Citibank 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

ACCOUNTING CHANGES

Credit Quality and Allowance for Credit Losses

Disclosures

In July 2010, the FASB issued ASU No. 2010-20, Receivables (Topic 310):

Disclosures about Credit Quality of Financing Receivables and

Allowance for Credit Losses. The ASU required a greater level of

disaggregated information about the allowance for credit losses and the

credit quality of financing receivables. The period-end balance disclosure

requirements for loans and the allowance for loan losses were effective

for reporting periods ending on or after December 15, 2010 and were

included in the Company’s 2010 Annual Report on Form 10-K, while

disclosures for activity during a reporting period in the loan and allowance

for loan losses accounts were effective for reporting periods beginning on

or after December 15, 2010 and were included in the Company’s Forms

10-Q beginning with the first quarter of 2011 (see Notes 16 and 17 to

the Consolidated Financial Statements). The troubled debt restructuring

disclosure requirements that were part of this ASU became effective in the

third quarter of 2011 (see below).

Troubled Debt Restructurings (TDRs)

In April 2011, the FASB issued ASU No. 2011-02, Receivables (Topic 310):

A Creditor’s Determination of whether a Restructuring is a Troubled

Debt Restructuring, to clarify the guidance for accounting for troubled debt

restructurings. The ASU clarified the guidance on a creditor’s evaluation of

whether it has granted a concession and whether a debtor is experiencing

financial difficulties, such as:

Any shortfall in contractual loan payments is considered a concession.

Creditors cannot assume that debt extensions at or above a borrower’s

original contractual rate do not constitute troubled debt restructurings

because the new contractual rate could still be below the market rate.

If a borrower doesn’t have access to funds at a market rate for debt with

characteristics similar to the restructured debt, that may indicate that the

creditor has granted a concession.

A borrower that is not currently in default may still be considered to be

experiencing financial difficulty when payment default is considered

“probable in the foreseeable future.”

Effective in the third quarter of 2011, as a result of adopting ASU 2011-02,

certain loans modified under short-term programs since January 1, 2011 that

were previously measured for impairment under ASC 450 are now measured

for impairment under ASC 310-10-35. At the end of the first interim period

of adoption (September 30, 2011), the recorded investment in receivables

previously measured under ASC 450 was $1,170 million and the allowance

for credit losses associated with those loans was $467 million. The effect of

adopting the ASU was approximately $60 million.

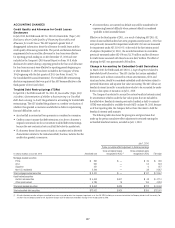

Change in Accounting for Embedded Credit Derivatives

In March 2010, the FASB issued ASU 2010-11, Scope Exception Related to

Embedded Credit Derivatives. The ASU clarifies that certain embedded

derivatives, such as those contained in certain securitizations, CDOs and

structured notes, should be considered embedded credit derivatives subject to

potential bifurcation and separate fair value accounting. The ASU allows any

beneficial interest issued by a securitization vehicle to be accounted for under

the fair value option at transition on July 1, 2010.

The Company has elected to account for certain beneficial interests issued

by securitization vehicles under the fair value option that are included in

the table below. Beneficial interests previously classified as held-to-maturity

(HTM) were reclassified to available-for-sale (AFS) on June 30, 2010, because

as of that reporting date, the Company did not have the intent to hold the

beneficial interests until maturity.

The following table also shows the gross gains and gross losses that

make up the pretax cumulative-effect adjustment to retained earnings for

reclassified beneficial interests, recorded on July 1, 2010:

*ULYææ

0RETAXæCUMULATIVEæEFFECTæADJUSTMENTæTOæ2ETAINEDæEARNINGS

In millions of dollars at June 30, 2010 !MORTIZEDæCOST

'ROSSæUNREALIZEDæLOSSESæ

RECOGNIZEDæINæ!/#)æ

'ROSSæUNREALIZEDæGAINSæ

RECOGNIZEDæINæ!/#) &AIRæVALUE

-ORTGAGEBACKEDæSECURITIESæ

0RIMEæ

!LT!æ

3UBPRIMEæ

.ON53æRESIDENTIALæ

4OTALæMORTGAGEBACKEDæSECURITIESæ

!SSETBACKEDæSECURITIESæ

!UCTIONæRATEæSECURITIES

/THERæASSETBACKED

4OTALæASSETBACKEDæSECURITIESæææææææææææææææææææææææææææææææææææææææææææææææææ

4OTALæRECLASSIFIEDæDEBTæSECURITIESæ

æ !LLæRECLASSIFIEDæDEBTæSECURITIESæWITHæGROSSæUNREALIZEDæLOSSESæWEREæASSESSEDæFORæOTHERTHANTEMPORARYIMPAIRMENTæASæOFæ*UNEæææINCLUDINGæANæASSESSMENTæOFæWHETHERæTHEæ#OMPANYæINTENDSæTOæSELLæTHEæSECURITYæ&ORæ

SECURITIESæTHATæTHEæ#OMPANYæINTENDSæTOæSELLæIMPAIRMENTæCHARGESæOFææMILLIONæWEREæRECORDEDæINæEARNINGSæINæTHEæSECONDæQUARTERæOFæ