Citibank 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.108

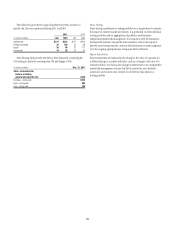

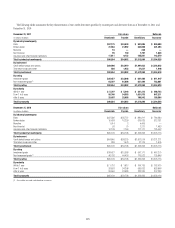

GIIPS

Gross funded credit exposure to the sovereign entities of Greece, Ireland,

Italy, Portugal and Spain (GIIPS), as well as financial institutions and

multinational and local corporations designated in these countries under

Citi’s risk management systems, was $20.2 billion at December 31, 2011. The

$20.2 billion of gross credit exposure was made up of $9.4 billion in funded

loans, before reserves, and $10.8 billion in derivative counterparty mark-to-

market exposure, inclusive of credit valuation adjustments. The derivative

counterparty mark-to-market exposure includes the net credit exposure

arising from secured financing transactions, such as repurchase and reverse

repurchase agreements. See “Secured Financing Transactions” below.

As of December 31, 2011, Citi’s net current funded exposure to the GIIPS

sovereigns, financial institutions and corporations was $7.7 billion. Included

in the $7.7 billion net current funded exposure was $1.3 billion of net trading

and available-for-sale securities exposure, and $6.4 billion of net current

funded credit exposure. Each component is described below in more detail.

Net Trading and AFS Exposure - $1.3 billion

Included in the net current funded exposure at December 31, 2011 was

a net position of $1.3 billion in securities and derivatives with the GIIPS

sovereigns, financial institutions and corporations as the issuer or reference

entity, which are held in Citi’s trading and AFS portfolios. These portfolios are

marked to market daily and, as previously disclosed, Citi’s trading exposure

levels vary as it maintains inventory consistent with customer needs.

Net Current Funded Credit Exposure - $6.4 billion

As of December 31, 2011, the net current funded credit exposure to the

GIIPS sovereigns, financial institutions and corporations was $6.4 billion.

Exposures were $0.7 billion to sovereigns, $1.6 billion to financial

institutions and $4.1 billion to corporations.

Consistent with Citi’s internal risk management measures and as set forth

in the table above, net current funded credit exposure has been reduced by

$4. billion of margin posted under legally enforceable margin agreements

and collateral pledged under bankruptcy-remote structures. At December 31,

2011, the majority of this margin and collateral was in the form of cash, with

the remainder in predominantly non-GIIPS, non-French securities, which

are included at fair value.

Net current funded credit exposure also reflects a reduction for $9.6 billion

in purchased credit protection, predominantly from financial institutions

outside the GIIPS and France. Such protection generally pays out only

upon the occurrence of certain credit events with respect to the country or

borrower covered by the protection, as determined by a committee composed

of dealers and other market participants. In addition to counterparty credit

risks (see “Credit Default Swaps” below), the credit protection may not fully

cover all situations that may adversely affect the value of Citi’s exposure

and, accordingly, Citi could still experience losses despite the existence of the

credit protection.

Unfunded Commitments—$7.3 billion

As of December 31, 2011, Citi also had $7.3 billion of unfunded

commitments to the GIIPS sovereigns, financial institutions and

corporations, with $6.7 billion of this amount to corporations. These

unfunded lines generally have standard conditions that must be met before

they can be drawn.

Other Activities

Like other banks, Citi also provides settlement and clearing facilities for

a variety of clients in these countries and actively monitors and manages

these intra-day exposures. In addition, at December 31, 2011, Citi had

approximately $7.4 billion of locally funded exposure in the GIIPS, generally

to retail customers and small businesses as part of its local lending activities.

The vast majority of this exposure is in Citi Holdings (Spain and Greece).

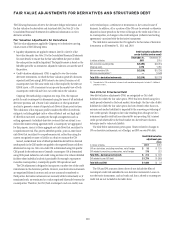

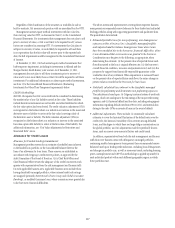

France

Gross funded credit exposure to the French sovereign, financial institutions

and corporations was $11.7 billion at December 31, 2011. The $11.7 billion

of gross credit exposure was made up of $4.7 billion in funded loans,

before reserves, and $7.0 billion in derivative counterparty mark-to-

market exposure, inclusive of credit valuation adjustments. The derivative

counterparty mark-to-market exposure includes the net credit exposure

arising from secured financing transactions, such as repurchase and reverse

repurchase agreements. See “Secured Financing Transactions” below.

As of December 31, 2011, Citi’s net current funded exposure to the French

sovereign, financial institutions and corporations was $1.9 billion. Included

in the $1.9 billion net current funded exposure was $0.6 billion of net trading

and available-for-sale securities exposure, and $1.3 billion of net current

funded credit exposure. Each component is described below in more detail.

Net Trading and AFS Exposure - $0.6 billion

Included in the net current funded exposure at December 31, 2011 was a

net position of $0.6 billion in securities and derivatives with the French

sovereign, financial institutions and corporations as the issuer or reference

entity, which are held in Citi’s trading and AFS portfolios. These portfolios are

marked to market daily and, as previously disclosed, Citi’s trading exposure

levels vary as it maintains inventory consistent with customer needs.

Net Current Funded Credit Exposure - $1.3 billion

As of December 31, 2011, the net current funded credit exposure to the French

sovereign, financial institutions and corporations was $1.3 billion. Exposures

were $1.9 billion to financial institutions and $(0.6) billion to corporations.

Consistent with Citi’s internal risk management measures and as set

forth in the table above, net current funded credit exposure has been

reduced by $5.3 billion of margin posted under legally enforceable margin

agreements and collateral pledged under bankruptcy-remote structures. As

of December 31, 2011, the majority of this margin and collateral was in the

form of cash, with the remainder in non-GIIPS, non-French securities, which

are included at fair value.

2