Citibank 2011 Annual Report Download - page 286

Download and view the complete annual report

Please find page 286 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.264

normal course of business based on an assessment that the risk of loss is

remote. Often these clauses are intended to ensure that terms of a contract

are met at inception. No compensation is received for these standard

representations and warranties, and it is not possible to determine their fair

value because they rarely, if ever, result in a payment. In many cases, there

are no stated or notional amounts included in the indemnification clauses

and the contingencies potentially triggering the obligation to indemnify

have not occurred and are not expected to occur. These indemnifications

are not included in the tables above.

Value-Transfer Networks

The Company is a member of, or shareholder in, hundreds of value-transfer

networks (VTNs) (payment, clearing and settlement systems as well as

exchanges) around the world. As a condition of membership, many of

these VTNs require that members stand ready to pay a pro rata share of the

losses incurred by the organization due to another member’s default on

its obligations. The Company’s potential obligations may be limited to its

membership interests in the VTNs, contributions to the VTN’s funds, or, in

limited cases, the obligation may be unlimited. The maximum exposure

cannot be estimated as this would require an assessment of future claims that

have not yet occurred. We believe the risk of loss is remote given historical

experience with the VTNs. Accordingly, the Company’s participation

in VTNs is not reported in the Company’s guarantees tables above and

there are no amounts reflected on the Consolidated Balance Sheet as of

December 31, 2011 or December 31, 2010 for potential obligations that could

arise from the Company’s involvement with VTN associations.

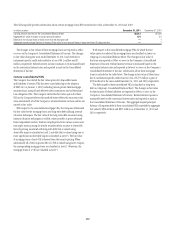

Long-Term Care Insurance Indemnification

In the sale of an insurance subsidiary, the Company provided an

indemnification to an insurance company for policyholder claims and

other liabilities relating to a book of long-term care (LTC) business (for the

entire term of the LTC policies) that is fully reinsured by another insurance

company. The reinsurer has funded two trusts with securities whose fair

value (approximately $4.4 billion at December 31, 2011 and $3.6 billion at

December 31, 2010) is designed to cover the insurance company’s statutory

liabilities for the LTC policies. The assets in these trusts are evaluated and

adjusted periodically to ensure that the fair value of the assets continues to

cover the estimated statutory liabilities related to the LTC policies, as those

statutory liabilities change over time. If the reinsurer fails to perform under

the reinsurance agreement for any reason, including insolvency, and the

assets in the two trusts are insufficient or unavailable to the ceding insurance

company, then Citigroup must indemnify the ceding insurance company for

any losses actually incurred in connection with the LTC policies. Since both

events would have to occur before Citi would become responsible for any

payment to the ceding insurance company pursuant to its indemnification

obligation and the likelihood of such events occurring is currently not

probable, there is no liability reflected in the Consolidated Balance Sheet as of

December 31, 2011 related to this indemnification. However, Citi continues to

closely monitor its potential exposure under this indemnification obligation.

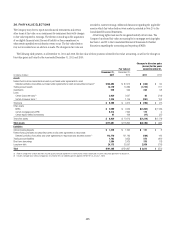

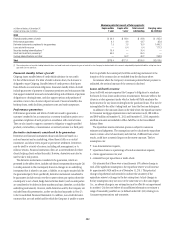

Carrying Value—Guarantees and Indemnifications

At December 31, 2011 and December 31, 2010, the total carrying amounts

of the liabilities related to the guarantees and indemnifications included in

the tables above amounted to approximately $3.2 billion and $2.1 billion,

respectively. The carrying value of derivative instruments is included in

either Trading liabilities or Other liabilities, depending upon whether

the derivative was entered into for trading or non-trading purposes. The

carrying value of financial and performance guarantees is included in

Other liabilities. For loans sold with recourse, the carrying value of the

liability is included in Other liabilities. In addition, at December 31, 2011

and December 31, 2010, Other liabilities on the Consolidated Balance Sheet

include an allowance for credit losses of $1,136 million and $1,066 million,

respectively, relating to letters of credit and unfunded lending commitments.

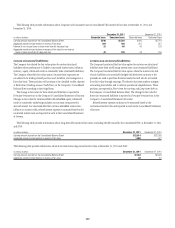

Collateral

Cash collateral available to the Company to reimburse losses realized

under these guarantees and indemnifications amounted to $35 billion at

December 31, 2011 and December 31, 2010. Securities and other marketable

assets held as collateral amounted to $65 billion and $41 billion at

December 31, 2011 and December 31, 2010, respectively, the majority of

which collateral is held to reimburse losses realized under securities lending

indemnifications. Additionally, letters of credit in favor of the Company held

as collateral amounted to $1.5 billion and $2.0 billion at December 31, 2011

and December 31, 2010, respectively. Other property may also be available to

the Company to cover losses under certain guarantees and indemnifications;

however, the value of such property has not been determined.

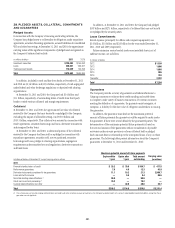

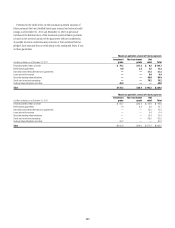

Performance risk

Citi evaluates the performance risk of its guarantees based on the assigned

referenced counterparty internal or external ratings. Where external ratings

are used, investment-grade ratings are considered to be Baa/BBB and above,

while anything below is considered non-investment grade. The Citi internal

ratings are in line with the related external rating system. On certain

underlying referenced credits or entities, ratings are not available. Such

referenced credits are included in the “not rated” category. The maximum

potential amount of the future payments related to guarantees and credit

derivatives sold is determined to be the notional amount of these contracts,

which is the par amount of the assets guaranteed.