Citibank 2011 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188

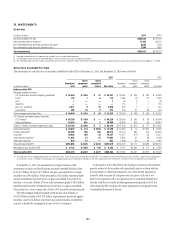

During the first quarter of 2011, the Company determined that it no

longer had the intent to hold $12.7 billion of HTM securities to maturity.

As a result, the Company reclassified $10.0 billion carrying value of

mortgage-backed, other asset-backed, state and municipal, and corporate

debt securities from Investments held-to-maturity to Trading account

assets. The Company also sold an additional $2.7 billion of such HTM

securities, recognizing a corresponding receivable from the unsettled

sales as of March 31, 2011. As a result of these actions, a net pretax loss of

$709 million ($427 million after tax) was recognized in the Consolidated

Statement of Income for the three months ended March 31, 2011, composed

of gross unrealized gains of $311 million included in Other revenue, gross

unrealized losses of $1,387 million included in Other-than-temporary-

impairment losses on investments, and net realized gains of $367 million

included in Realized gains (losses) on sales of investments. Prior to the

reclassification, unrealized losses totalling $1,656 million pretax ($1,012

million after tax) had been reflected in AOCI (see table below) and have now

been reflected in the Consolidated Statement of Income, as detailed above.

Citigroup reclassified and sold the securities as part of its overall efforts to

mitigate its risk-weighted assets (RWA) in order to comply with significant

new regulatory capital requirements which, although not yet implemented

or formally adopted, are nonetheless currently being used to assess the

forecasted capital adequacy of the Company and other large U.S. banking

organizations. These regulatory capital changes, which were largely

unforeseen when the Company initially reclassified the debt securities from

Trading account assets and Investments available-for-sale to Investments

held-to-maturity in the fourth quarter of 2008 (see note 1 to the table below),

include: (i) the U.S. Basel II credit and operational risk capital standards;

(ii) the Basel Committee’s agreed-upon, and the U.S.-proposed, revisions

to the market risk capital rules, which significantly increased the risk

weightings for certain trading book positions; (iii) the Basel Committee’s

substantial issuance of Basel III, which raised the quantity and quality of

required regulatory capital and materially increased RWA for securitization

exposures; and (iv) certain regulatory capital-related provisions in The

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

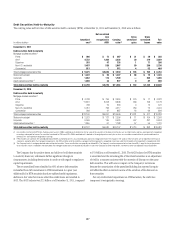

Through December 31, 2011, the Company has sold substantially all of the $12.7 billion of HTM securities that were reclassified to Trading account assets

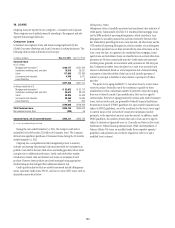

in the first quarter of 2011. The carrying value and fair value of debt securities at the date of reclassification or sale were as follows:

In millions of dollars

Amortized

cost (2)

Net unrealized

loss

recognized in

AOCI

Carrying

value (3)

Gross

gains

Gross

losses

Fair

value

Held-to-maturity debt securities transferred

to Trading account assets or sold (1)

-ORTGAGEBACKEDæSECURITIES

0RIME $ 3,410 $ 528 $ 2,882 $ 131 $ 131 $ 2,882

!LT! 5,357 896 4,461 605 188 4,878

3UBPRIME 240 7 233 5 36 202

.ON53æRESIDENTIAL 317 75 242 76 2 316

#OMMERCIAL 117 18 99 22 — 121

4OTALæMORTGAGEBACKEDæSECURITIES $ 9,441 $ 1,524 $ 7,917 $ 839 $ 357 $ 8,399

3TATEæANDæMUNICIPAL $ 900 $ 8 $ 892 $ 68 $ 7 $ 953

#ORPORATE 3,569 115 3,454 396 41 3,809

!SSETBACKEDæSECURITIES 456 9 447 50 2 495

Total held-to-maturity debt securities transferred

to Trading account assets or sold (1) $ 14,366 $ 1,656 $ 12,710 $ 1,353 $ 407 $13,656

æ $URINGæTHEæFOURTHæQUARTERæOFæææBILLIONæANDææBILLIONæCARRYINGæVALUEæOFæTHESEæDEBTæSECURITIESæWEREæTRANSFERREDæFROMæTrading account assets ANDæInvestmentsæAVAILABLEFORSALEæTOæInvestments HELDTOMATURITYæ

RESPECTIVELYæ4HEæTRANSFERæOFæTHESEæDEBTæSECURITIESæFROMæTrading account assets WASæINæRESPONSEæTOæTHEæSIGNIFICANTæDETERIORATIONæINæMARKETæCONDITIONSæWHICHæWASæESPECIALLYæACUTEæDURINGæTHEæFOURTHæQUARTERæOFæ

æ &ORæSECURITIESæTRANSFERREDæTOæHELDTOMATURITYæFROMæTrading account assets INææAMORTIZEDæCOSTæISæDEFINEDæASæTHEæFAIRæVALUEæAMOUNTæOFæTHEæSECURITIESæATæTHEæDATEæOFæTRANSFERæPLUSæANYæACCRETIONæINCOMEæANDæLESSæANYæ

IMPAIRMENTSæRECOGNIZEDæINæEARNINGSæSUBSEQUENTæTOæTRANSFERæ&ORæSECURITIESæTRANSFERREDæTOæHELDTOMATURITYæFROMæAVAILABLEFORSALEæINææAMORTIZEDæCOSTæISæDEFINEDæASæTHEæORIGINALæPURCHASEæCOSTæPLUSæORæMINUSæANYæ

ACCRETIONæORæAMORTIZATIONæOFæAæPURCHASEæDISCOUNTæORæPREMIUMæLESSæANYæIMPAIRMENTæRECOGNIZEDæINæEARNINGS

æ (ELDTOMATURITYæSECURITIESæAREæCARRIEDæONæTHEæ#ONSOLIDATEDæ"ALANCEæ3HEETæATæAMORTIZEDæCOSTæANDæTHEæCHANGESæINæTHEæVALUEæOFæTHESEæSECURITIESæOTHERæTHANæIMPAIRMENTæCHARGESæAREæNOTæREPORTEDæINæTHEæFINANCIALæSTATEMENTS