Citibank 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

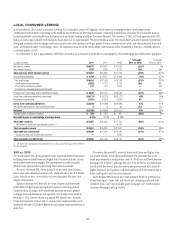

LOCAL CONSUMER LENDING

As of December 31, 2011, Local Consumer Lending (LCL) included a portion of Citigroup’s North America mortgage business, retail partner cards,

CitiFinancial North America (consisting of the OneMain and CitiFinancial Servicing businesses), remaining student loans, and other local Consumer finance

businesses globally (including Western European cards and retail banking and Japan Consumer Finance). At December 31, 2011, LCL had approximately $201

billion of assets (approximately $186 billion in North America) or approximately 75% of Citi Holdings assets. The North America assets consisted of residential

mortgages (residential first mortgages and home equity loans), retail partner card loans, personal loans, commercial real estate, and other consumer loans and

assets. As referenced under “Citi Holdings” above, the substantial majority of the retail partner cards business will be transferred to Citicorp—NA RCB, effective

in the first quarter of 2012.

As of December 31, 2011, approximately $108 billion of assets in LCL consisted of North America mortgages in Citi’s CitiMortgage and CitiFinancial operations.

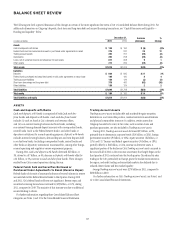

In millions of dollars 2011

% Change

2011 vs. 2010

æ#HANGEæ

æVSæ

.ETæINTERESTæREVENUE $10,872 (21)%

.ONINTERESTæREVENUE 1,195 (40)

Total revenues, net of interest expense $12,067 (24)%

4OTALæOPERATINGæEXPENSES $ 7,769 (4)%

.ETæCREDITæLOSSES $10,659 (37)%

#REDITæRESERVEæBUILDæRELEASE (2,862) (62) .-

0ROVISIONæFORæBENEFITSæANDæCLAIMS 772 —

0ROVISIONæFORæUNFUNDEDæLENDINGæCOMMITMENTS — —

0ROVISIONSæFORæCREDITæLOSSESæANDæFORæBENEFITSæANDæCLAIMS $ 8,569 (47)%

,OSSæFROMæCONTINUINGæOPERATIONSæBEFOREæTAXES $ (4,271) 48%

"ENEFITSæFORæINCOMEæTAXES (1,437) 56

(Loss) from continuing operations $ (2,834) 43%

.ETæINCOMEæATTRIBUTABLEæTOæNONCONTROLLINGæINTERESTS 2 (75)

Net (loss) $ (2,836) 43%

!VERAGEæASSETSæ(in billions of dollars) $ 228 (30)%

Net credit losses as a percentage of average loans 5.34%

Total GAAP revenues $12,067 (24)%

æ.ETæIMPACTæOFæCREDITæCARDæSECURITIZATIONSæACTIVITYæ —

Total managed revenues $12,067 (24)%

Total GAAP net credit losses $10,659 (37)%

æ)MPACTæOFæCREDITæCARDæSECURITIZATIONSæACTIVITYæ —

Total managed net credit losses $10,659 (37)%

ææ 3EEæ.OTEææTOæTHEæ#ONSOLIDATEDæ&INANCIALæ3TATEMENTSæFORæAæDISCUSSIONæOFæTHEæIMPACTæOFæ3&!3æ

.-æ .OTæMEANINGFUL

2011 vs. 2010

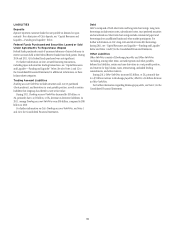

Net loss decreased 43%, driven primarily by the improving credit environment,

including lower net credit losses and higher loan loss reserve releases, in both

retail partner cards and mortgages. The improvement in credit was partly

offset by lower revenues due to decreasing asset balances and sales.

Revenues decreased 24%, driven primarily by the lower asset balances

due to asset sales, divestitures and run-offs, which also drove the 21% decline

in Net interest revenue. Non-interest revenue decreased 40% due to the

impact of divestitures.

Expenses decreased 4%, driven by the lower volumes and divestitures,

partly offset by higher legal and regulatory expenses, including without

limitation those relating to the United States and state attorneys general

mortgage servicing discussions and agreement in principle announced on

February 9, 2012, reserves related to potential PPI refunds (see “Payment

Protection Insurance” below) and, to a lesser extent, implementation costs

associated with the OCC/Federal Reserve Board consent orders entered into in

April 2011.

Provisions decreased 47%, driven by lower credit losses and higher loan

loss reserve releases. Net credit losses decreased 37%, primarily due to the

credit improvements in retail partner cards ($3.0 billion) and North America

mortgages ($1.6 billion), although the pace of the decline in net credit losses

in both portfolios slowed. Loan loss reserve releases increased 62%, driven by

higher releases in retail partner cards and CitiFinancial North America due to

better credit quality and lower loan balances.

Assets declined 20% from the prior year, primarily driven by portfolio run-

off and the impact of asset sales and divestitures, including continued sales

of student loans, auto loans and delinquent mortgages (see “North America

Consumer Mortgage Lending” below).