Citibank 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

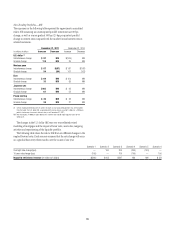

103

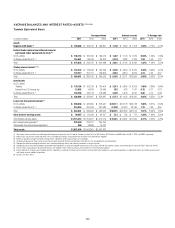

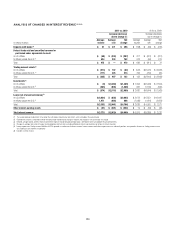

AVERAGE BALANCES AND INTEREST RATES—LIABILITIES AND EQUITY,

AND NET INTEREST REVENUE (1)(2)(3)(4)

Taxable Equivalent Basis

Average volume Interest expense % Average rate

In millions of dollars 2011 2011 2011

Liabilities

Deposits

)Næ53æOFFICES

3AVINGSæDEPOSITSæ $ 193,762 $ 1,922 0.99%

/THERæTIMEæDEPOSITS 29,034 249 0.86

)NæOFFICESæOUTSIDEæTHEæ53æ 485,101 6,385 1.32

4OTAL $ 707,897 æ $ 8,556 1.21%

Federal funds purchased and securities loaned

or sold under agreements to repurchase (7)

)Næ53æOFFICES $ 120,039 $ 776 æ 0.65%

)NæOFFICESæOUTSIDEæTHEæ53æ 99,848 2,421 2.42

4OTAL $ 219,887 $ 3,197 1.45%

Trading account liabilities (8)(9)

)Næ53æOFFICES $ 37,279 $ 266 æ 0.71%

)NæOFFICESæOUTSIDEæTHEæ53æ 49,162 142 0.29

4OTAL $ 86,441 $ 408 0.47%

Short-term borrowings

)Næ53æOFFICES $ 87,472 $ 139 æ 0.16%

)NæOFFICESæOUTSIDEæTHEæ53æ 39,052 511 1.31

4OTAL $ 126,524 $ 650 0.51%

Long-term debt (10)

)Næ53æOFFICES $ 325,709 $ 10,697 3.28%

)NæOFFICESæOUTSIDEæTHEæ53æ 17,970 721 4.01

4OTAL $ 343,679 $ 11,418 3.32%

Total interest-bearing liabilities $1,484,428 $ 24,229 1.63%

$EMANDæDEPOSITSæINæ53æOFFICES $ 16,410

/THERæNONINTERESTBEARINGæLIABILITIESæ 275,408

4OTALæLIABILITIESæFROMæDISCONTINUEDæOPERATIONS 10

Total liabilities $1,776,256

Citigroup stockholders’ equity (11) $ 174,351

.ONCONTROLLINGæINTEREST 2,029

Total equity (11) $ 176,380

Total liabilities and stockholders’ equity $1,952,636

Net interest revenue as a percentage of average

interest-earning assets (12)

)Næ53æOFFICES $ 971,792 $ 25,723 2.65%

)NæOFFICESæOUTSIDEæTHEæ53æ 741,626 23,249 3.13 æ

Total $1,713,418 $ 48,972 2.86%

æ Net interest revenueæINCLUDESæTHEæTAXABLEæEQUIVALENTæADJUSTMENTSæBASEDæONæTHEæ53æFEDERALæSTATUTORYæTAXæRATEæOFææOFææMILLIONææMILLIONæANDææMILLIONæFORæææANDææRESPECTIVELY

æ )NTERESTæRATESæANDæAMOUNTSæINCLUDEæTHEæEFFECTSæOFæRISKæMANAGEMENTæACTIVITIESæASSOCIATEDæWITHæTHEæRESPECTIVEæASSETæANDæLIABILITYæCATEGORIES

æ -ONTHLYæORæQUARTERLYæAVERAGESæHAVEæBEENæUSEDæBYæCERTAINæSUBSIDIARIESæWHEREæDAILYæAVERAGESæAREæUNAVAILABLE

æ $ETAILEDæAVERAGEæVOLUMEæINTERESTæREVENUEæANDæINTERESTæEXPENSEæEXCLUDEæDISCONTINUEDæOPERATIONSæ3EEæ.OTEææTOæTHEæ#ONSOLIDATEDæ&INANCIALæ3TATEMENTS

æ 3AVINGSæDEPOSITSæCONSISTæOFæ)NSUREDæ-ONEYæ-ARKETæACCOUNTSæ./7æACCOUNTSæANDæOTHERæSAVINGSæDEPOSITSæ4HEæINTERESTæEXPENSEæINCLUDESæ&$)#æDEPOSITæINSURANCEæFEESæANDæCHARGES

æ !VERAGEæRATESæREFLECTæPREVAILINGæLOCALæINTERESTæRATESæINCLUDINGæINFLATIONARYæEFFECTSæANDæMONETARYæCORRECTIONSæINæCERTAINæCOUNTRIES

æ !VERAGEæVOLUMESæOFæSECURITIESæLOANEDæORæSOLDæUNDERæAGREEMENTSæTOæREPURCHASEæAREæREPORTEDæNETæPURSUANTæTOæ&).ææ!3#ææ(OWEVERæ)NTERESTæEXPENSEæEXCLUDESæTHEæIMPACTæOFæ&).ææ!3#æ

æ 4HEæFAIRæVALUEæCARRYINGæAMOUNTSæOFæDERIVATIVEæCONTRACTSæAREæREPORTEDæINæNon-interest-earning assetsæANDæOther non-interest-bearing liabilities.

æ )NTERESTæEXPENSEæONæTrading account liabilitiesæOFæICGæISæREPORTEDæASæAæREDUCTIONæOFæInterest revenueæ)NTERESTæREVENUEæANDæINTERESTæEXPENSEæONæCASHæCOLLATERALæPOSITIONSæAREæREPORTEDæINæINTERESTæONæTrading account assetsæ

ANDæTrading account liabilitiesæRESPECTIVELY

æ %XCLUDESæHYBRIDæFINANCIALæINSTRUMENTSæANDæBENEFICIALæINTERESTSæINæCONSOLIDATEDæ6)%SæTHATæAREæCLASSIFIEDæASæLong-term debtæASæTHESEæOBLIGATIONSæAREæACCOUNTEDæFORæATæFAIRæVALUEæWITHæCHANGESæRECORDEDæINæPrincipal transactions

æ)NCLUDESæSTOCKHOLDERSæEQUITYæFROMæDISCONTINUEDæOPERATIONS

æ)NCLUDESæALLOCATIONSæFORæCAPITALæANDæFUNDINGæCOSTSæBASEDæONæTHEæLOCATIONæOFæTHEæASSET