Citibank 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

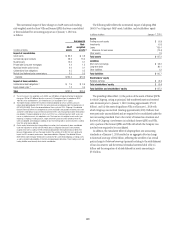

149

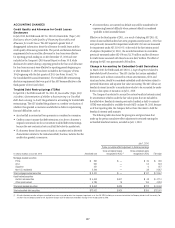

The incremental impact of these changes on GAAP assets and resulting

risk-weighted assets for those VIEs and former QSPEs that were consolidated

or deconsolidated for accounting purposes as of January 1, 2010 was

as follows:

æIncremental

In billions of dollars

GAAP

assets

Risk-

weighted

assets

(1)

Impact of consolidation

#REDITæCARDS

#OMMERCIALæPAPERæCONDUITS

3TUDENTæLOANS

0RIVATEæLABELæ#ONSUMERæMORTGAGES

-UNICIPALæTENDERæOPTIONæBONDS

#OLLATERALIZEDæLOANæOBLIGATIONS

-UTUALæFUNDæDEFERREDæSALESæCOMMISSIONS

3UBTOTAL

Impact of deconsolidation

#OLLATERALIZEDæDEBTæOBLIGATIONSæ

%QUITYLINKEDæNOTESæ

Total

æ 4HEæNETæINCREASEæINæRISKWEIGHTEDæASSETSæ27!æWASææBILLIONæPRINCIPALLYæREFLECTINGæTHEæDEDUCTIONæ

FROMæGROSSæ27!æOFææBILLIONæOFæLOANæLOSSæRESERVESæ,,2æRECOGNIZEDæFROMæTHEæADOPTIONæOFæ3&!3æ

æWHICHæEXCEEDEDæTHEææLIMITATIONæONæ,,2SæINCLUDABLEæINæ4IERææ#APITAL

æ 4HEæIMPLEMENTATIONæOFæ3&!3ææRESULTEDæINæTHEæDECONSOLIDATIONæOFæCERTAINæSYNTHETICæANDæCASHæ

COLLATERALIZEDæDEBTæOBLIGATIONæ#$/æ6)%SæTHATæWEREæPREVIOUSLYæCONSOLIDATEDæUNDERæTHEæREQUIREMENTSæOFæ

!3#ææ&).æ2æ$UEæTOæTHEæDECONSOLIDATIONæOFæTHESEæSYNTHETICæ#$/Sæ#ITIGROUPSæ#ONSOLIDATEDæ

"ALANCEæ3HEETæNOWæREFLECTSæTHEæRECOGNITIONæOFæCURRENTæRECEIVABLESæANDæPAYABLESæRELATEDæTOæPURCHASEDæ

ANDæWRITTENæCREDITæDEFAULTæSWAPSæENTEREDæINTOæWITHæTHESEæ6)%SæWHICHæHADæPREVIOUSLYæBEENæELIMINATEDæINæ

CONSOLIDATIONæ4HEæDECONSOLIDATIONæOFæCERTAINæCASHæ#$/SæHASæAæMINIMALæIMPACTæONæ'!!0æASSETSæBUTæ

CAUSESæAæSIZABLEæINCREASEæINæRISKWEIGHTEDæASSETSæ4HEæIMPACTæONæRISKWEIGHTEDæASSETSæRESULTSæFROMæ

REPLACINGæINæ#ITIGROUPSæTRADINGæACCOUNTæLARGELYæINVESTMENTæGRADEæSECURITIESæOWNEDæBYæTHESEæ6)%Sæ

WHENæCONSOLIDATEDæWITHæ#ITIGROUPSæHOLDINGSæOFæNONINVESTMENTæGRADEæORæUNRATEDæSECURITIESæISSUEDæBYæ

THESEæ6)%SæWHENæDECONSOLIDATED

æ #ERTAINæEQUITYLINKEDæNOTEæCLIENTæINTERMEDIATIONæTRANSACTIONSæTHATæHADæPREVIOUSLYæBEENæCONSOLIDATEDæ

UNDERæTHEæREQUIREMENTSæOFæ!3#ææ&).ææ2æBECAUSEæ#ITIGROUPæHADæREPURCHASEDæANDæHELDæAæ

MAJORITYæOFæTHEæNOTESæISSUEDæBYæTHEæ6)%æWEREæDECONSOLIDATEDæWITHæTHEæIMPLEMENTATIONæOFæ3&!3ææ

BECAUSEæ#ITIGROUPæDOESæNOTæHAVEæTHEæPOWERæTOæDIRECTæTHEæACTIVITIESæOFæTHEæ6)%æTHATæMOSTæSIGNIFICANTLYæ

IMPACTæTHEæ6)%SæECONOMICæPERFORMANCEæ5PONæDECONSOLIDATIONæ#ITIGROUPSæ#ONSOLIDATEDæ"ALANCEæ

3HEETæREFLECTSæBOTHæTHEæEQUITYLINKEDæNOTESæISSUEDæBYæTHEæ6)%SæANDæHELDæBYæ#ITIGROUPæASæTRADINGæASSETSæ

ASæWELLæASæRELATEDæTRADINGæLIABILITIESæINæTHEæFORMæOFæPREPAIDæEQUITYæDERIVATIVESæ4HESEæTRADINGæASSETSæANDæ

TRADINGæLIABILITIESæWEREæFORMERLYæELIMINATEDæINæCONSOLIDATION

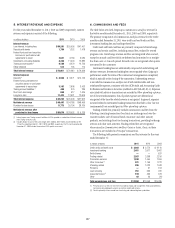

The following table reflects the incremental impact of adopting SFAS

166/167 on Citigroup’s GAAP assets, liabilities, and stockholders’ equity.

In billions of dollars *ANUARYææ

Assets

4RADINGæACCOUNTæASSETS

)NVESTMENTS

,OANS

!LLOWANCEæFORæLOANæLOSSES

/THERæASSETS

Total assets

Liabilities

3HORTTERMæBORROWINGS

,ONGTERMæDEBT

/THERæLIABILITIES

Total liabilities

Stockholders’ equity

2ETAINEDæEARNINGS

Total stockholders’ equity

Total liabilities and stockholders’ equity

The preceding tables reflect: (i) the portion of the assets of former QSPEs

to which Citigroup, acting as principal, had transferred assets and received

sales treatment prior to January 1, 2010 (totaling approximately $712.0

billion), and (ii) the assets of significant VIEs as of January 1, 2010 with

which Citigroup was involved (totaling approximately $219.2 billion) that

were previously unconsolidated and are required to be consolidated under the

new accounting standards. Due to the variety of transaction structures and

the level of Citigroup’s involvement in individual former QSPEs and VIEs,

only a portion of the former QSPEs and VIEs with which the Company was

involved were required to be consolidated.

In addition, the cumulative effect of adopting these new accounting

standards as of January 1, 2010 resulted in an aggregate after-tax charge

to Retained earnings of $8.4 billion, reflecting the net effect of an overall

pretax charge to Retained earnings (primarily relating to the establishment

of loan loss reserves and the reversal of residual interests held) of $13.4

billion and the recognition of related deferred tax assets amounting to

$5.0 billion.