Citibank 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

Since none of the Company’s reporting units are publicly traded,

individual reporting unit fair value determinations cannot be directly

correlated to Citigroup’s stock price. The sum of the fair values of the

reporting units at July 1, 2011 exceeded the overall market capitalization

of Citi as of July 1, 2011. However, Citi believes that it was not meaningful

to reconcile the sum of the fair values of its reporting units to its market

capitalization during the 2011 annual impairment test due to the fact

that Citi’s market capitalization reflects the execution risk in a transaction

involving Citigroup due to its size. The individual reporting units’ fair values

are not subject to the same level of execution risk or a business model that is

perceived to be complex.

See also Note 18 to the Consolidated Financial Statements.

Income Taxes

Citi is subject to the income tax laws of the U.S., its states and local

municipalities and the foreign jurisdictions in which Citi operates. These

tax laws are complex and are subject to differing interpretations by the

taxpayer and the relevant governmental taxing authorities. Disputes over

interpretations of the tax laws may be subject to review and adjudication by

the court systems of the various tax jurisdictions or may be settled with the

taxing authority upon audit.

In establishing a provision for income tax expense, Citi must make

judgments and interpretations about the application of these inherently

complex tax laws. Citi must also make estimates about when in the future

certain items will affect taxable income in the various tax jurisdictions, both

domestic and foreign. Deferred taxes are recorded for the future consequences

of events that have been recognized in the financial statements or tax

returns, based upon enacted tax laws and rates. Deferred tax assets (DTAs)

are recognized subject to management’s judgment that realization is more

likely than not.

At December 31, 2011, Citi had recorded net DTAs of approximately

$51.5 billion, a decrease of $0.6 billion from $52.1 billion at December 31, 2010.

Although realization is not assured, Citi believes that the realization of the

recognized net DTA of $51.5 billion at December 31, 2011 is more likely than

not based upon expectations as to future taxable income in the jurisdictions

in which the DTAs arise and based on available tax planning strategies (as

defined in ASC 740, Income Taxes) that would be implemented, if necessary,

to prevent a carryforward from expiring.

In general, Citi would need to generate approximately $111 billion of

taxable income during the respective carryforward periods (discussed below)

to fully realize its U.S. federal, state and local DTAs. Citi’s net DTAs will

decline primarily as additional domestic GAAP taxable income is generated.

As of December 31, 2011, Citi was no longer in a three-year cumulative

loss position for purposes of evaluating its DTAs. While this removes a

significant piece of negative evidence in evaluating the need for a valuation

allowance, Citi will continue to weigh the evidence supporting its DTAs. Citi

has concluded that there are two pieces of positive evidence that support the

full realizability of its DTAs. First, Citi forecasts sufficient taxable income in

the carryforward period, exclusive of tax planning strategies. Second, Citi has

sufficient tax planning strategies, including potential sales of assets, in which

it could realize the excess of appreciated value over the tax basis of its assets.

The amount of the DTAs considered realizable, however, is necessarily subject

to Citi’s estimates of future taxable income in the jurisdictions in which it

operates during the respective carry-forward periods, which is in turn subject

to overall market and global economic conditions.

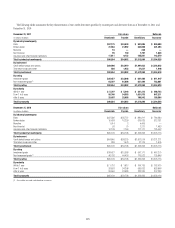

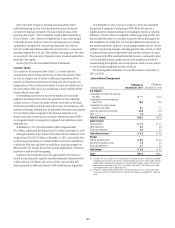

The following table summarizes Citi’s net DTAs balance at December 31,

2011 and 2010:

Jurisdiction/Component

In billions of dollars

DTA balance

December 31, 2011

$4!æBALANCE

$ECEMBERææ

U.S. federal (1)

#ONSOLIDATEDæTAXæRETURNæNETæOPERATINGæ

LOSSæ./, $—

#ONSOLIDATEDæTAXæRETURNæFOREIGNæTAXææ

CREDITæ&4# 15.8

#ONSOLIDATEDæTAXæRETURNæGENERALæ

BUSINESSæCREDITæ'"# 2.1

&UTUREæTAXæDEDUCTIONSæANDæCREDITS 23.0

/THERæ 1.4

Total U.S. federal $42.3

State and local

.EWæ9ORKæ./,S $ 1.3

/THERæSTATEæ./,S 0.7

&UTUREæTAXæDEDUCTIONS 2.2

Total state and local $ 4.2

Foreign

!0"ææSUBSIDIARYæ./,S $ 0.5

.ON!0"ææSUBSIDIARYæ./,S 1.8

&UTUREæTAXæDEDUCTIONS 2.7

Total foreign $ 5.0

Total $51.5

æ )NCLUDEDæINæTHEæNETæ53æFEDERALæ$4!SæOFææBILLIONæATæ$ECEMBERæææAREæDEFERREDæTAXæLIABILITIESæ

OFææBILLIONæTHATæWILLæREVERSEæINæTHEæRELEVANTæCARRYFORWARDæPERIODæANDæMAYæBEæUSEDæTOæSUPPORTæTHEæ$4!Sæ

ANDææBILLIONæINæCOMPENSATIONæDEDUCTIONSæTHATæREDUCEDæADDITIONALæPAIDINæCAPITALæINæ*ANUARYææ

ANDæFORæWHICHæNOæADJUSTMENTæTOæSUCHæ$4!SæISæPERMITTEDæATæ$ECEMBERæææBECAUSEæTHEæRELATEDæ

STOCKæCOMPENSATIONæWASæNOTæYETæDEDUCTIBLEæTOæ#ITI

æ )NCLUDESææBILLIONæANDææBILLIONæFORææANDææRESPECTIVELYæOFæTAXæCARRYFORWARDSæRELATEDæ

TOæCOMPANIESæTHATæFILEæ53æFEDERALæTAXæRETURNSæSEPARATEæFROMæ#ITIGROUPSæCONSOLIDATEDæ53æFEDERALæTAXæ

RETURN