Citibank 2011 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

184

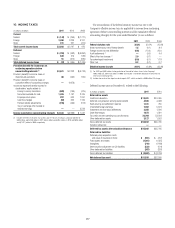

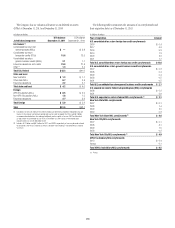

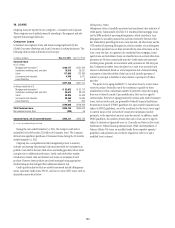

15. INVESTMENTS

Overview

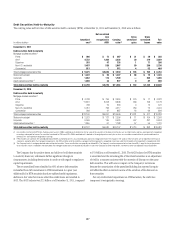

In millions of dollars 2011

3ECURITIESæAVAILABLEFORSALE $265,204

$EBTæSECURITIESæHELDTOMATURITYæ 11,483

.ONMARKETABLEæEQUITYæSECURITIESæCARRIEDæATæFAIRæVALUEæ 8,836

.ONMARKETABLEæEQUITYæSECURITIESæCARRIEDæATæCOSTæ 7,890

Total investments $293,413

æ 2ECORDEDæATæAMORTIZEDæCOSTæLESSæIMPAIRMENTæFORæSECURITIESæTHATæHAVEæCREDITRELATEDæIMPAIRMENT

æ 5NREALIZEDæGAINSæANDæLOSSESæFORæNONMARKETABLEæEQUITYæSECURITIESæCARRIEDæATæFAIRæVALUEæAREæRECOGNIZEDæINæEARNINGS

æ .ONMARKETABLEæEQUITYæSECURITIESæCARRIEDæATæCOSTæPRIMARILYæCONSISTæOFæSHARESæISSUEDæBYæTHEæ&EDERALæ2ESERVEæ"ANKæ&EDERALæ(OMEæ,OANæ"ANKSæFOREIGNæCENTRALæBANKSæANDæVARIOUSæCLEARINGæHOUSESæOFæWHICHæ#ITIGROUPæISæAæMEMBER

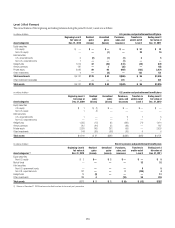

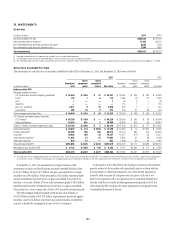

Securities Available-for-Sale

The amortized cost and fair value of securities available-for-sale (AFS) at December 31, 2011 and December 31, 2010 were as follows:

2011

In millions of dollars

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

!MORTIZEDæ

COST

'ROSSæ

UNREALIZEDæ

GAINS

'ROSSæ

UNREALIZEDæ

LOSSES &AIRæVALUE

Debt securities AFS

-ORTGAGEBACKEDæSECURITIESæ

53æGOVERNMENTSPONSOREDæAGENCYæGUARANTEED $ 44,394 $ 1,438 $ 51 $ 45,781

0RIME 118 1 6 113

!LT! 1—— 1

3UBPRIME ————

.ON53æRESIDENTIAL 4,671 9 22 4,658

#OMMERCIAL 465 16 9 472

4OTALæMORTGAGEBACKEDæSECURITIES $ 49,649 $ 1,464 $ 88 $ 51,025

53æ4REASURYæANDæFEDERALæAGENCYæSECURITIES

53æ4REASURY $ 48,790 $ 1,439 $ — $ 50,229

!GENCYæOBLIGATIONS 34,310 601 2 34,909

4OTALæ53æ4REASURYæANDæFEDERALæAGENCYæSECURITIES $ 83,100 $ 2,040 $ 2 $ 85,138

3TATEæANDæMUNICIPAL $ 16,819 $ 134 $ 2,554 $ 14,399

&OREIGNæGOVERNMENT 84,360 558 404 84,514

#ORPORATE 10,005 305 53 10,257

!SSETBACKEDæSECURITIESæ 11,053 31 81 11,003

/THERæDEBTæSECURITIES 670 13 — 683

4OTALæDEBTæSECURITIESæ!&3 $255,656 $ 4,545 $ 3,182 $257,019

-ARKETABLEæEQUITYæSECURITIESæ!&3 $ 6,722 $ 1,658 $ 195 $ 8,185

Total securities AFS $262,378 $ 6,203 $ 3,377 $265,204

ææ 4HEæ#OMPANYæINVESTSæINæMORTGAGEBACKEDæANDæASSETBACKEDæSECURITIESæ4HESEæSECURITIZATIONSæAREæGENERALLYæCONSIDEREDæ6)%Sæ4HEæ#OMPANYSæMAXIMUMæEXPOSUREæTOæLOSSæFROMæTHESEæ6)%SæISæEQUALæTOæTHEæCARRYINGæAMOUNTæ

OFæTHEæSECURITIESæWHICHæISæREFLECTEDæINæTHEæTABLEæABOVEæ&ORæMORTGAGEBACKEDæANDæASSETBACKEDæSECURITIZATIONSæINæWHICHæTHEæ#OMPANYæHASæOTHERæINVOLVEMENTæSEEæ.OTEææTOæTHEæ#ONSOLIDATEDæ&INANCIALæ3TATEMENTS

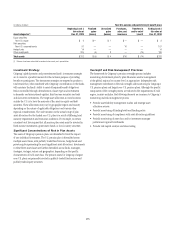

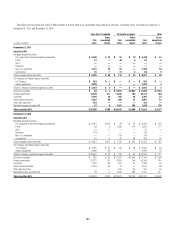

At December 31, 2011, the amortized cost of approximately 4,000

investments in equity and fixed-income securities exceeded their fair value

by $3.377 billion. Of the $3.377 billion, the gross unrealized loss on equity

securities was $195 million. Of the remainder, $362 million represents fixed-

income investments that have been in a gross-unrealized-loss position for

less than a year and, of these, 99% are rated investment grade; $2.820 billion

represents fixed-income investments that have been in a gross-unrealized-

loss position for a year or more and, of these, 95% are rated investment grade.

The AFS mortgage-backed securities portfolio fair value balance of

$51.025 billion consists of $45.781 billion of government-sponsored agency

securities, and $5.244 billion of privately sponsored securities, of which the

majority is backed by mortgages that are not Alt-A or subprime.

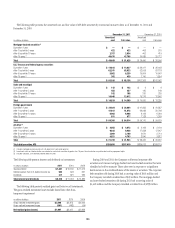

As discussed in more detail below, the Company conducts and documents

periodic reviews of all securities with unrealized losses to evaluate whether

the impairment is other than temporary. Any credit-related impairment

related to debt securities the Company does not plan to sell and is not

likely to be required to sell is recognized in the Consolidated Statement of

Income, with the non-credit-related impairment recognized in AOCI. For

other impaired debt securities, the entire impairment is recognized in the

Consolidated Statement of Income.