Citibank 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

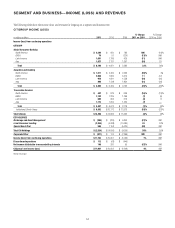

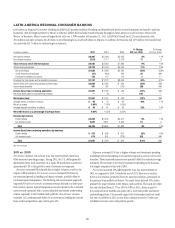

LATIN AMERICA REGIONAL CONSUMER BANKING

Latin America Regional Consumer Banking (LATAM RCB) provides traditional banking and branded card services to retail customers and small to mid-size

businesses, with the largest presence in Mexico and Brazil. LATAM RCB includes branch networks throughout Latin America as well as Banco Nacional de

Mexico, or Banamex, Mexico’s second-largest bank, with over 1,700 branches. At December 31, 2011, LATAM RCB overall had 2,221 retail branches, with

29.2 million customer accounts, $24.0 billion in retail banking loans and $44.8 billion in deposits. In addition, the business had 12.9 million Citi-branded card

accounts with $13.7 billion in outstanding loan balances.

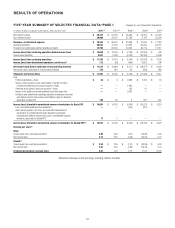

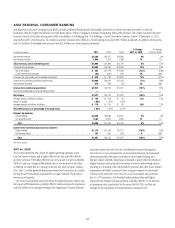

In millions of dollars 2011

% Change

2011 vs. 2010

æ#HANGEæ

æVSæ

.ETæINTERESTæREVENUE $ 6,465 8%

.ONINTERESTæREVENUE 3,018 11

Total revenues, net of interest expense $ 9,483 9%

4OTALæOPERATINGæEXPENSES $ 5,734 11%

.ETæCREDITæLOSSES $ 1,684 (10)%

#REDITæRESERVEæBUILDæRELEASE (67) 92 .-

0ROVISIONæFORæBENEFITSæANDæCLAIMS 130 2

0ROVISIONSæFORæLOANæLOSSESæANDæFORæBENEFITSæANDæCLAIMS $ 1,747 49%

)NCOMEæLOSSæFROMæCONTINUINGæOPERATIONSæBEFOREæTAXES $ 2,002 (15)% .-

)NCOMEæTAXESæBENEFITS 401 (29) .-

Income (loss) from continuing operations $ 1,601 (11)% .-

.ETæLOSSæATTRIBUTABLEæTOæNONCONTROLLINGæINTERESTS — 100

Net income (loss) $ 1,601 (11)% .-

!VERAGEæASSETSæ(in billions of dollars) $80 10%

2ETURNæONæASSETS 2.00%

!VERAGEæDEPOSITS (in billions of dollars) $46 12%

Net credit losses as a percentage of average loans 4.64%

Revenue by business

2ETAILæBANKING $ 5,482 9%

#ITIBRANDEDæCARDS 4,001 10

Total $ 9,483 9%

Income (loss) from continuing operations by business

2ETAILæBANKING $ 923 (2)%

#ITIBRANDEDæCARDS 678 (20) .-

Total $ 1,601 (11)% .-

.-æ .OTæMEANINGFUL

2011 vs. 2010

Net income declined 11% as lower loan loss reserve releases more than

offset increased operating margin. During 2011, the U.S. dollar generally

depreciated versus local currencies. As a result, FX translation contributed

approximately 2% to the growth in each of revenues and expenses.

Revenues increased 9% primarily due to higher volumes as well as the

impact of FX translation. Net interest revenue increased 8% driven by

the continued growth in lending and deposit volumes, partially offset by

continued spread compression. The declining rate environment negatively

impacted Net interest revenue as interest revenue declined at a faster pace

than interest expense. Spread compression was also driven by the continued

move towards customers with a lower risk profile and stricter underwriting

criteria, especially in the branded cards portfolio. Non-interest revenue

increased 11%, predominantly driven by an increase in banking fee income

from credit card purchase sales, which grew 22%.

Expenses increased 11% due to higher volumes and investment spending,

including increased marketing and customer acquisition costs as well as new

branches. These increased expenses were partially offset by continued savings

initiatives. The increase in the level of investment spending in the business

was largely completed at the end of 2011.

Provisions increased 49% reflecting lower loan loss reserve releases in

2011 as compared to 2010. Towards the end of 2011, there was a build in

the loan loss reserves, primarily driven by increased volumes, particularly in

the personal loan portfolio in Mexico. Net credit losses declined 10%, driven

primarily by improvements in the Mexico cards portfolio. The cards net credit

loss ratio declined from 11.7% in 2010 to 8.8% in 2011, driven in part by

the continued move towards customers with a lower risk profile and stricter

underwriting criteria. Citi currently expects the Citi-branded cards net credit

loss ratio to stabilize in 2012 as new loans continue to season. Credit costs

will likely increase in line with portfolio growth.