Citibank 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

Net current funded credit exposure also reflects a reduction for $5.1 billion

in purchased credit protection, predominantly from financial institutions

outside GIIPS and France. Such protection generally pays out only upon the

occurrence of certain credit events with respect to the country or borrower

covered by the protection, as determined by a committee composed of

dealers and other market participants. In addition to counterparty credit

risks (see “Credit Default Swaps” below), the credit protection may not fully

cover all situations that may adversely affect the value of Citi’s exposure

and, accordingly, Citi could still experience losses despite the existence of the

credit protection.

Unfunded Commitments—$16.1 billion

As of December 31, 2011, Citi also had $16.1 billion of unfunded

commitments to the French sovereign, financial institutions and

corporations, with $11.9 billion of this amount to corporations. These

unfunded lines generally have standard conditions that must be met before

they can be drawn.

Other Activities

Similar to other banks, Citi also provides settlement and clearing facilities for

a variety of clients in France and actively monitors and manages these intra-

day exposures. Citi also has locally funded exposure in France; however, as of

December 31, 2011, the amount of this exposure was not material.

Credit Default Swaps

Citi buys and sells credit protection, through credit default swaps, on

underlying GIIPS or French entities as part of its market-making activities for

clients in its trading portfolios. Citi also purchases credit protection, through

credit default swaps, to hedge its own credit exposure to these underlying

entities that arises from loans to these entities or derivative transactions with

these entities.

Citi buys and sells credit default swaps as part of its market-making

activity, and purchases credit default swaps for credit protection, with

financial institutions that Citi believes are of high quality. The counterparty

credit exposure that can arise from the purchase or sale of credit default

swaps is usually covered by legally enforceable netting and margining

agreements with a given counterparty, so that the credit exposure to that

counterparty is measured and managed in aggregate across all products

covered by a given netting or margining agreement.

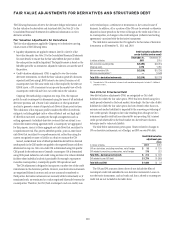

The notional amount of credit protection purchased or sold on GIIPS or

French underlying single reference entities as of December 31, 2011 is set

forth in the table below. The net notional contract amounts, less mark-to-

market adjustments, are included in “net current funded exposure” in the

table under “GIIPS and France” above, and appear in either “net trading

exposure” when part of a trading strategy or in “purchased credit protection”

when purchased as a hedge against a credit exposure (see note 1 to the

table below).

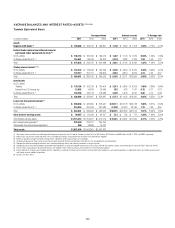

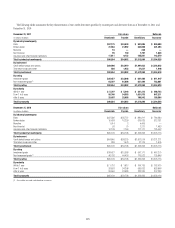

Credit default swaps purchased or sold on underlying single reference entities in these countries (1)

In billions of U.S. dollars GIIPS Greece Ireland Italy Portugal Spain France

Notional CDS contracts on underlying reference entities (1)

Net purchased (2) $ (16.9) $(1.0) $(1.0) $(9.2) $ (1.9) $(7.6) $ (10.4)

Net sold (2) 7.8 1.0 0.7 2.7 2.0 5.3 6.4

3OVEREIGNæUNDERLYINGæREFERENCEæENTITY

.ETæPURCHASEDæ (11.7) (0.8) (0.6) (7.4) (1.2) (4.5) (4.6)

.ETæSOLDæ 5.7 0.8 0.6 1.9 1.2 4.0 4.5

&INANCIALæINSTITUTIONæUNDERLYINGæREFERENCEæENTITY

.ETæPURCHASEDæ (2.9) — (0.4) (1.3) (0.4) (1.3) (1.8)

.ETæSOLDæ 2.4 — 0.1 1.4 0.4 1.0 1.6

#ORPORATEæUNDERLYINGæREFERENCEæENTITY

.ETæPURCHASEDæ (5.2) (0.4) (0.2) (2.4) (0.7) (2.8) (6.7)

.ETæSOLDæ 2.6 0.3 0.2 1.4 0.8 1.2 3.0

æ 4HEæNETæNOTIONALæCONTRACTæAMOUNTSæLESSæMARKTOMARKETæADJUSTMENTSæAREæINCLUDEDæINæ#ITISæhNETæCURRENTæFUNDEDæEXPOSUREvæINæTHEæTABLEæUNDERæh'))03æANDæ&RANCEvæONæPAGEææ4HESEæAMOUNTSæAREæREFLECTEDæINæTWOæPLACESæ

INæSUCHæTABLEææBILLIONæANDææBILLIONæFORæ'))03æANDæ&RANCEæRESPECTIVELYæAREæINCLUDEDæINæhPURCHASEDæCREDITæPROTECTIONvæHEDGINGæhGROSSæFUNDEDæCREDITæEXPOSUREvæ4HEæREMAININGæACTIVITYæISæREFLECTEDæINæhNETæTRADINGæ

EXPOSUREvæSINCEæTHESEæPOSITIONSæAREæPARTæOFæAæTRADINGæSTRATEGY

æ 4HEæSUMMATIONæOFæNOTIONALæAMOUNTSæFORæEACHæ'))03æCOUNTRYæDOESæNOTæEQUALæTHEæNOTIONALæAMOUNTæPRESENTEDæINæTHEæ'))03æTOTALæCOLUMNæINæTHEæTABLEæABOVEæASæADDITIONALæNETTINGæISæACHIEVEDæATæTHEæAGREEMENTæLEVELæWITHæAæ

SPECIFICæCOUNTERPARTYæACROSSæVARIOUSæ'))03æCOUNTRIES