Citibank 2011 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

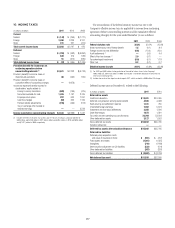

187

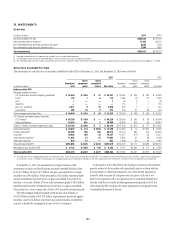

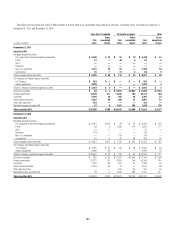

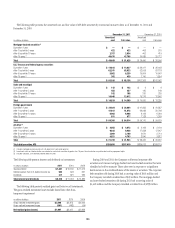

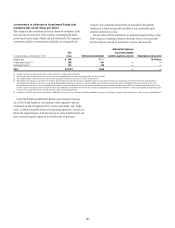

Debt Securities Held-to-Maturity

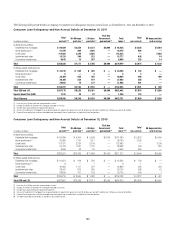

The carrying value and fair value of debt securities held-to-maturity (HTM) at December 31, 2011 and December 31, 2010 were as follows:

In millions of dollars

Amortized

cost (1)

Net unrealized

loss

recognized in

AOCI

Carrying

value (2)

Gross

unrealized

gains

Gross

unrealized

losses

Fair

value

December 31, 2011

Debt securities held-to-maturity

-ORTGAGEBACKEDæSECURITIESæ

0RIME $ 360 $ 73 $ 287 $ 21 $ 20 $ 288

!LT! 4,732 1,404 3,328 20 319 3,029

3UBPRIME 383 47 336 1 71 266

.ON53æRESIDENTIAL 3,487 520 2,967 59 290 2,736

#OMMERCIAL 513 1 512 4 52 464

4OTALæMORTGAGEBACKEDæSECURITIES $ 9,475 $ 2,045 $ 7,430 $ 105 $ 752 $ 6,783

3TATEæANDæMUNICIPAL $ 1,422 $ 95 $ 1,327 $ 68 $ 72 $ 1,323

#ORPORATE 1,862 113 1,749 — 254 1,495

!SSETBACKEDæSECURITIESæ 1,000 23 977 9 87 899

Total debt securities held-to-maturity $ 13,759 $ 2,276 $ 11,483 $ 182 $ 1,165 $ 10,500

December 31, 2010

Debt securities held-to-maturity

-ORTGAGEBACKEDæSECURITIESæ

0RIME

!LT!

3UBPRIME

.ON53æRESIDENTIAL

#OMMERCIAL

4OTALæMORTGAGEBACKEDæSECURITIES

3TATEæANDæMUNICIPAL

#ORPORATE

!SSETBACKEDæSECURITIESæ

Total debt securities held-to-maturity

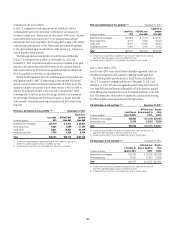

æ &ORæSECURITIESæTRANSFERREDæTOæ(4-æFROMæTrading account assetsæINææAMORTIZEDæCOSTæISæDEFINEDæASæTHEæFAIRæVALUEæOFæTHEæSECURITIESæATæTHEæDATEæOFæTRANSFERæPLUSæANYæACCRETIONæINCOMEæANDæLESSæANYæIMPAIRMENTSæRECOGNIZEDæ

INæEARNINGSæSUBSEQUENTæTOæTRANSFERæ&ORæSECURITIESæTRANSFERREDæTOæ(4-æFROMæ!&3æINææAMORTIZEDæCOSTæISæDEFINEDæASæTHEæORIGINALæPURCHASEæCOSTæPLUSæORæMINUSæANYæACCRETIONæORæAMORTIZATIONæOFæAæPURCHASEæDISCOUNTæORæ

PREMIUMæLESSæANYæIMPAIRMENTæRECOGNIZEDæINæEARNINGS

æ (4-æSECURITIESæAREæCARRIEDæONæTHEæ#ONSOLIDATEDæ"ALANCEæ3HEETæATæAMORTIZEDæCOSTæLESSæANYæUNREALIZEDæGAINSæANDæLOSSESæRECOGNIZEDæINæ!/#)æ4HEæCHANGESæINæTHEæVALUESæOFæTHESEæSECURITIESæAREæNOTæREPORTEDæINæTHEæFINANCIALæ

STATEMENTSæEXCEPTæFORæOTHERTHANTEMPORARYæIMPAIRMENTSæ&ORæ(4-æSECURITIESæONLYæTHEæCREDITæLOSSæCOMPONENTæOFæTHEæIMPAIRMENTæISæRECOGNIZEDæINæEARNINGSæWHILEæTHEæREMAINDERæOFæTHEæIMPAIRMENTæISæRECOGNIZEDæINæ!/#)

ææ 4HEæ#OMPANYæINVESTSæINæMORTGAGEBACKEDæANDæASSETBACKEDæSECURITIESæ4HESEæSECURITIZATIONSæAREæGENERALLYæCONSIDEREDæ6)%Sæ4HEæ#OMPANYSæMAXIMUMæEXPOSUREæTOæLOSSæFROMæTHESEæ6)%SæISæEQUALæTOæTHEæCARRYINGæAMOUNTæ

OFæTHEæSECURITIESæWHICHæISæREFLECTEDæINæTHEæTABLEæABOVEæ&ORæMORTGAGEBACKEDæANDæASSETBACKEDæSECURITIZATIONSæINæWHICHæTHEæ#OMPANYæHASæOTHERæINVOLVEMENTæSEEæ.OTEææTOæTHEæ#ONSOLIDATEDæ&INANCIALæ3TATEMENTS

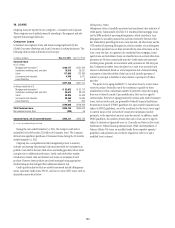

The Company has the positive intent and ability to hold these securities

to maturity absent any unforeseen further significant changes in

circumstances, including deterioration in credit or with regard to regulatory

capital requirements.

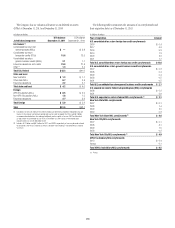

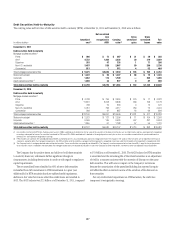

The net unrealized losses classified in AOCI relate to debt securities

reclassified from AFS investments to HTM investments in a prior year.

Additionally, for HTM securities that have suffered credit impairment,

declines in fair value for reasons other than credit losses are recorded in

AOCI. The AOCI balance was $2.3 billion as of December 31, 2011, compared

to $5.0 billion as of December 31, 2010. The AOCI balance for HTM securities

is amortized over the remaining life of the related securities as an adjustment

of yield in a manner consistent with the accretion of discount on the same

debt securities. This will have no impact on the Company’s net income

because the amortization of the unrealized holding loss reported in equity

will offset the effect on interest income of the accretion of the discount on

these securities.

For any credit-related impairment on HTM securities, the credit loss

component is recognized in earnings.