Citibank 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.106

OPERATIONAL RISK

Operational risk is the risk of loss resulting from inadequate or failed internal

processes, systems or human factors, or from external events. It includes the

reputation and franchise risk associated with business practices or market

conduct in which Citi is involved. Operational risk is inherent in Citigroup’s

global business activities and, as with other risk types, is managed through

an overall framework designed to balance strong corporate oversight with

well-defined independent risk management. This framework includes:

recognized ownership of the risk by the businesses;

oversight by Citi’s independent risk management; and

independent review by Citi’s Audit and Risk Review (ARR).

The goal is to keep operational risk at appropriate levels relative to the

characteristics of Citigroup’s businesses, the markets in which it operates, its

capital and liquidity, and the competitive, economic and regulatory environment.

Notwithstanding these controls, Citigroup incurs operational losses.

Framework

To monitor, mitigate and control operational risk, Citigroup maintains

a system of comprehensive policies and has established a consistent

framework for assessing and communicating operational risk and the

overall effectiveness of the internal control environment across Citigroup.

An Operational Risk Council provides oversight for operational risk across

Citigroup. The Council’s membership includes senior members of the

Chief Risk Officer’s organization covering multiple dimensions of risk

management, with representatives of the Business and Regional Chief Risk

Officers’ organizations and the business management group (see “Managing

Global Risk—Risk Management—Overview” above). The Council’s focus

is on identification and mitigation of operational risk and related incidents.

The Council works with the business segments and the control functions

with the objective of ensuring a transparent, consistent and comprehensive

framework for managing operational risk globally.

Each major business segment must implement an operational risk

process consistent with the requirements of this framework. The process for

operational risk management includes the following steps:

identify and assess key operational risks;

establish key risk indicators;

produce a comprehensive operational risk report; and

prioritize and assure adequate resources to actively improve the

operational risk environment and mitigate emerging risks.

The operational risk standards facilitate the effective communication

and mitigation of operational risk both within and across businesses. As

new products and business activities are developed, processes are designed,

modified or sourced through alternative means and operational risks are

considered. Enterprise risk management, a newly formed organization

within Citi’s independent risk management, proactively assists the businesses,

operations and technology and the other independent control groups in

enhancing the effectiveness of controls and managing operational risks

across products, business lines and regions.

Information about the businesses’ operational risk, historical losses and

the control environment is reported by each major business segment and

functional area, and is summarized and reported to senior management

as well as the Risk Management and Finance Committee of Citi’s Board of

Directors and the full Board of Directors.

Measurement and Basel II

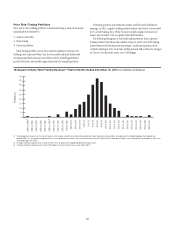

To support advanced capital modeling and management, the businesses

are required to capture relevant operational risk capital information. A risk

capital model for operational risk has been developed and implemented

across the major business segments as a step toward readiness for Basel II

capital calculations. The risk capital calculation is designed to qualify as an

“Advanced Measurement Approach” under Basel II. It uses a combination

of internal and external loss data to support statistical modeling of capital

requirement estimates, which are then adjusted to reflect qualitative data

regarding the operational risk and control environment.

Information Security and Continuity of Business

Information security and the protection of confidential and sensitive customer

data are a priority for Citigroup. Citi has implemented an Information Security

Program in accordance with the Gramm-Leach-Bliley Act and regulatory

guidance. The Information Security Program is reviewed and enhanced

periodically to address emerging threats to customers’ information.

The Corporate Office of Business Continuity, with the support of senior

management, continues to coordinate global preparedness and mitigate

business continuity risks by reviewing and testing recovery procedures.