Citibank 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

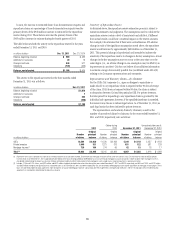

Value at Risk

Value at risk (VAR) estimates, at a 99% confidence level, the potential decline

in the value of a position or a portfolio under normal market conditions.

VAR statistics can be materially different across firms due to differences in

portfolio composition, differences in VAR methodologies, and differences in

model parameters. Citi believes VAR statistics can be used more effectively as

indicators of trends in risk taking within a firm, rather than as a basis for

inferring differences in risk taking across firms.

Citi uses Monte Carlo simulation, which it believes is conservatively

calibrated to incorporate the greater of short-term (most recent month) and

long-term (three years) market volatility. The Monte Carlo simulation involves

approximately 300,000 market factors, making use of 180,000 time series, with

market factors updated daily and model parameters updated weekly.

The conservative features of the VAR calibration contribute approximately

20% add-on to what would be a VAR estimated under the assumption of

stable and perfectly normally distributed markets. Under normal and stable

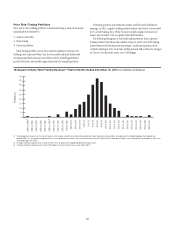

market conditions, Citi would thus expect the number of days where trading

losses exceed its VAR to be less than two or three exceptions per year. Periods

of unstable market conditions could increase the number of these exceptions.

During the last four quarters, there was one back-testing exception where

trading losses exceeded the VAR estimate at the Citigroup level (back-testing

is the process in which the daily VAR of a portfolio is compared to the actual

daily change in the market value of transactions). This occurred on August 8,

2011, after the U.S. government rating was downgraded by S&P.

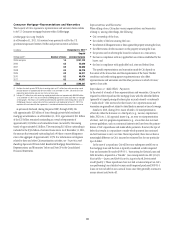

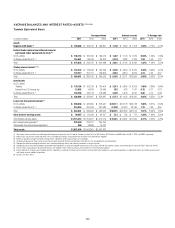

The table below summarizes VAR for Citi-wide trading portfolios at

and during 2011 and 2010, including quarterly averages. Historically,

Citi included only the hedges associated with the CVA of its derivative

transactions in its VAR calculations and disclosures (these hedges were,

and continue to be, included within the relevant risk type (e.g., interest

rate, foreign exchange, equity, etc.)). However, Citi now includes both

the hedges associated with the CVA of its derivatives and the CVA on the

derivative counterparty exposure (included in the line “Incremental Impact

of Derivative CVA”). The inclusion of the CVA on derivative counterparty

exposure reduces Citi’s total trading VAR; Citi believes this calculation and

presentation reflect a more complete and accurate view of its mark-to-market

risk profile as it incorporates both the CVA underlying derivative transactions

and related hedges.

For comparison purposes, Citi has included in the table below (i) total

VAR, the specific risk-only component of VAR and the isolated general market

factor VAR, each as reported previously (i.e., including only hedges associated

with the CVA of its derivatives counterparty exposures), (ii) the incremental

impact of adding in the derivative counterparty CVA, and (iii) the total

trading and CVA VAR.

As set forth in the table below, Citi’s total trading and CVA VAR was

$183 million at December 31, 2011 and $186 million at December 31, 2010.

Daily total trading and CVA VAR averaged $189 million in 2011 and ranged

from $135 million to $255 million (prior period information is not available

for comparability purposes). The change in total trading and CVA VAR year

over year was driven by a reduction in Citi’s trading exposures across S&B,

particularly in the latter part of the year, offset by an increase in market

volatility and an increase in CVA exposures and associated hedges.

In millions of dollars

Dec. 31,

2011

2011

Average

$ECææ

æ

!VERAGE

)NTERESTæRATE $ 250 $ 246

&OREIGNæEXCHANGE 51 61

%QUITY 36 46

#OMMODITY 16 22

#OVARIANCEæADJUSTMENTæ (118) (162)

4OTALæ4RADINGæ6!2æ

ALLæMARKETæRISKæFACTORSæ

INCLUDINGæGENERALæ

ANDæSPECIFICæRISKæ

EXCLUDINGæDERIVATIVEæ#6! $ 235 $ 213

3PECIFICæRISKONLYæ

#OMPONENTæ $14 $22

Total—general

market factors only $ 221 $ 191

)NCREMENTALæ)MPACTæOFæ

$ERIVATIVEæ#6! $ (52) $ (24) .!

Total Trading and

CVA VAR $ 183 $ 189 .!

æ #OVARIANCEæADJUSTMENTæALSOæKNOWNæASæDIVERSIFICATIONæBENEFITæEQUALSæTHEæDIFFERENCEæBETWEENæTHEæ

TOTALæ6!2æANDæTHEæSUMæOFæTHEæ6!2SæTIEDæTOæEACHæINDIVIDUALæRISKæTYPEæ4HEæBENEFITæREFLECTSæTHEæFACTæTHATæ

THEæRISKSæWITHINæEACHæANDæACROSSæRISKæTYPESæAREæNOTæPERFECTLYæCORRELATEDæANDæCONSEQUENTLYæTHEæTOTALæ

6!2æONæAæGIVENæDAYæWILLæBEæLOWERæTHANæTHEæSUMæOFæTHEæ6!2SæRELATINGæTOæEACHæINDIVIDUALæRISKæTYPEæ

4HEæDETERMINATIONæOFæTHEæPRIMARYæDRIVERSæOFæCHANGESæTOæTHEæCOVARIANCEæADJUSTMENTæISæMADEæBYæANæ

EXAMINATIONæOFæTHEæIMPACTæOFæBOTHæMODELæPARAMETERæANDæPOSITIONæCHANGES

æ 4HEæSPECIFICæRISKONLYæCOMPONENTæREPRESENTSæTHEæLEVELæOFæEQUITYæANDæFIXEDæINCOMEæISSUERSPECIFICæRISKæ

EMBEDDEDæINæ6!2

.!æ .OTæAVAILABLE