Citibank 2011 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160

A portion of the immediately vested cash incentive compensation

awarded in January 2011 to selected highly compensated employees

(and in January 2012 to such employees in the EU) was delivered in

immediately-vested stock payments. In the EU, the shares awarded were

subject to a six-month sale restriction.

Annual incentive awards made in January 2011, January 2010, and

December 2009 to certain executive officers and highly compensated

employees were made in the form of long-term restricted stock (LTRS),

with terms prescribed by the Emergency Economic Stabilization Act of

2008, as amended. (See EESA-related Stock Compensation below for

additional information.)

The annual incentive awards made in January 2011 to executive officers

have a performance-based vesting condition. If Citigroup has pretax net

losses during any of the years of the deferral period, the Committee may

exercise its discretion to eliminate or reduce the number of shares that vest

for that year. This performance-based vesting condition applies to CAP and

LTRS awards made in January 2011 to executive officers. These awards are

subject to variable accounting. Compensation expense was accrued based on

Citigroup’s stock price at year end and the estimated outcome of meeting the

performance conditions.

All CAP awards made in January 2011 and 2012 and all LTRS awards

made in January 2011 provide for a clawback that applies to specified cases,

including in the case of employee misconduct or where the awards were

based on earnings that were misstated. Some of these awards are subject to

variable accounting.

Generally, in order to reduce the use of shares under Citigroup’s

stockholder-approved stock incentive plan, the percentages of total annual

incentives awarded pursuant to CAP in January 2010 and January 2009 were

reduced and were instead awarded as deferred cash awards primarily in

the U.S. and the U.K. The deferred cash awards are subject to two-year and

four-year vesting schedules, but the other terms and conditions are the same

as CAP awards made in those years. The deferred cash awards earn a return

during the vesting period based on LIBOR; in 2010 only, a portion of the

deferred cash award was denominated as a stock unit, the value of which will

fluctuate based on the price of Citi common stock. In both cases, only cash

will be delivered at vesting.

In January 2009, members of the Management Executive Committee

(except the CEO and CFO) received 30% of their incentive awards for 2008

as performance vesting-equity awards. These awards vest 50% if the price

of Citigroup common stock meets a price target of $106.10, and 50% for a

price target of $178.50, in each case on or prior to January 14, 2013. The

price target will be met only if the NYSE closing price equals or exceeds the

applicable price target for at least 20 NYSE trading days within any period

of 30 consecutive NYSE trading days ending on or before January 14, 2013.

Any shares that have not vested by such date will vest according to a fraction,

the numerator of which is the share price on the delivery date and the

denominator of which is the price target of the unvested shares. No dividend

equivalents are paid on unvested awards. The fair value of the awards is

recognized as compensation expense ratably over the vesting period. This fair

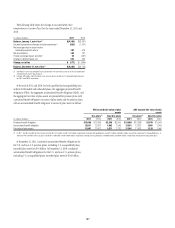

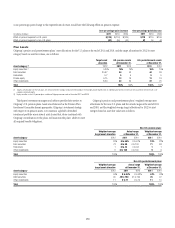

value was determined using the following assumptions:

Weighted-average per-share fair value $22.97

Weighted-average expected life 3.85 years

Valuation assumptions

%XPECTEDæVOLATILITY

2ISKFREEæINTERESTæRATE

%XPECTEDæDIVIDENDæYIELD

From 2003 to 2007, Citigroup granted annual stock awards under its

Citigroup Ownership Program (COP) to a broad base of employees who

were not eligible for CAP. The COP awards of restricted or deferred stock vest

after three years, but otherwise have terms similar to CAP. Amortization of

restricted and deferred stock awards shown in the table above for 2010 and

2009 includes expense associated with these awards.

EESA-related Stock Compensation. Incentive compensation in

respect of 2009 performance for the senior executive officers and the next

95 most highly compensated employees (2009 Top 100) was administered

in accordance with the Emergency Economic Stabilization Act of 2008, as

amended (EESA) pursuant to structures approved by the Special Master for

TARP Executive Compensation (Special Master). Pursuant to such structures,

the affected employees did not participate in CAP and instead received equity

compensation in the form of fully vested stock payments, LTRS and other

restricted and deferred stock awards subject to vesting requirements and sale

restrictions. The other restricted and deferred stock awards to the 2009 Top

100 vest ratably over three years pursuant to terms similar to CAP awards,

but vested shares are subject to sale restrictions until the later of the first

anniversary of the regularly scheduled vesting date or January 20, 2013.

Pursuant to EESA-prescribed structures, incentive compensation in respect of

2010 performance was delivered to the senior executive officers and next 20

most highly compensated employees for 2010 (2010 Top 25), in the form of

LTRS awards. The LTRS awards to the 2009 Top 100 and 2010 Top 25 vest in

full after three years of service and there are no provisions for early vesting in

the event of retirement, involuntary termination of employment or change in

control, but early vesting will occur upon death or disability.

In 2009 and January 2010, the 2009 Top 100 received salary stock

payments that become transferrable in monthly installments over periods

of either one year or three years beginning in January 2010. In September

2010, salary stock payments were made to the 2010 Top 25 (other than

the CEO) in a manner consistent with the salary stock payments made in

2009 pursuant to rulings issued by the Special Master. The salary stock paid

for 2010, net of tax withholdings, is transferable over a 12-month period

beginning in January 2011. There are no provisions for early release of the

transfer restrictions on salary stock in the event of retirement, involuntary

termination of employment, change in control, or any other reason.