Citibank 2011 Annual Report Download - page 253

Download and view the complete annual report

Please find page 253 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.231

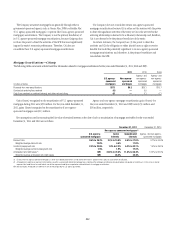

Client Intermediation

Client intermediation transactions represent a range of transactions

designed to provide investors with specified returns based on the returns of

an underlying security, referenced asset or index. These transactions include

credit-linked notes and equity-linked notes. In these transactions, the VIE

typically obtains exposure to the underlying security, referenced asset or

index through a derivative instrument, such as a total-return swap or a

credit-default swap. In turn the VIE issues notes to investors that pay a return

based on the specified underlying security, referenced asset or index. The VIE

invests the proceeds in a financial asset or a guaranteed insurance contract

(GIC) that serves as collateral for the derivative contract over the term of

the transaction. The Company’s involvement in these transactions includes

being the counterparty to the VIE’s derivative instruments and investing in a

portion of the notes issued by the VIE. In certain transactions, the investor’s

maximum risk of loss is limited and the Company absorbs risk of loss above

a specified level. The Company does not have the power to direct the activities

of the VIEs that most significantly impact their economic performance and

thus it does not consolidate them.

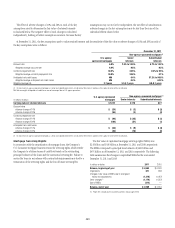

The Company’s maximum risk of loss in these transactions is defined

as the amount invested in notes issued by the VIE and the notional amount

of any risk of loss absorbed by the Company through a separate instrument

issued by the VIE. The derivative instrument held by the Company may

generate a receivable from the VIE (for example, where the Company

purchases credit protection from the VIE in connection with the VIE’s

issuance of a credit-linked note), which is collateralized by the assets

owned by the VIE. These derivative instruments are not considered variable

interests and any associated receivables are not included in the calculation of

maximum exposure to the VIE.

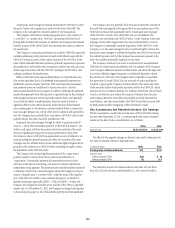

Investment Funds

The Company is the investment manager for certain investment funds that

invest in various asset classes including private equity, hedge funds, real

estate, fixed income and infrastructure. The Company earns a management

fee, which is a percentage of capital under management, and may earn

performance fees. In addition, for some of these funds the Company has

an ownership interest in the investment funds. The Company has also

established a number of investment funds as opportunities for qualified

employees to invest in private equity investments. The Company acts as

investment manager to these funds and may provide employees with

financing on both recourse and non-recourse bases for a portion of the

employees’ investment commitments.

The Company has determined that a majority of the investment entities

managed by Citigroup are provided a deferral from the requirements of

SFAS 167, Amendments to FASB Interpretation No. 46(R), because

they meet the criteria in Accounting Standards Update No. 2010-10,

Consolidation (Topic 810), Amendments for Certain Investment

Funds (ASU 2010-10). These entities continue to be evaluated under the

requirements of ASC 810-10, prior to the implementation of SFAS 167

(FIN 46(R), Consolidation of Variable Interest Entities), which required

that a VIE be consolidated by the party with a variable interest that will

absorb a majority of the entity’s expected losses or residual returns, or both.

Where the Company has determined that certain investment entities are

subject to the consolidation requirements of SFAS 167, the consolidation

conclusions reached upon initial application of SFAS 167 are consistent

with the consolidation conclusions reached under the requirements of

ASC 810-10, prior to the implementation of SFAS 167.

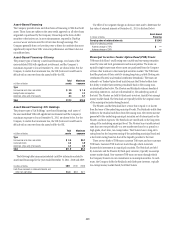

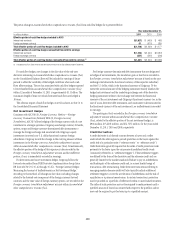

Trust Preferred Securities

The Company has raised financing through the issuance of trust preferred

securities. In these transactions, the Company forms a statutory business trust

and owns all of the voting equity shares of the trust. The trust issues preferred

equity securities to third-party investors and invests the gross proceeds in

junior subordinated deferrable interest debentures issued by the Company.

The trusts have no assets, operations, revenues or cash flows other than those

related to the issuance, administration and repayment of the preferred equity

securities held by third-party investors. Obligations of the trusts are fully and

unconditionally guaranteed by the Company.

Because the sole asset of each of the trusts is a receivable from the

Company and the proceeds to the Company from the receivable exceed

the Company’s investment in the VIE’s equity shares, the Company is not

permitted to consolidate the trusts, even though it owns all of the voting

equity shares of the trust, has fully guaranteed the trusts’ obligations, and

has the right to redeem the preferred securities in certain circumstances.

The Company recognizes the subordinated debentures on its Consolidated

Balance Sheet as long-term liabilities.