Citibank 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

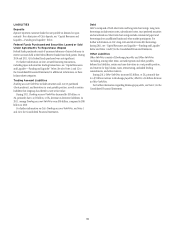

Regulatory Capital Standards

The prospective regulatory capital standards for financial institutions, both

in the U.S. and internationally, continue to be subject to ongoing debate,

extensive rulemaking activity and substantial uncertainty. See “Risk

Factors—Regulatory Risks” below.

Basel II and II.5. In November 2005, the Basel Committee on Banking

Supervision (Basel Committee) published a new set of risk-based capital

standards (Basel II) that permits banking organizations to leverage internal

risk models used to measure credit and operational risks to derive risk-

weighted assets. In November 2007, the U.S. banking agencies adopted

these standards for large, internationally active U.S. banking organizations,

including Citi. As adopted, the standards require Citi to comply with the most

advanced Basel II approaches for calculating risk-weighted assets for credit

and operational risks. The U.S. Basel II implementation timetable originally

consisted of a parallel calculation period under the current regulatory capital

regime (Basel I), followed by a three-year transitional “floor” period, during

which Basel II risk-based capital requirements could not fall below certain

floors based on application of the Basel I rules. Citi began parallel Basel I

and Basel II reporting to the U.S. banking agencies on April 1, 2010.

In June 2011, the U.S. banking agencies adopted final regulations

to implement the “capital floor” provision of the so-called “Collins

Amendment” of The Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010 (Dodd-Frank Act). These regulations eliminated the

three-year transitional floor period in favor of a permanent floor based on

the generally applicable risk-based capital rules (currently Basel I). Pursuant

to these regulations, a banking organization that has formally implemented

Basel II must calculate its risk-based capital requirements under both Basel I

and Basel II, compare the two results, and then use the lower of the resulting

capital ratios for purposes of determining compliance with its minimum Tier

1 Capital and Total Capital requirements. As of December 31, 2011 neither

Citi nor any other U.S. banking organization had received approval from

the U.S. banking agencies to formally implement Basel II. Accordingly, the

timing of Citi’s Basel II implementation remains subject to uncertainty.

Apart from the Basel II rules regarding credit and operational risks, in

June 2010, the Basel Committee agreed on certain revisions to the market risk

capital framework (Basel II.5) that would also result in additional capital

requirements. In January 2011, the U.S. banking agencies issued a proposal

to amend the market risk capital rules to implement certain revisions

approved by the Basel Committee. However, the U.S. banking agencies’

proposal excluded the methodologies adopted by the Basel Committee for

calculating capital requirements on certain debt and securitization positions

covered by the market risk capital rules, as such methodologies include

reliance on external credit ratings, which is prohibited by the Dodd-Frank Act

(see below).

Basel III and Global Systemically Important Banks (G-SIBs)

Basel III. As an outgrowth of the financial crisis, in December 2010, the Basel

Committee issued final rules to strengthen existing capital requirements

(Basel III). The U.S. banking agencies are required to finalize, by December

2012, the rules to be applied by U.S. banking organizations commencing on

January 1, 2013. While expected to be substantially the same as those of the

Basel Committee as described below, as of December 31, 2011, the U.S. banking

agencies had yet to issue the proposed U.S. version of the Basel III rules.

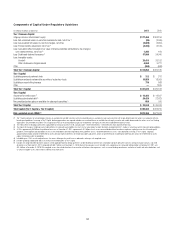

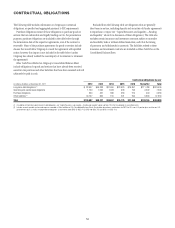

Under Basel III, when fully phased in on January 1, 2019, Citi would

be required to maintain minimum risk-based capital ratios (exclusive of a

G-SIB capital surcharge) as follows:

Tier 1 Common Tier 1 Capital Total Capital

3TATEDæMINIMUMæRATIOæ æ

0LUSæ#APITALæCONSERVATIONæ

BUFFERæREQUIREMENT æ

%FFECTIVEæMINIMUMæRATIOæ

WITHOUTæ'3)"æSURCHARGE

While banking organizations would be permitted to draw on the 2.5%

capital conservation buffer to absorb losses during periods of financial

or economic stress, restrictions on earnings distributions (e.g., dividends,

equity repurchases, and discretionary compensation) would result, with

the degree of such restrictions greater based upon the extent to which

the buffer is utilized. Moreover, subject to national discretion by the

respective bank supervisory or regulatory authorities (i.e., for Citi, the U.S.

banking agencies), a countercyclical capital buffer ranging from 0% to

2.5%, consisting of only Tier 1 Common Capital, could also be imposed

on banking organizations when it is deemed that excess aggregate credit

growth is resulting in a build-up of systemic risk in a given country. This

countercyclical capital buffer, when in effect, would serve as an additional

buffer supplementing the capital conservation buffer.

Under Basel III, Tier 1 Common Capital will be required to be measured

after applying generally all regulatory adjustments (including applicable

deductions). The impact of these regulatory adjustments on Tier 1 Common

Capital would be phased in incrementally at 20% annually beginning on

January 1, 2014, with full implementation by January 1, 2018. During the

transition period, the portion of the regulatory adjustments (including

applicable deductions) not applied against Tier 1 Common Capital would

continue to be subject to existing national treatments.

Further, under Basel III, certain capital instruments will no longer

qualify as non-common components of Tier 1 Capital (e.g., trust preferred

securities and cumulative perpetual preferred stock) or Tier 2 Capital.

These instruments will be subject to a 10% per year phase-out over 10 years

beginning on January 1, 2013, except for certain limited grandfathering.

This phase-out period will be substantially shorter in the U.S. as a result of

the Collins Amendment of the Dodd-Frank Act, which will generally require

a phase-out of these securities over a three-year period also beginning on

January 1, 2013. In addition, the Basel Committee has subsequently issued

supplementary minimum requirements to those contained in Basel III,