the growth of Bank

Danamon’s Microfinance Program, which lends to

microentrepreneurs and small businesses.

Three Central Responsibilities

Finally, let me turn to three central responsibilities and

update you on what we accomplished in these areas over

the past year. First, in everything we do, we seek to place

the safety and soundness of this institution beyond question

— an objective that is particularly important in the current

environment. Second, we continually work to boost confidence

in our franchise. And third, we strive to grow our book value

as much as possible.

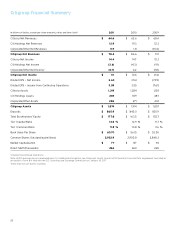

First, with respect to safety and soundness, our capital

strength is among the highest of all our peers. We ended

the year with a Basel I Tier 1 Common ratio of 11.8%, up from

10.8% one year ago. We remain highly liquid, with nearly a

quarter of our balance sheet in cash and liquid securities.

And our loan loss reserves remain strong.

Clearly, reducing risk in our trading books and across the

franchise negatively impacted revenues in the second half

of 2011. But it was the right and necessary step to take in

this environment. Safety and soundness must come first.

That’s why, among other measures, we’ve been carefully

managing our exposure to Western Europe — for instance,

selling off our interest in Egg Banking PLC and our Belgian

retail network while continuing to serve our clients throughout

the region. We also have hedges in place to mitigate the

various outcomes — or the ongoing lack of one — to the

European situation.

In addition, we have been taking steps to reduce operating

risk throughout our company. And our new enterprise risk

framework and anti-money laundering efforts are working to

spot trouble before it arises.

Second, opinion of our company has been steadily improving.

We’re increasingly given credit for what we offer and for what

we have accomplished since the financial crisis. The vast

majority of major equity analysts agree that Citi is a good

investment. We won numerous awards, including Best Bank

in Asia from Euromoney and Best Global Private Bank and

Transaction Services Bank of the Year from The Banker.

Third, we continue to increase our company’s book value.

We achieved a 7.8% return on tangible common equity in 2011.

That’s in the middle of the pack with respect to our peers

but well ahead of some and solid given the environment. In

addition, we generated this return while growing our tangible

common equity by 12%, a level near the top for our industry.

More to the point, we achieved that with about half our capital

essentially unavailable for use in our core franchise. Citigroup

has GAAP capital of roughly $180 billion. However, for Basel I

purposes, approximately $25 billion of goodwill is deducted,

and around $40 billion of deferred tax assets is disallowed.

This leaves us with $115 billion of Tier 1 Common, of which

approximately $25 billion is tied up in Citi Holdings. In other

words, only about $90 billion, or half our capital, is available

to support assets that can generate returns for our core

franchise. The approximately 16% return we generated on our

Citicorp franchise was quite good considering the ultra-low

interest rate environment and sluggish worldwide growth

during the year.

Yet our stock price suffered. The entire sector was down. All

the macroeconomic factors discussed above — especially the

problems in Europe — played a role. We suffered more than

some, less than others. Citi Holdings and deferred tax assets