Citibank 2011 Annual Report Download - page 291

Download and view the complete annual report

Please find page 291 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.269

Citigroup’s involvement with CDOs, MBS and structured investment vehicles,

Citigroup’s underwriting activity for mortgage lenders, and Citigroup’s more

general mortgage- and credit-related activities.

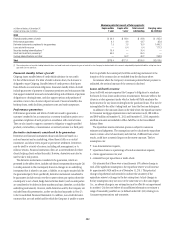

Regulatory Actions: On October 19, 2011, in connection with its industry-

wide investigation concerning CDO-related business activities, the SEC filed

a complaint in the United States District Court for the Southern District of

New York regarding Citigroup’s structuring and sale of the Class V Funding

III CDO transaction (Class V). On the same day, the SEC and Citigroup

announced a settlement of the SEC’s claims, subject to judicial approval,

and the SEC filed a proposed final judgment pursuant to which Citigroup’s

U.S. broker-dealer Citigroup Global Markets Inc. (CGMI) agreed to disgorge

$160 million, and pay $30 million in prejudgment interest and a $95 million

penalty. On November 28, 2011, the district court issued an order refusing to

approve the proposed settlement and ordering trial to begin on July 16, 2012.

On December 15 and 19, 2011, respectively, the SEC and CGMI filed notices

of appeal from the district court’s November 28 order. On December 27, 2011,

the United States Court of Appeals for the Second Circuit granted an

emergency stay of further proceedings in the district court, pending the

Second Circuit’s ruling on the SEC’s motion to stay the district court

proceedings during the pendency of the appeals. Additional information

relating to this matter is publicly available in court filings under the docket

numbers 11 Civ. 7387 (S.D.N.Y.) (Rakoff, J.) and 11-5227 (2d Cir.).

On February 9, 2012, Citigroup announced that CitiMortgage, along with

other major mortgage servicers, had reached an agreement in principle with

the United States and with the Attorneys General for 49 states (Oklahoma did

not participate) and the District of Columbia to settle a number of related

investigations into residential loan servicing and origination practices (the

National Mortgage Settlement). The agreement is subject to the satisfaction

of certain conditions, including final court approval.

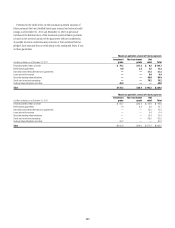

Under the National Mortgage Settlement, Citigroup commits to make

payments and provide financial relief to homeowners in three categories:

(1) cash payments payable to the states and federal agencies in the aggregate

amount of $415 million, a portion of which will be used by the states for

payments to homeowners affected by foreclosure practices; (2) customer

relief in the form of loan modifications for delinquent borrowers, including

principal reductions, to be completed over three years, with a total value of

$1,411 million; and (3) refinancing concessions to enable current borrowers

whose properties are worth less than the value of their loans to reduce

their interest rates, to be completed over three years, with a total value of

$378 million. The total amount of the financial consideration to be paid

by Citigroup is $2.2 billion. As of December 31, 2011, Citigroup had fully

provided for the cash payments called for under the National Mortgage

Settlement (see Note 30 to the Consolidated Financial Statements). Citigroup

expects that its loan loss reserves as of December 31, 2011 will be sufficient

to cover the customer relief payments to delinquent borrowers. The impact of

the refinancing concessions will be recognized over a period of years in the

form of lower interest income. What impact, if any, the National Mortgage

Settlement will have on the behavior of borrowers in general, however,

whether or not their loans are within the scope of the settlement, is uncertain

and difficult to predict.

The National Mortgage Settlement also provides for mortgage servicing

standards in addition to those previously agreed in Consent Orders dated

April 13, 2011 with the Federal Reserve Board and the Office of Comptroller of

the Currency. While Citigroup expects to incur additional operating expenses

in implementing these standards, it does not currently expect that the impact

of these expenses will be material.

Citigroup is receiving legal releases in connection with the National

Mortgage Settlement. These releases will address a broad range of, but not

all, potential claims related to mortgage servicing and origination. Citigroup

will not receive releases related to securitizations or whole loan sales, nor

will it receive releases from criminal, tax, environmental, and certain other

categories of liability.

In conjunction with the National Mortgage Settlement, Citigroup and

Related Parties also entered into a settlement with the United States Attorney’s

Office for the Southern District of New York of a “qui tam” action. This action

alleged that, as a participant in the Direct Endorsement Lender program,

CitiMortgage had certified to the United States Department of Housing and

Urban Development (HUD) and the Federal Housing Administration (FHA)

that certain loans were eligible for FHA insurance when in fact they were

not. The settlement releases Citigroup from claims arising out of its acts or

omissions relating to the origination, underwriting, or endorsement of all

FHA-insured loans prior to the effective date of the settlement. Under the

settlement, Citigroup will pay the United States $158.3 million, for which

Citigroup had fully provided as of December 31, 2011 (see Note 30 to the

Consolidated Financial Statements). CitiMortgage will continue to participate

in the Direct Endorsement Lender program. Additional information relating

to this action is publicly available in court filings under the docket number

11 Civ. 5423 (S.D.N.Y.) (Marrero, J.).

Federal and state regulators have served subpoenas or otherwise requested

information concerning a variety of aspects of Citigroup’s mortgage

origination and mortgage servicing practices, including with respect to

ancillary insurance products or practices. The subjects of such inquiries have

included, among other things, Citigroup’s compliance with the SCRA and

analogous state statutes. Many, but not all, of these inquiries are within the

scope of the claims released in the National Mortgage Settlement. In some

instances, Citigroup is also a defendant in purported class actions, “qui tam”

actions, or other actions addressing the same or similar subject matters,

including the SCRA. Such actions by private litigants or counties and

municipalities are not released in the National Mortgage Settlement.

Federal and state regulators, including the SEC, also have served

subpoenas or otherwise requested information related to Citigroup’s issuing,

sponsoring, or underwriting of MBS. These inquiries include a subpoena

from the Civil Division of the Department of Justice that Citigroup received on

January 27, 2012.