Citibank 2011 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.227

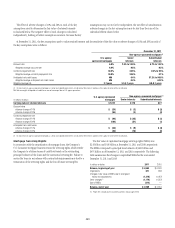

Finally, the Company is one of several named dealers in the commercial

paper issued by the conduits and earns a market-based fee for providing

such services. Along with third-party dealers, the Company makes a market

in the commercial paper and may from time to time fund commercial

paper pending sale to a third party. On specific dates with less liquidity in

the market, the Company may hold in inventory commercial paper issued

by conduits administered by the Company, as well as conduits administered

by third parties. The amount of commercial paper issued by its administered

conduits held in inventory fluctuates based on market conditions and

activity. As of December 31, 2011, the Company owned $144 million of the

commercial paper issued by its unconsolidated administered conduit.

With the exception of the government-guaranteed loan conduit described

below, the asset-backed commercial paper conduits are consolidated by the

Company. The Company determined that through its role as administrator

it had the power to direct the activities that most significantly impacted the

entities’ economic performance. These powers included its ability to structure

and approve the assets purchased by the conduits, its ongoing surveillance

and credit mitigation activities, and its liability management. In addition, as

a result of all the Company’s involvement described above, it was concluded

that the Company had an economic interest that could potentially be

significant. However, the assets and liabilities of the conduits are separate and

apart from those of Citigroup. No assets of any conduit are available to satisfy

the creditors of Citigroup or any of its other subsidiaries.

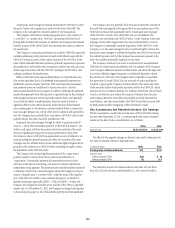

The Company administers one conduit that originates loans to

third-party borrowers and those obligations are fully guaranteed primarily

by AAA-rated government agencies that support export and development

financing programs. The economic performance of this government-

guaranteed loan conduit is most significantly impacted by the performance

of its underlying assets. The guarantors must approve each loan held by

the entity and the guarantors have the ability (through establishment of

the servicing terms to direct default mitigation and to purchase defaulted

loans) to manage the conduit’s loans that become delinquent to improve the

economic performance of the conduit. Because the Company does not have

the power to direct the activities of this government-guaranteed loan conduit

that most significantly impact the economic performance of the entity, it

was concluded that the Company should not consolidate the entity. The

total notional exposure under the program-wide liquidity agreement for the

Company’s unconsolidated administered conduit as of December 31, 2011

is $0.6 billion. The program-wide liquidity agreement, along with each

asset APA, is considered in the Company’s maximum exposure to loss to the

unconsolidated administered conduit.

As of December 31, 2011, this unconsolidated government-guaranteed

loan conduit held assets of approximately $13.0 billion.

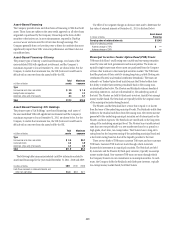

Third-Party Commercial Paper Conduits

The Company also provides liquidity facilities to single- and multi-seller

conduits sponsored by third parties. These conduits are independently owned

and managed and invest in a variety of asset classes, depending on the nature

of the conduit. The facilities provided by the Company typically represent a

small portion of the total liquidity facilities obtained by each conduit, and

are collateralized by the assets of each conduit. As of December 31, 2011,

the notional amount of these facilities was approximately $746 million, of

which $448 million was funded under these facilities. The Company is not

the party that has the power to direct the activities of these conduits that

most significantly impact their economic performance and thus does not

consolidate them.

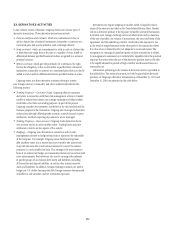

Collateralized Debt and Loan Obligations

A securitized collateralized debt obligation (CDO) is an SPE that purchases

a pool of assets consisting of asset-backed securities and synthetic exposures

through derivatives on asset-backed securities and issues multiple tranches of

equity and notes to investors.

A cash CDO, or arbitrage CDO, is a CDO designed to take advantage of

the difference between the yield on a portfolio of selected assets, typically

residential mortgage-backed securities, and the cost of funding the CDO

through the sale of notes to investors. “Cash flow” CDOs are entities in which

the CDO passes on cash flows from a pool of assets, while “market value”

CDOs pay to investors the market value of the pool of assets owned by the

CDO at maturity. In these transactions, all of the equity and notes issued by

the CDO are funded, as the cash is needed to purchase the debt securities.

A synthetic CDO is similar to a cash CDO, except that the CDO obtains

exposure to all or a portion of the referenced assets synthetically through

derivative instruments, such as credit default swaps. Because the CDO does

not need to raise cash sufficient to purchase the entire referenced portfolio, a

substantial portion of the senior tranches of risk is typically passed on to CDO

investors in the form of unfunded liabilities or derivative instruments. Thus,

the CDO writes credit protection on select referenced debt securities to the

Company or third parties and the risk is then passed on to the CDO investors

in the form of funded notes or purchased credit protection through derivative

instruments. Any cash raised from investors is invested in a portfolio of

collateral securities or investment contracts. The collateral is then used to

support the obligations of the CDO on the credit default swaps written to

counterparties.

A securitized collateralized loan obligation (CLO) is substantially similar

to the CDO transactions described above, except that the assets owned by

the SPE (either cash instruments or synthetic exposures through derivative

instruments) are corporate loans and to a lesser extent corporate bonds,

rather than asset-backed debt securities.