Citibank 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.118

This evaluation process is subject to numerous estimates and judgments.

The frequency of default, risk ratings, loss recovery rates, the size and

diversity of individual large credits, and the ability of borrowers with foreign

currency obligations to obtain the foreign currency necessary for orderly debt

servicing, among other things, are all taken into account during this review.

Changes in these estimates could have a direct impact on Citi’s credit costs

in any quarter and could result in a change in the allowance. Changes to the

allowance are recorded in the Provision for loan losses.

Allowance for Unfunded Lending Commitments

A similar approach to the allowance for loan losses is used for calculating

a reserve for the expected losses related to unfunded loan commitments

and standby letters of credit. This reserve is classified on the Consolidated

Balance Sheet in Other liabilities. Changes to the allowance for unfunded

lending commitments are recorded in the Provision for unfunded lending

commitments.

For a further description of the loan loss reserve and related accounts, see

Notes 1 and 17 to the Consolidated Financial Statements.

Securitizations

Citigroup securitizes a number of different asset classes as a means of

strengthening its balance sheet and accessing competitive financing rates in

the market. Under these securitization programs, assets are transferred into

a trust and used as collateral by the trust to obtain financing. The cash flows

from assets in the trust service the corresponding trust liabilities and equity

interests. If the structure of the trust meets certain accounting guidelines,

trust assets are treated as sold and are no longer reflected as assets of Citi.

If these guidelines are not met, the assets continue to be recorded as Citi’s

assets, with the financing activity recorded as liabilities on Citi’s Consolidated

Balance Sheet.

Citigroup also assists its clients in securitizing their financial assets and

packages and securitizes financial assets purchased in the financial markets.

Citi may also provide administrative, asset management, underwriting,

liquidity facilities and/or other services to the resulting securitization entities

and may continue to service some of these financial assets.

Elimination of Qualifying Special Purpose Entities (QSPEs) and Changes

in the Consolidation Model for VIEs

In June 2009, the FASB issued SFAS No. 166, Accounting for Transfers

of Financial Assets, an amendment of FASB Statement No. 140

(SFAS 166, now incorporated into ASC Topic 860) and SFAS No. 167,

Amendments to FASB Interpretation No. 46(R) (SFAS 167, now

incorporated into ASC Topic 810). Citigroup adopted both standards on

January 1, 2010 and elected to apply SFAS 166 and SFAS 167 prospectively.

Accordingly, prior periods have not been restated.

SFAS 166 eliminated the concept of QSPEs from U.S. GAAP and amends

the guidance on accounting for transfers of financial assets. SFAS 167 details

three key changes to the consolidation model. First, former QSPEs are

now included in the scope of SFAS 167. Second, the FASB has changed the

method of analyzing which party to a variable interest entity (VIE) should

consolidate the VIE (known as the primary beneficiary) to a qualitative

determination of which party to the VIE has “power,” combined with

potentially significant benefits or losses, instead of the previous quantitative

risks and rewards model. The party that has “power” has the ability to direct

the activities of the VIE that most significantly impact the VIE’s economic

performance. Third, the new standard requires that the primary beneficiary

analysis be re-evaluated whenever circumstances change. The previous rules

required reconsideration of the primary beneficiary only when specified

reconsideration events occurred.

As a result of implementing these new accounting standards, Citigroup

consolidated certain of the VIEs and former QSPEs with which it had

involvement on January 1, 2010. Further, certain asset transfers, including

transfers of portions of assets, that would have been considered sales under

SFAS 140 are considered secured borrowings under the new standards.

Citigroup consolidated all required VIEs and former QSPEs, as of January 1,

2010, at carrying values or unpaid principal amounts, except for certain

private-label residential mortgage and mutual fund deferred sales

commissions VIEs, for which the fair value option was elected.

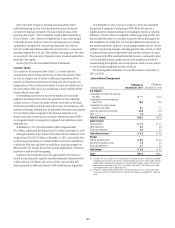

The incremental impact of these changes on GAAP assets and resulting

risk-weighted assets for those VIEs and former QSPEs that were consolidated or

deconsolidated for accounting purposes as of January 1, 2010 was an increase

in GAAP assets of $137.3 billion and $24.0 billion in risk-weighted assets. In

addition, the cumulative effect of adopting these new accounting standards

as of January 1, 2010 resulted in an aggregate after-tax charge to Retained

earnings of $8.4 billion, reflecting the net effect of an overall pretax charge

to Retained earnings (primarily relating to the establishment of loan loss

reserves and the reversal of residual interests held) of $13.4 billion and the

recognition of related deferred tax assets amounting to $5.0 billion.

Non-Consolidation of Certain Investment Funds

The FASB issued Accounting Standards Update No. 2010-10, Consolidation

(Topic 810), Amendments for Certain Investment Funds (ASU

2010-10) in the first quarter of 2010. ASU 2010-10 provides a deferral of

the requirements of SFAS 167 for certain investment funds. Citigroup has

determined that a majority of the investment vehicles managed by it are

provided a deferral from the requirements of SFAS 167 as they meet these

criteria. These vehicles continue to be evaluated under the requirements of

FIN 46(R) (ASC 810-10), prior to the implementation of SFAS 167.