Citibank 2011 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164

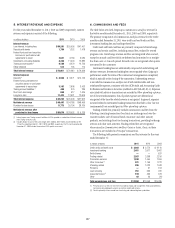

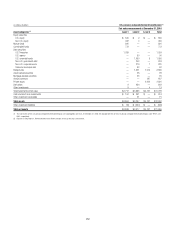

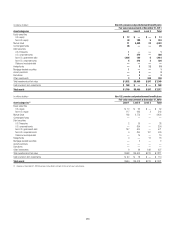

Fair Value Assumptions

Valuation and related assumption information for Citigroup option programs

is presented below. Citigroup uses a lattice-type model to value stock options.

For options granted during 2011

Weighted-average per-share fair

value, at December 31 $ 13.90

Weighted-average expected life

/RIGINALæGRANTS 4.95 yrs. æYRS æYRS

Valuation assumptions

%XPECTEDæVOLATILITY 35.64%

2ISKFREEæINTERESTæRATE 2.33%

%XPECTEDæDIVIDENDæYIELD 0.00%

Expected annual forfeitures

/RIGINALæANDæRELOADæGRANTS 9.62%

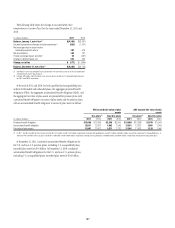

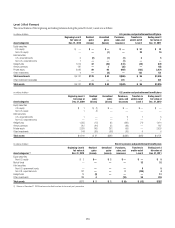

Profit Sharing Plan

In October 2010, the Committee approved awards under the 2010 Key

Employee Profit Sharing Plan (KEPSP) which may entitle participants to

profit-sharing payments based on an initial performance measurement

period of January 1, 2010 through December 31, 2012. Generally, if a

participant remains employed and all other conditions to vesting and

payment are satisfied, the participant will be entitled to an initial payment

in 2013, as well as a holdback payment in 2014 that may be reduced

based on performance during the subsequent holdback period (generally,

January 1, 2013 through December 31, 2013). If the vesting and performance

conditions are satisfied, a participant’s initial payment will equal two-thirds

of the product of the cumulative pretax income of Citicorp (as defined in the

KEPSP) for the initial performance period and the participant’s applicable

percentage. The initial payment will be paid after January 20, 2013, but no

later than March 15, 2013.

The participant’s holdback payment, if any, will equal the product

of (a) the lesser of cumulative pretax income of Citicorp for the initial

performance period and cumulative pretax income of Citicorp for the initial

performance period and the holdback period combined (generally, January

1, 2010 through December 31, 2013), and (b) the participant’s applicable

percentage, less the initial payment; provided that the holdback payment

may not be less than zero. The holdback payment, if any, will be paid after

January 20, 2014, but no later than March 15, 2014. The holdback payment,

if any, will be credited with notional interest during the holdback period. It is

intended that the initial payment and holdback payment will be paid in cash;

however, awards may be paid in Citi common stock if required by regulatory

authority. Regulators have required that U.K. participants receive at least

50% of their initial payment and at least 50% of their holdback payment, if

any, in shares of Citi common stock that will be subject to a six-month sales

restriction. Clawbacks apply to the award.

Independent risk function employees were not eligible to participate in the

KEPSP as the independent risk function participates in the determination of

whether payouts will be made under the KEPSP.

On February 14, 2011, the Committee approved grants of awards under the

2011 KEPSP to certain executive officers, and on May 17, 2011, to the CEO.

These awards have a performance period of January 1, 2011 to December 31,

2012, and other terms of the awards are similar to the 2010 KEPSP.

Expense taken in 2011 in respect of the KEPSP was $285 million.

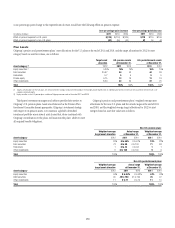

Other Incentive Compensation

Citigroup may at times issue Cash in Lieu of Equity awards, which are

deferred cash awards given to new hires in replacement of prior employer’s

awards or other forfeited compensation. The vesting schedules and terms and

conditions of these deferred cash awards are generally structured to match

the terms of awards or other compensation from a prior employer that was

forfeited to accept employment with the Company. Expense taken in 2011 for

these awards was $172 million.

Additionally, certain subsidiaries or business units of the Company operate

and may from time to time introduce other incentive plans for certain

employees that have an incentive-based award component. These awards are

not considered material to Citigroup’s operations.